Will These 3 Gaming Stocks Level Up in 2025?

The gaming industry could enjoy a return to growth in 2025 fueled by a number of key launches. Who will be the sector leaders?

Key Takeaways

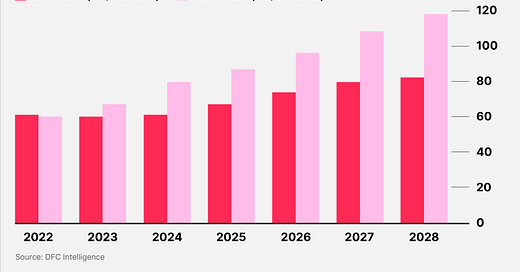

The gaming sector is expected to return to pandemic-era growth levels in 2025;

New hardware and game releases are set to spur demand;

An increased price tag for blockbuster games could help reverse decades of price deflation despite production cost increases.

Keep reading with a 7-day free trial

Subscribe to Foresight to keep reading this post and get 7 days of free access to the full post archives.