3. The Power of Diversification

While it does not necessarily increase returns, diversification has been shown to reduce volatility and protect portfolios against risk if used strategically.

There are various types of diversification, some of which are more relevant to different types of portfolio. These include diversification between asset classes, such as stocks, bonds, commodities and cash; diversification between industries, sectors and themes; growth stocks versus value stocks; large cap stocks versus small caps; and physical locations (US-domiciled versus emerging markets, for example), to name just a few1.

In general, we will focus on the forms of diversification that are relevant to an all-equity portfolio.

Reducing Unsystematic Risk

There are all sorts of macro factors that could impact an investors’ portfolio. These systematic risks are not within the control of individual investors; their portfolio should account for the fact that market conditions will change, but they cannot directly control their exposure to systematic risk.

Unsystematic risk is different. This risk, which is particular to individual securities, has the potential to drag on portfolio performance relative to the broader market if it is not correctly managed. In equities, unsystematic risk can take the form of competition for market share, regulatory changes or charges, strikes and legal actions, supply chain breakdowns, or general mismanagement and strategic shortcomings2.

Unlike systematic risk, though, investors can manage unsystematic risk. Investing in a diverse range of securities, rather than just one or two, reduces the overall portfolio’s exposure to unsystematic risk.

According to Fidelity, choosing different investments that have not historically moved in the same direction as one another and diversifying a portfolio among these means that “even if a portion of your portfolio is declining, the rest of your portfolio is more likely to be growing, or at least not declining as much”3.

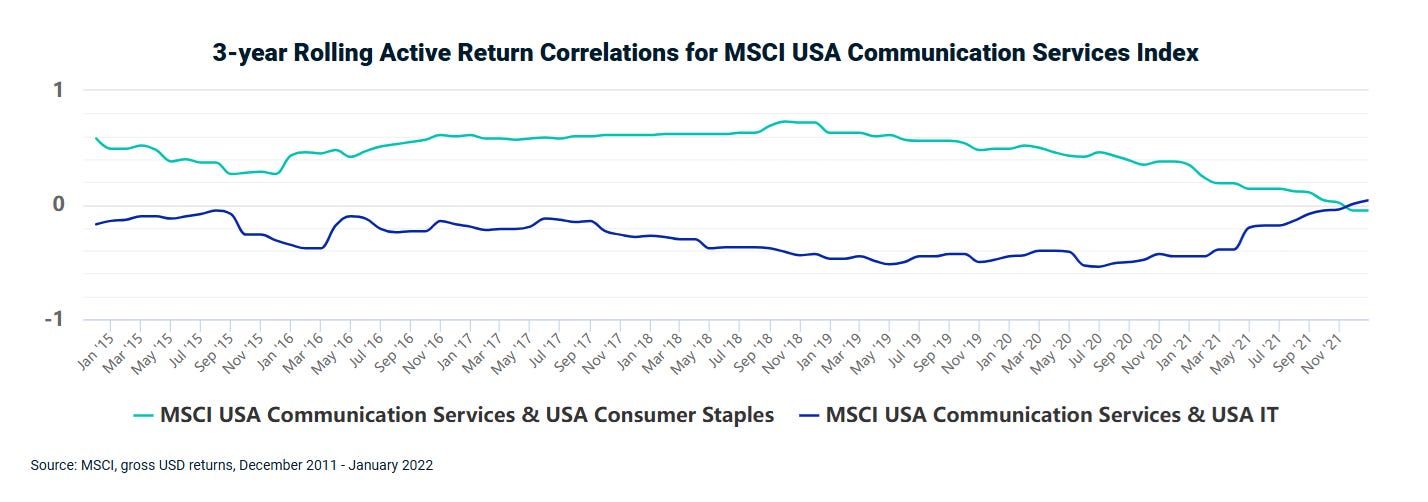

The performance of some sectors, such as industrial and materials, has a higher correlation; the performance of others, such as utilities and health care, can differ considerably. Diversifying among different stocks within an all-equity portfolio, however, can offer investors a degree of protection against unsystematic risk.

Optimal Number of Stocks

How diversified should a portfolio be?

While a measure of diversification is important, too much can be a bad thing. Asher Rogovy, Chief Investment Officer of Magnifina, says that 20 to 30 stocks is “plenty to realistically diversify against catastrophic risk”4.

Warren Buffett advocates for less than this: he generally supports investing in a small number of stocks that the investor knows very well and has high conviction about. He has previously said that three or six “wonderful businesses” are all the diversification a portfolio needs5.

Research from the CFA Institute suggests that the optimal number of stocks depends on the kinds of stocks being invested in6. In a portfolio of small cap stocks, it found diminishing returns in the form of lower levels of volatility reduction in diversifying beyond approximately 30 stocks; in a large cap portfolio, these effects occurred above 10–15 holdings. Similarly, a non-dividend portfolio saw a greater fall in volatility when increased from 10 to 40 stocks than a dividend portfolio.

It is important to remember the trade-offs involved in diversification. Less diversification means greater unsystematic risk, which could increase volatility, but more diversification means less aggregate knowledge of and conviction in the holdings, plus greater dilution, both of which could hamper returns. For most portfolios, 10–20 stocks is likely to offer sufficient diversification to guard against unsystematic risk.

4. Portfolio Weighting Strategies

Having decided how many stocks to include in a portfolio, the next decision is how much of each stock to include. This is where a portfolio weighting strategy comes in.

Market Cap-Weighted Portfolios

What is a Market Cap-Weighted Portfolio?

A market cap-weighted portfolio allocates to its component stocks based on their market capitalization.

Market capitalization is the total value of all outstanding shares. It is calculated by multiplying the number of outstanding shares by the stock’s current share price. As such, if the share price increases, the company’s market cap will increase proportionately.

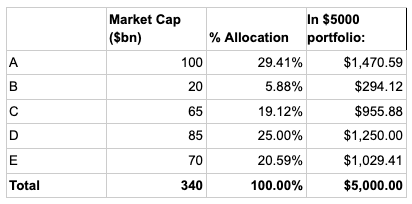

Consider constructing a portfolio with $5,000 of investment, consisting of five stocks that have market caps of $100bn, $20bn, $65bn, $85bn and $70bn.

The amount to allocate to each stock is determined by calculating each stock’s market cap as a percentage of the total market cap of all five stocks, then multiplying the amount to be invested ($5,000 in this case) by the resulting percentages.

Advantages of Market Cap-Weighting

Allocation reflects the market consensus on relative company values. Portfolio performance will be relatively similar to that of the market.

Tends to favor larger, potentially more stable companies.

Provides positive exposure to momentum factor.

Disadvantages of Market Cap-Weighting

Can lead to overexposure to overvalued large-cap stocks. This can, in turn, increase volatility — often, the inclusion of these stocks in market cap-weighted indices such as the S&P 500 forces tracker funds to continue buying the stock, which adds upward pressure to their share prices, causing market saturation as well as portfolio saturation7.

May underrepresent smaller companies with high growth potential.

Implies buying high and selling low — as stocks whose market caps increase will have a larger allocation when it comes to rebalancing, and vice-versa8.

Market cap-weighted portfolios can be more volatile. The CFA Institute found that, while the average and median performance of market cap-weighted portfolios in stock market crashes between 1932 and 2020 was identical, there were five years in which their performance diverged significantly from one another. In all five occasions, market cap-weighted portfolios suffered greater drawdowns9.

Equal Weighted Portfolios

What is an Equal-Weighted Portfolio?

This approach divides the principal investment between all holdings equally. The five-stock $5,000 portfolio above would allocate $1,000 to each holding.

Pros

Provides exposure to smaller companies that may offer higher growth.

Historically, equal-weighted portfolios have outperformed market cap-weighted portfolios in certain periods. The CFA Institute found that equal-weighted portfolios of US stocks outperformed market cap-weighted portfolios between 1926 and 2021 by 4.5 percentage points.

Cons

Requires more frequent rebalancing, increasing transaction costs.

May introduce higher volatility due to exposure to smaller, riskier stocks.

5. Strategic Rebalancing

Importance of Rebalancing

Asset prices are not static. A portfolio that is constructed according to a specific risk profile and weighted to reflect this will become distorted after its first session, as its component asset prices change in uncorrelated ways.

For this reason, failure to rebalance adds volatility to a portfolio. Fidelity Investments research calculated that a never-rebalanced portfolio carried 16% more volatility than a regularly rebalanced one, and did not provide any performance benefit in return10.

As such, investors need to periodically rebalance their portfolios to ensure that they continue to serve their desired purpose; that is, reset the allocation of each asset or stock to match the weighting profile of the portfolio.

In a market cap-weighted portfolio this will mean recalculating the market caps of each holding and dividing the portfolio’s current value between them accordingly. In an equal-weighted portfolio, it means distributing the current portfolio value among all stocks equally.

Note that this means two opposite things will happen in each of these cases. A market cap-weighted portfolio will see a greater concentration in assets whose price has outperformed, whereas an equal-weighted portfolio will sell these for profit and buy assets that have underperformed.

This is complex and time-consuming to perform often, and could imply taxes or fees at each rebalancing. Investors should therefore pick a predetermined interval and stick to this to ensure consistency.

Most of the time, failing to rebalance skews a portfolio towards riskier investments. These assets tend to gain steadily during most phases of a market cycle and fall quickly during downturns11.

Performance vs Risk Management

As John Rekenthaler, Vice-President of Research at Morningstar, emphasizes, rebalancing is only a reliable means of reducing risk, not of increasing returns12.

He makes the point that rebalancing between two assets that have identical long-term returns always makes sense, as it implies selling yesterday’s winner high and buying tomorrow’s winner low. However, in reality no two assets have the same long-term performance.

Reallocating from a stock that gains over the long term to one that falls is, he explains “almost always a losing strategy”. The trouble is that no one knows in advance which assets will post the greater long-term gains.

What rebalancing does achieve, consistently, is the reduction of risk, regardless of return. A portfolio consisting of growth stocks and cash will skew to growth stocks over time, posting greater returns, but also greatly increasing risk.

Read Part 3: A Holistic Approach: Diversification & Smart Allocation

This is for informational purposes only. OPTO Markets LLC does not recommend any specific securities or investment strategies. Investing involves risk and investments may lose value, including the loss of principal. Past performance does not guarantee future results.

https://www.investopedia.com/terms/d/diversification.asp

https://www.investopedia.com/terms/u/unsystematicrisk.asp

https://www.fidelity.com/viewpoints/investing-ideas/guide-to-diversification

https://www.investopedia.com/ask/answers/031115/what-did-warren-buffett-mean-when-he-said-diversification-protection-against-ignorance-it-makes.asp

https://blogs.cfainstitute.org/investor/2021/05/06/peak-diversification-how-many-stocks-best-diversify-an-equity-portfolio/

https://www.investopedia.com/terms/c/capitalizationweightedindex.asp

https://www.researchaffiliates.com/publications/articles/674-buy-high-and-sell-low-with-index-funds

https://blogs.cfainstitute.org/investor/2021/09/10/equal-vs-market-cap-weighted-portfolios-in-stock-market-crashes/

https://www.fidelity.com/bin-public/060_www_fidelity_com/documents/PAS_rebalancing-portfolio.pdf

https://www.fidelity.com/viewpoints/investing-ideas/the-market-cycle-and-investors

https://www.morningstar.com/columns/rekenthaler-report/when-rebalancing-creates-higher-returnsand-when-it-doesnt