Will Interest in This Data Center Infrastructure Stock Heat Up in 2026?

With strong Q3 results and surging demand for its critical cooling solutions for AI data centers, analysts see this stock poised to rally.

Key Takeaways

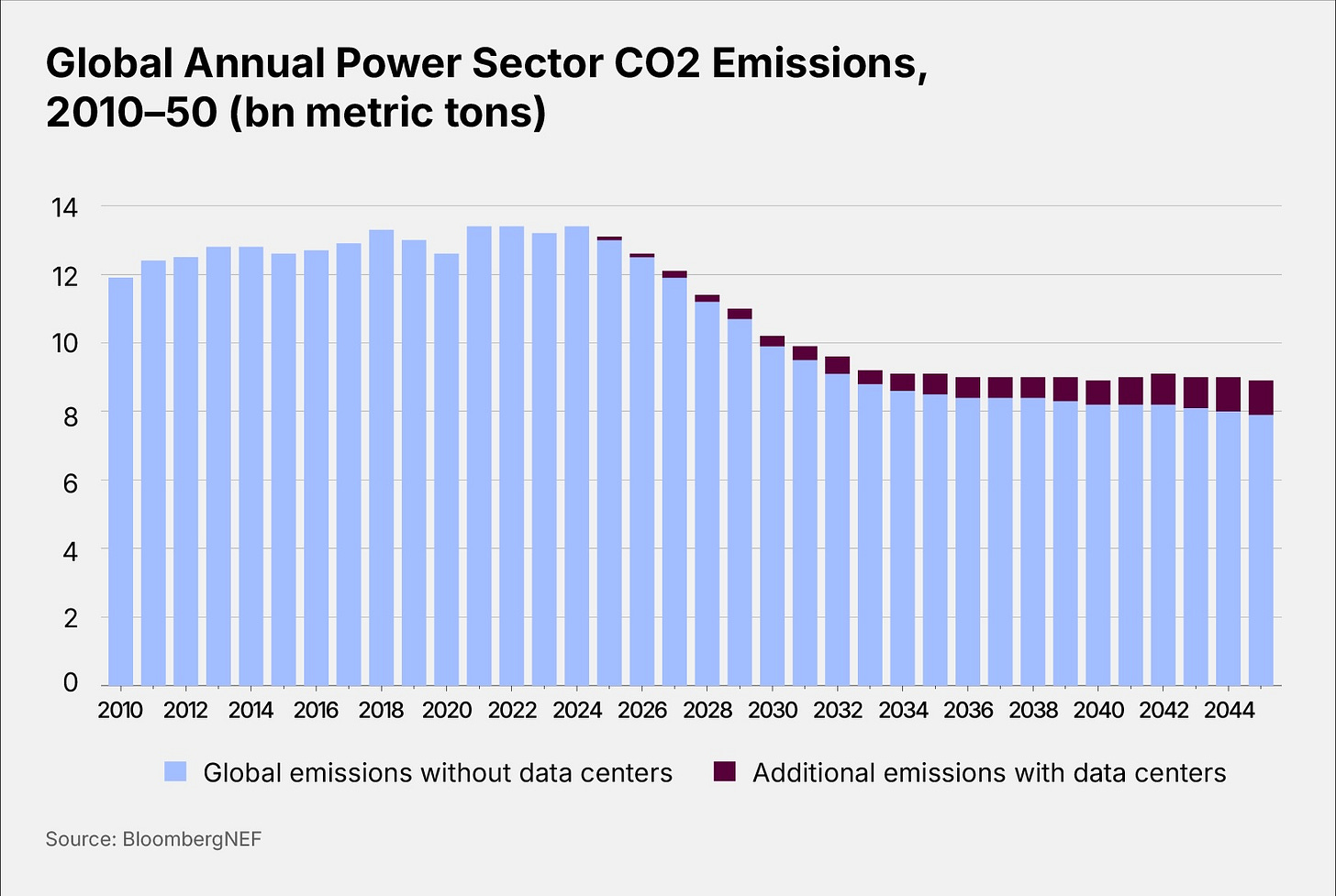

Data centers are becoming major electricity consumers and CO2 emitters, responsible for 100 million metric tons of CO2 in 2025.

Vertiv delivered impressive Q3 2025 results with sales up 29% to $2.68bn and earnings jumping 63%, driven by 43% sales growth in the Americas.

Despite competition from new cooling technologies like Microsoft’s microfluidics system, analysts remain bullish — Barclays upgraded VRT stock to ‘overweight’ with a $200 price target.

According to BloombergNEF, if artificial intelligence (AI) data centers were a country, they would be on track to become the fourth-largest electricity guzzler after the US, China and India.[1]

Data centers’ contribution to global CO2 emissions is set to continue rising over the next decade. As the graph below shows, data centers were responsible for approximately 100 million metric tons of CO2 in 2025, with 13 billion emitted by other sources. By 2035, they will be emitting approximately 600 million tons, alongside 8.5 billion from other sources.

All this activity generates a vast amount of heat. This is where Vertiv [VRT] comes in.

Vertiv is an Ohio-based infrastructure company that provides cooling and power management for data centers. This piece will look at how the AI boom is fueling demand for Vertiv’s cooling and solutions.

Vertiv’s Push into AI Predictive Maintenance

In late January, Vertiv announced Next Predict, an AI-powered solution for data center maintenance. It monitors the condition of equipment, machinery and cooling systems, detecting potential faults and predicting when failures might occur.

“Data center operators need innovative technologies to stay ahead of potential risks, as compute intensity rises and infrastructures evolve,” said Ryan Jarvis, Vice President of Vertiv’s global services business unit, in the press release.[2]

Moving maintenance from a traditional calendar-based model, which is reactive, to a more proactive model will help reduce unforeseen downtime.

VRT Stock in Demand

News of Next Predict did not move the Vertiv share price, although this should be expected given the recent tumble in stocks spurred by a selloff in gold and silver.

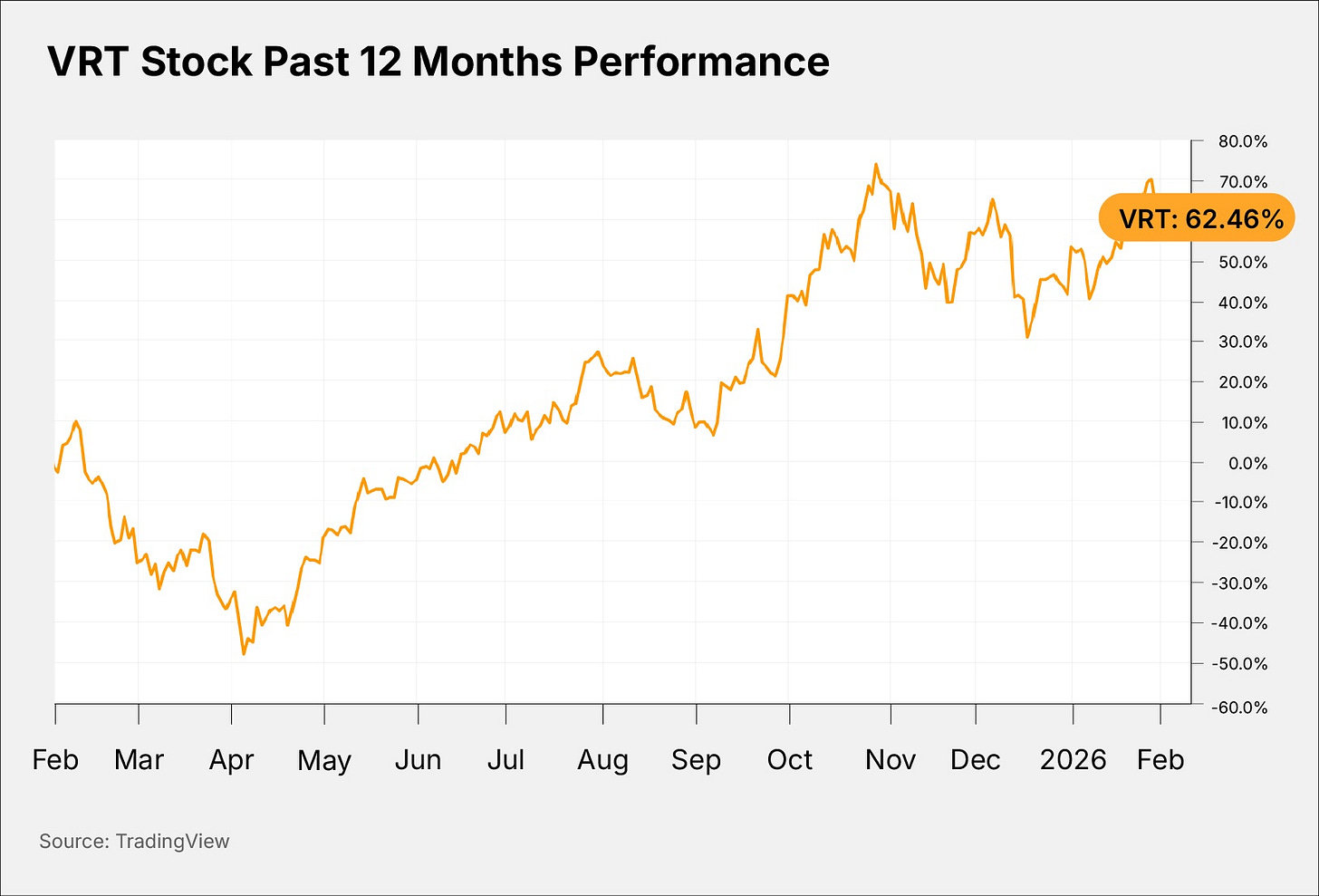

Nevertheless, while VRT stock pulled back 4.57% on January 30, it has gained 14.92% year-to-date through January 30, to $186.18, and is up 68.79% in the past 52 weeks. The share price is down 8.04% since setting an all-time high of $202.45 on October 30 2025, on the back of a strong set of Q3 results.

Infrastructure Boom: VRT vs ETN vs NVT

Vertiv reported sales of $2.68bn for Q3, up 29% year-over-year from $2.07bn. Growth was driven by a 43% rise in sales in the Americas and 20% in the Asia-Pacific region. Meanwhile, adjusted diluted earnings jumped 63% to $1.24 per share from $0.76 in Q3 2024.[3]

Vertiv CEO Giordano Albertazzi said in the earnings press release that the numbers “demonstrate our unique position in enabling the future of digital infrastructure”. The firm’s backlog, which increased to $9.5bn in the three months to the end of September, signals “accelerating market demand” and the company’s “strong competitive position”, he added.

For comparison, Eaton [ETN], which makes electrical equipment for data centers, saw Q3 sales rise 10% to a Q3 record $7bn.[4] nVent Electric [NVT], whose products include liquid cooling systems for data centers, reported sales growing 35% to $1.05bn in Q3.[5]

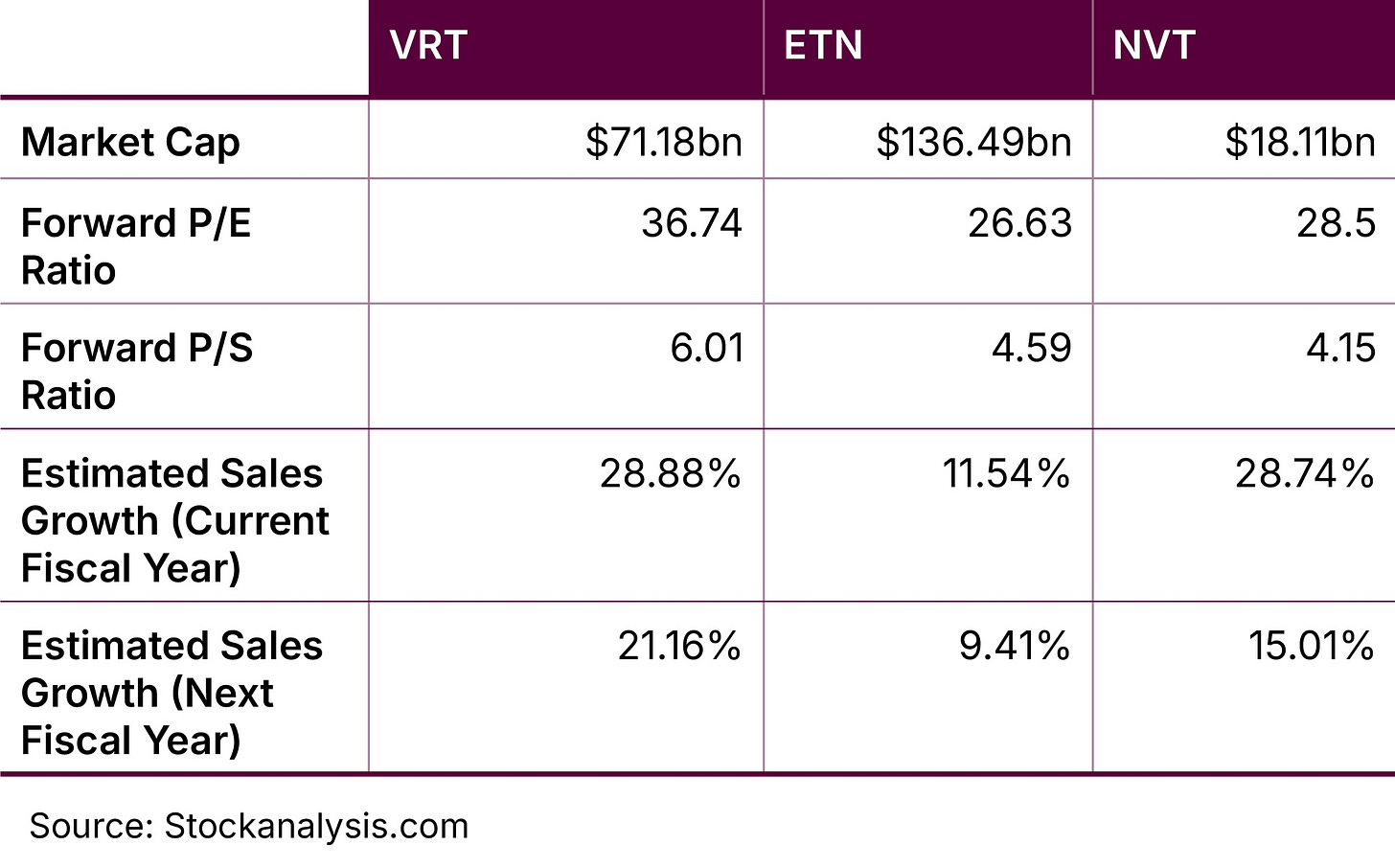

Here are how the fundamentals of VRT stock, ETN stock and NVT stock currently compare:

Despite its high forward P/E ratio, VRT stock could be considered undervalued relative to its forward P/S ratio. While the consensus is for revenue growth to slow in fiscal 2026, the outlook could improve when Vertiv updates the market on its outlook in its Q4 earnings report on February 11.

ETN stock and NVT stock could both be considered undervalued as well.

VRT Stock: The Investment Case

The Bull Case for Vertiv

VRT stock could be primed for a strong 2026, according to Barclays analyst Julian Mitchell, who upgraded the stock from ‘equal weight’ to ‘overweight’ at the start of January.

In a note to clients, Mitchell pointed out that VRT stock had underperformed NVT stock, as well as GE Vernova [GEV], in 2025 and is “ripe for some catch-up”.[6]

He added that “the recent volatility in the stock has created an attractive entry point”. His price target was raised from $181 to $200, implying an upside of 7.42% from the most recent closing price.

The Bear Case for Vertiv

As the AI gold rush continues, data centers will only get more power-hungry and, as a result, hotter.

According to Goldman Sach’s Alberto Gandolfi, Head of Pan-European Utilities, 30–40% of a hyperscaler’s energy consumption is from cooling.[7] Hyperscalers are likely to invest in developing new technologies that can make cooling more efficient. This could potentially impact demand for Vertiv’s cooling solutions in the long term.

In September 2025, Microsoft [MSFT] revealed a new cooling method using microfluids that it claims is three times more efficient than cold plates — the latter are currently used in the majority of data center cooling systems.[8] Vertiv’s share price fell approximately 6% on concerns about how demand could be impacted by Microsoft’s technology.

CEO Albertazzi dismissed such concerns on Vertiv’s Q3 earnings call, emphasizing that the company’s role in the thermal chain remains “intact”.[9]

Conclusion

The AI build-out is showing no signs of relenting, which means data center infrastructure stocks will be in hot demand for the foreseeable future.

VRT stock could be one of the key beneficiaries, as data center operators turn to its cooling technology and its predictive maintenance solution.

This is for informational purposes only. OPTO Markets does not recommend any specific securities or investment strategies. Investing involves risk and investments may lose value, including the loss of principal. Past performance does not guarantee future results.

[1] https://www.bloomberg.com/news/features/2025-11-21/how-the-data-center-boom-tests-grids-water-resources-capital-markets

[2] https://investors.vertiv.com/news/news-details/2026/Vertiv-Announces-New-AI-Powered-Predictive-Maintenance-Service-for-Modern-Data-Centers-and-AI-Factories/default.aspx

[3] https://investors.vertiv.com/news/news-details/2025/Vertiv-Reports-Strong-Third-Quarter-Results-including-Organic-Orders-60-Diluted-EPS-122-Adjusted-EPS-63-Raises-2025-Guidance/default.aspx

[4] https://www.eaton.com/us/en-us/company/news-insights/news-releases/2025/eaton-reports-record-third-quarter-2025-results-with-accelerating-orders.html

[5] https://s22.q4cdn.com/268397047/files/doc_financials/2025/q3/Q3-2025-NVT-Press-Release-FINAL.pdf

[6] https://www.barrons.com/articles/vertiv-stock-upgrade-ai-2b79061a

[7] https://www.goldmansachs.com/insights/articles/ai-to-drive-165-increase-in-data-center-power-demand-by-2030

[8] https://news.microsoft.com/source/features/innovation/microfluidics-liquid-cooling-ai-chips/

[9] https://fortune.com/company/vertiv-holdings/earnings/q3-2025/