Duolingo: How AI is Supercharging Edtech

Discover how AI is revolutionizing and supercharging the world of edtech through the case study of Duolingo.

Key Takeaways

Duolingo’s AI-infused edtech app has given it powerful user acquisition metrics, leading to its first profitable financial year in 2023.

However, the stock tanked 27.5% in the week after it reported a slowdown in user acquisition rates in May, despite Q1 earnings more than doubling analysts’ expectations.

CEO Luis von Ahn is upbeat and maintains that user acquisition rates will remain around 60% over longer time periods.

A new subscription tier, powered by GPT-4, could be set to boost Duolingo’s paid subscriber conversions.

1. Talking Investors’ Language

While artificial intelligence (AI) has captured the public imagination over the past year and a half, compelling business cases are surprisingly thin on the ground.1

Duolingo [DUOL] merits attention as a product that harnesses the potential of AI in innovative, practical ways. Predominantly an educational technology (edtech) stock, AI is interwoven across Duolingo’s offering: playing a crucial role in personalization, driving user engagement, and underpinning a new subscription tier that could transform how people learn to speak new languages.

Duolingo’s share price was up 9.7% year-to-date before it posted Q1 earnings on May 8, when it showed the slowest rate of new user growth in five quarters. Shares fell 16% in afterhours trading that day, and, as of June 7, are down 16.7% year-to-date.

However, the stock is still 20.1% above its level 12 months ago, and 85.3% above the $102 per share at which it debuted in July 2021.2

Duolingo’s Q1 bookings grew 41% year-over-year to $197.5m and subscriptions increased 47% to $161.5m. Revenues were up 45% to 167.6m and diluted earnings per share (EPS) came to $0.57, up from a loss of $0.06 per share and beating the average LSEG analyst forecast of $0.27.3

The figures marked the most profitable quarter in Duolingo’s history.

“We’re excited about the broader rollout of Duolingo Max, our higher-priced subscription tier, and the strides we’re making to improve our family plan, giving us the confidence to raise our full-year guidance,” said Co-founder and CEO Luis von Ahn in the earnings release.

So why the slump? In short, Duolingo’s active user growth slowed.4 In each of the four previous quarters,5daily active users (DAUs) increased by over 60% year-over-year, and monthly active users (MAUs) increased by 45–50%. In Q1 2024, however, these numbers slowed to 54% and 35% respectively.

This might not sound like a big deal. As we will see, however, user growth gets to the heart of what makes Duolingo a unique business: its use of AI and gamification to drive user engagement, retention and acquisition.

2. Education Meets Intelligence

Duolingo is, first and foremost, an edtech product. Its app offers over 100 free courses in subjects including math and music,6 but predominantly these courses teach users new languages.

Over 40 languages are available on the app; these include common modern languages such as English, Spanish or Chinese, as well as vulnerable or endangered ones such as Navajo or Gaelic.7 Duolingo users can even learn fictional languages such as Klingon, High Valyrian or Esperanto.8

According to Statista, the global market for online learning platforms was worth $57.4bn in 2023. This figure is estimated to rise to $58.5bn in 2024, and $75.5bn in 2029.9

Duolingo’s IPO prospectus went into more detail.10 It cited research from HolonIQ that priced the online and offline language learning market at $61bn in 2019 and forecast it would grow at a CAGR of 11% between then and 2025, to reach $115bn during that time.

When it comes to online language learning alone, the growth is even steeper: “Online language learning is the fastest-growing market segment, projected to grow from $12bn in 2019 to $47bn in 2025, representing a CAGR of approximately 26% over this period, and to comprise 41% of total consumer spend on language learning in 2025,” the filing continued.

The opportunity beyond language learning was also highlighted: “approximately $6trn was spent on education globally in 2019. And GSV Ventures reports that $160bn was spent on digital learning, with digital spend expected to grow at a 26% CAGR from 2019 to 2026.”

AI Overtones

Duolingo is also, to a significant extent, an AI stock, because AI is a key component of the company’s product. Duolingo uses a large language model (LLM) called Birdbrain to generate lessons that suit an individual user’s proficiency level with a given language.11

Advances in AI technology could positively impact Duolingo by improving its product offering. Conversely, its Form 10-Q cautions that changes in the regulation of AI “could adversely affect our use of such technologies in our products and services”.12

While AI plays an important role in enabling Duolingo’s educational features, user engagement and product development, its primary market is edtech. In other words, Duolingo’s business is driven by demand for edtech, rather than demand for AI (as would be the case for a company such as OpenAI, for example).

Duolingo can therefore be considered primarily as an edtech stock, and secondarily as an AI stock; it sits firmly at the intersection of these two themes.

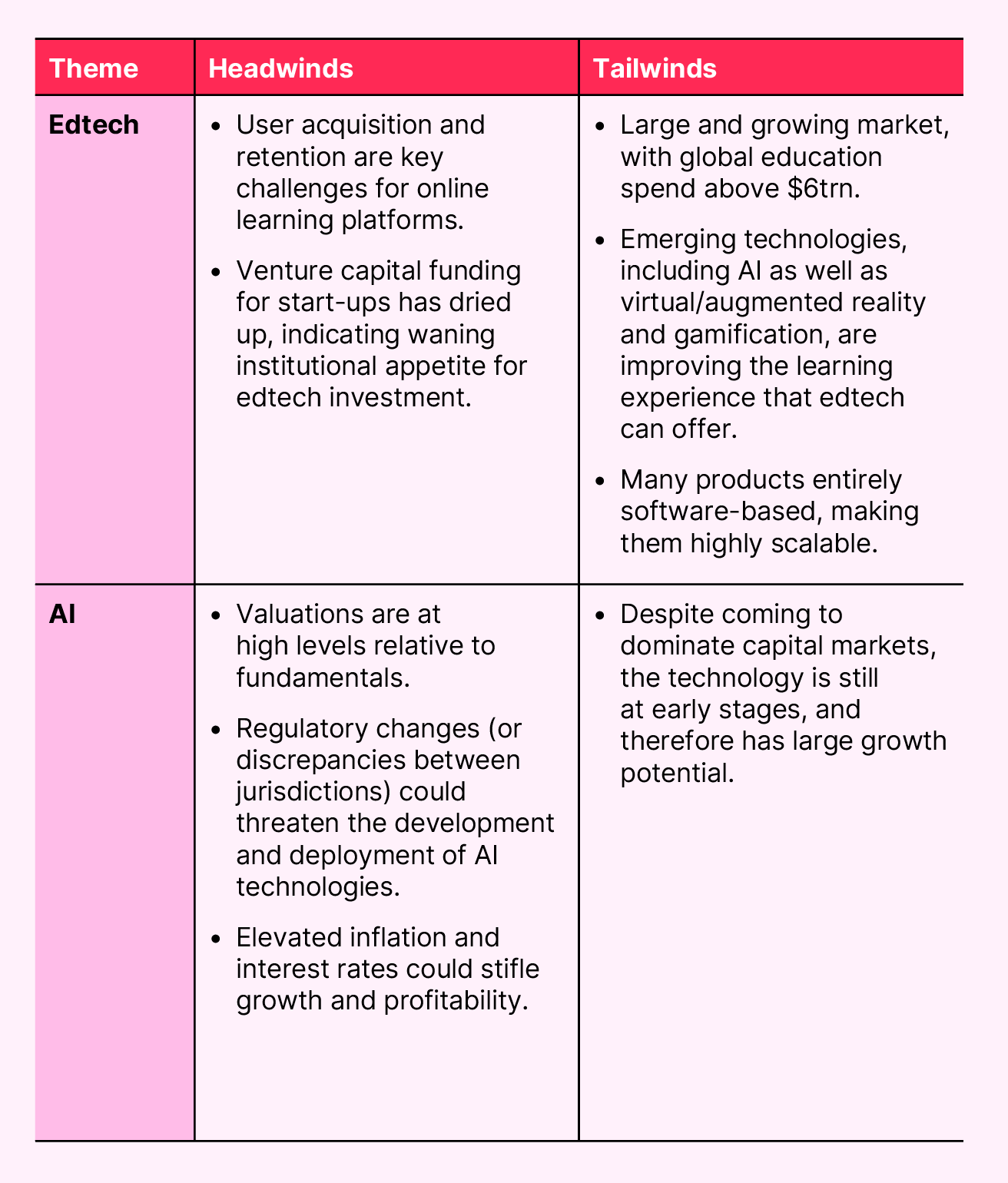

Duolingo — Theme Headwinds and Tailwinds

3. Duolingo’s AI Alignment

OPTO’s proprietary ‘Relevance Score’ aims to assess a public company’s alignment with a primary investment theme; it does not aim to measure the strength of the company or investment. The model uses information from the following sources:

Duolingo’s website and product descriptions

Company press releases and investor presentations

Industry reports and analyst coverage (i.e., Gartner, IDC, Forrester)

Patent databases (e.g., USPTO, Google Patents)

Financial reports and earnings transcripts

News articles and media coverage

The overall score is based on five key criteria:

Product and Services: A review of the company's current product and services suite, and its alignment with the primary theme.

Innovation and Development: An analysis of the company's activities related to innovation, within the selected theme.

Market Influence and Leadership: An evaluation of the company’s influence within the chosen theme, and its capacity to dictate theme-wide change and performance.

Financial Commitment: The company's financial commitment to the industry, assessed by fundamental metrics, including R&D spend.

Keep reading with a 7-day free trial

Subscribe to Foresight to keep reading this post and get 7 days of free access to the full post archives.