The AI Hardware Stock Outperforming Nvidia in 2024

This AI hardware stock has gained 226% year-to-date, boosted by the growing server market and a key partnership with Nvidia, despite facing pricing and profit margin challenges.

Key Takeaways:

Super Micro’s shares gained 226% in the 12 months to July 2.

Global high availability server market, which Super Micro serves, expected to reach $12.92bn by 2025, growing at a 13.5% CAGR.

Super Micro’s partnership with Nvidia means it is particularly well-positioned to capture this trend.

However, this comes at the cost of reduced pricing control and, hence, limited profit margins compared to Nvidia.

1. Another Chip in the Wall

Super Micro Computer’s [SMCI] share price gained 239.7% in the 12 months to July 5, and 197.8% year-to-date. During both periods, it has outperformed even artificial intelligence (AI) darling Nvidia [NVDA], whose market capitalization increased 200% and 157.5% in the respective periods.

Who is this David to Nvidia’s Goliath?

Super Micro builds integrated systems for cloud, artificial intelligence (AI), metaverse, 5G and edge computing infrastructure.1 Put simply, it produces the hardware that goes into big tech’s data centers.

It may sound like a direct competitor of Nvidia, but the reality is more complex. Nvidia does make some integrated systems, such as its DGX suite,2 but its core products are computer chips, such as the GH200 Grace Hopper Superchip.

Super Micro takes computer chips (including Nvidia’s) and, in close collaboration with their manufacturers, combines them with other components into servers and other integrated hardware products, which can then be deployed in data centers. The GPU A+ Server AS-8125GS-TNHR, for example, integrates various components of the Nvidia Hopper architecture, including the H100 GPU.3

A simple way to conceptualize this relationship is that Nvidia builds bricks, while Super Micro builds walls. In this analogy, the bricklayers work closely with the brickmakers to ensure that the design of the bricks (and the cement used) will optimize the finished wall.4

2. Live to Serve

On that basis, it is logical to situate Super Micro in the semiconductors theme (even though, technically, its products are several manufacturing processes up from actual semiconductors, the raw materials of Nvidia’s computer chips).

Fortune Business Insights values the global semiconductor market size at $611.4bn in 2023, and projects it will grow to $2.1trn by 2032 at a CAGR of 14.9%.5

However, in assessing the thematic and sector tailwinds to which Super Micro is exposed, we can also examine the server market in more depth. This is the most relevant market for Super Micro’s business—the ‘finished goods’ of the semiconductor industry.

According to Fortune Business Insights, the global high-availability server market was worth $5.3bn in 2018 and is projected to reach $12.9bn by 2025, representing a CAGR of 13.5%.6 A June report states that this growth can mostly be attributed to increasing demand for data center services, increased demand for Internet of Things devices, and the falling costs of server infrastructures.

Falling costs could act as a headwind for Super Micro even if they grow the market as a whole, as they could act as one of several constraints on its pricing power.

3. Is Super Micro a Semiconductor Stock?

While there is some overlap between Super Micro’s business and the semiconductors theme, its position within that theme—particularly with regard to its relationship with Nvidia—isn’t as straightforward as that of some of its major competitors.

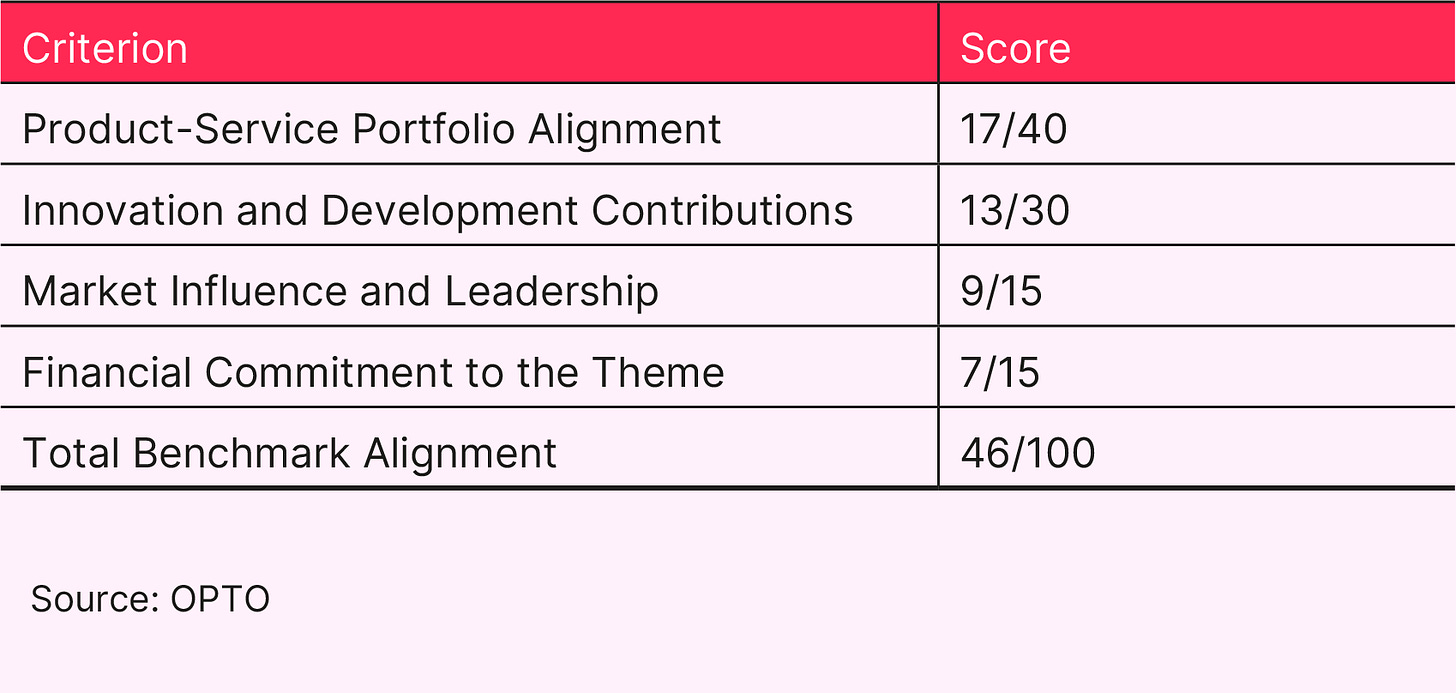

To quantify its relevance to the semiconductors theme, we have used OPTO’s proprietary ‘Relevance Score’, which aims to assess a public company’s alignment with a primary investment theme. It does not measure the strength of the company or investment. The model uses information from the following sources:

Super Micro’s official website and financial reports.

Industry reports and analyses of Super Micro’s market position.

Patent databases to evaluate Super Micro’s contributions to R&D and innovation.

The overall score is based on four key criteria:

Product and Services: A review of the company’s current product and services suite and its alignment with the primary theme.

Innovation and Development: An analysis of the company’s activities related to innovation within the selected theme.

Market Influence and Leadership: An evaluation of the company’s influence within the chosen theme and its capacity to dictate theme-wide change and performance.

Financial Commitment: The company’s financial commitment to the industry, assessed by fundamental metrics, including R&D spend.

How Aligned is Super Micro?

1. Product-Service Portfolio Alignment (Score: 17/40):

Super Micro’s high-performance server technology solutions include servers, storage systems, networking devices, and server management software. While semiconductors are essential components in its products, the company does not directly design or manufacture semiconductors or related equipment. Based on the product descriptions and market positioning, approximately 25–35% of its revenue appears to be derived from semiconductor-related products and services, which falls within the ‘Partially Aligned’ range.

2. Innovation and Development Contributions (Score: 13/30):

Super Micro has filed several patents related to server and data center technologies.6 Based on its product offerings and industry focus, Super Micro can be considered an ‘Active Participant’ in semiconductor-related innovation, with an estimated 5–9% of its R&D budget dedicated to semiconductor-related research and development.

3. Market Influence and Leadership (Score: 9/15):

Super Micro has a strong presence in the server and data center market, but its influence is primarily focused on their core product offerings rather than semiconductor-specific technologies. It also has a close relationship with Nvidia, the world’s third-most valuable company. Charles Liang, Co-founder, President and CEO of Super Micro, has said that the 30-year partnership enables Super Micro to release new products based on Nvidia’s latest technologies faster than competitors.7

In line with industry reports and market share data, Super Micro has a ‘Moderate Influence’ within semiconductor-related sectors, likely falling within the top 50–75% in market share for their server and storage solutions.

4. Financial Commitment to the Theme (Score: 7/15):

While Super Micro’s financial reports do not provide a breakdown of investments specific to the semiconductors theme, based on the company’s product portfolio and revenue sources, an estimated 5–10% of its revenue, operating income, or capital expenditures are dedicated to semiconductor-related activities, which falls within the ‘Moderate Theme Investment’ range.

Summary Table:

Based on the total score of 46/100, Super Micro can be considered a secondary sub-theme player within the semiconductors theme. While semiconductors are essential components in its server and data center solutions, the company’s primary focus is on system integration and server technology rather than direct semiconductor design or manufacturing.

4. Elon Musk and Super Micro

Super Micro’s ability to develop high-performance servers does, however, make it a key component of the developing AI landscape.

Tesla [TSLA] and xAI CEO Elon Musk acknowledged this publicly on June 19 when he revealed that, alongside Dell [DELL], Super Micro will provide the servers which xAI will use to create a supercomputer.8

Musk first posted on X that Dell would provide half the racks for xAI’s supercomputer. In response to a user asking who would provide the other half, Musk replied: “SMC”.9

On June 20, the day after Musk’s comment, Super Micro’s shares opened 4.5% higher. By the close of trading, however, they were 0.3% down.

Musk has previously promised to build a “super dense, water-cooled supercomputer cluster” at Tesla’s factory in Austin, Texas.

Super Micro could be an obvious choice of supplier. In a statement he made in June announcing Super Micro’s construction of three new centers in Silicon Valley and globally, Liang said that his company “has the highest performing generative deep learning and inferencing AI platform and clusters which benefit from liquid-cooled technologies”.10

5. Super Micro’s Breakthrough Year

Dear Supermicro Shareholders,

Super Micro celebrated its 30th anniversary in fiscal year 2023. It was a breakthrough year for the company, and we have achieved many firsts:

It was the first time Supermicro achieved a $2bn quarter.

It was the first time in the past many years that Supermicro reached 40% CAGR in revenues in two consecutive years.

It was the first time that our stock price grew more than 5x in one year.

It was the first time that I am 100% proud of our Green Computing Strategy (Save TCO for customers, reduce CO2 impact and grow Supermicro business).

— Charles Liang, President and CEO, Super Micro Computer Annual Report 202311

Revenue Growth

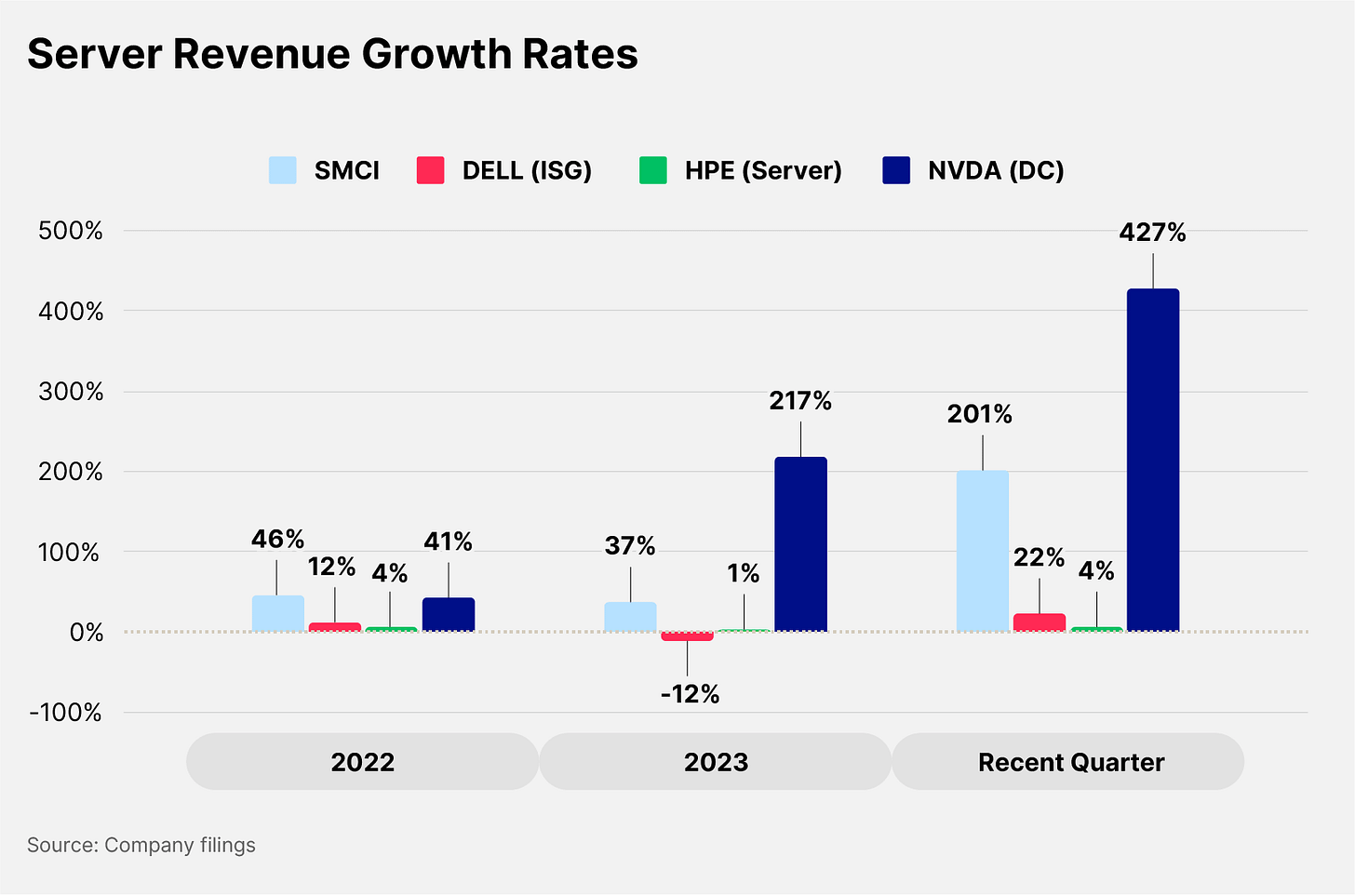

In the 2023 financial year, Super Micro brought in $7.1bn in revenue. This represented a 37.1% year-over-year increase, with revenue having grown 46.1% the previous year.

As of Q3 2024,12 however, Super Micro appears to be on track to blow these figures out of the water. Q3 net sales tripled year-over-year, and the company raised its full-year revenue guidance from $14.3–14.7bn to $14.7–15.1bn. Even the low end of this revised guidance would represent 107% year-over-year revenue growth.

Analysts polled by FactSet expect Super Micro’s revenue to land in the mid-point of this range ($14.9bn) in 2024,13 before growing 59.7% to $23.8bn in 2025 and by 17.3% to $27.97bn in 2026. (Interestingly, they then predict a sharp fall to $15.4bn in 2027 — it is unclear why).

Key Segment Revenue

The key segment for Super Micro is ‘server and storage systems’, which it defines as the “assembly and integration of subsystems and accessories and related services”. This accounted for approximately 92% of revenue during the 2023 financial year and 96% of revenue during Q3 2024.14

Its other segment—‘subsystems and accessories’—includes the less-technological accessories used to build its servers into data centers: “Serverboards, chassis and accessories.” Super Micro’s strategy is clearly focused on the technological components that give it the greatest advantage; subsystems revenue fell 24.4% in the 2023 financial year and comprised just 4% of revenue in Q3 2024.

Super Micro’s Competitors

As highlighted above, it is too simplistic to compare Super Micro directly with other semiconductor companies since its products fall into a different stage of the value chain than those of (for example) Intel [INTC] or Taiwan Semiconductor Manufacturing Co [TSM].

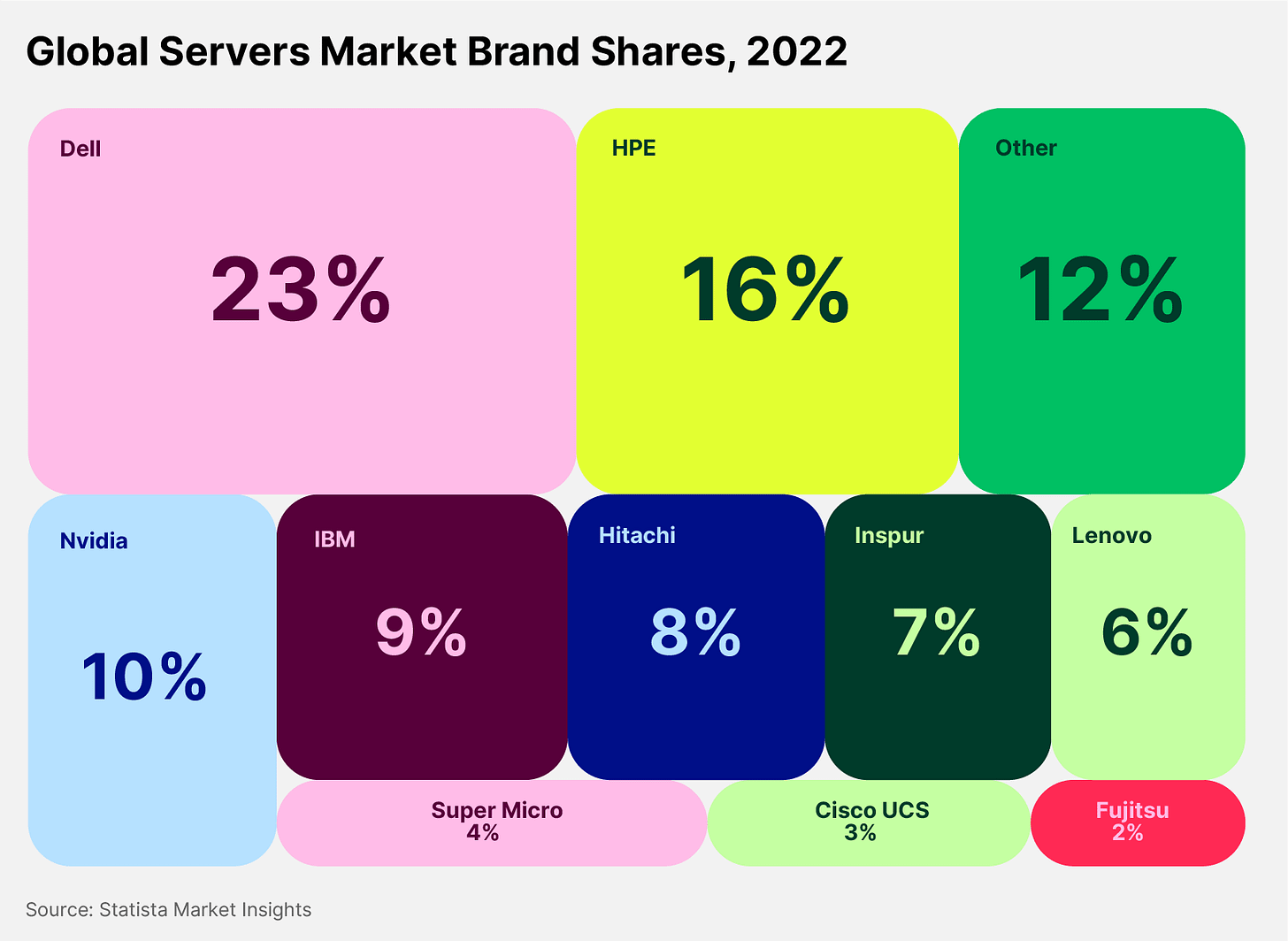

According to Statista, in 2022, the largest players in the data center server market were Dell, with 23% of the market, Hewlett Packard Enterprise [HPE] with 16%, and Nvidia with 10%. Super Micro took 4% of the market during that year, making it the eighth-largest company by market share.15

Compared to Super Micro, the top three are large and diversified businesses. Rather than comparing total revenue growth, this section will focus on the specific business segments that align with the server market.

In comparing the revenue growth of these companies, the relevant segment in Dell’s business is its Infrastructure Solutions Group (ISG). This encompasses Dell’s server portfolio, which “includes high-performance general-purpose and AI-optimized servers able to run workloads across customers’ IT environments, on-premises, and in multicloud and edge environments.”16

In HPE’s case, most of its business segments are directly relevant to servers, with the exception of ‘financial services’ and ‘corporate investments and other’. These two segments comprised a combined 16% of HPE’s revenue in the most recent financial year.17 This has been subtracted from HPE’s total revenue to generate HPE (server) revenue figures.

In Nvidia’s case, the relevant segment is its ‘data center’ revenue, which “consists of compute and networking offerings typically delivered to customers as systems, subsystems, or modules, along with software and services”.18

Nvidia’s data center revenue growth between 2022 and 2023 has been the talk of Wall Street. Aside from this, none of Super Micro’s competitors have demonstrated a comparable pace of growth over the past three years.

Comparing how the various divisions are tracking in the current year is challenging because their various financial years start at different points (Super Micro released its Q3 2024 results at approximately the same time as Nvidia released its Q1 2025 results).

However, Super Micro’s revenue in the most recent quarter increased by 201% year-over-year. Nvidia’s data center revenue increased more than twice as fast — 427% year-over-year19 — but Dell’s ISG revenue only increased 22% year-over-year,20 while HPE’s server revenue increased 17.6%.21

The trend seems clear. Nvidia’s server revenue growth is increasing rapidly and taking Super Micro’s with it (though at a slower rate). Both are eating into the market share of the industry’s two largest incumbents in the process.

Pick Your Shovels

There is a cautionary tale for the would-be Super Micro investor, though. It isn’t just that its revenue isn’t growing as fast as Nvidia’s. There is a legitimate argument that, due to the nature of its business, it can’t.

Keep reading with a 7-day free trial

Subscribe to Foresight to keep reading this post and get 7 days of free access to the full post archives.