Will China Curbs Weigh on This US Chip Stock?

Despite the concerns surrounding US-China trade tensions, chip equipment maker Lam Research could have room to grow.

Introduction

Lam Research [LRCX] is an American semiconductor equipment maker whose customers include Samsung [SSNLF], SK Hynix [000660.KS] and Taiwan Semiconductor Manufacturing Co [TSM].

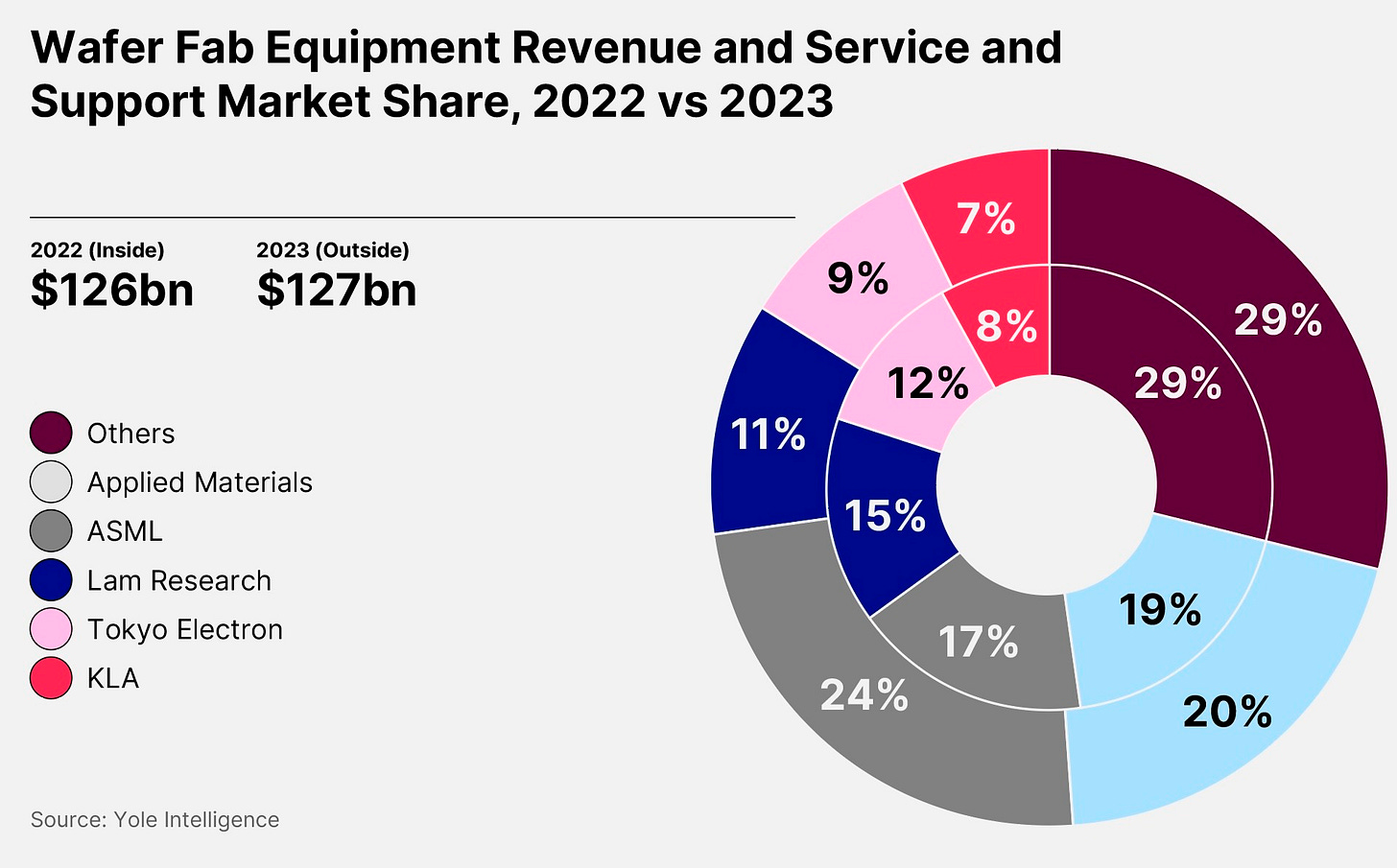

The company’s share of the wafer fabrication equipment (WFE) market fell from 15% in 2022 to 11% in 2023, according to research firm Yole Group. The market leader in 2022 was Applied Materials [AMAT] with a 19% share, which rose to 20%; the market leader in 2023 was ASML [ASML], with a 24% share, up from 17%.[i]

The global WFE market was worth $8.7bn in 2023, and Grand View Research expects it to grow at a CAGR of 5.8% between 2024 and 2030.[ii]

This stock spotlight will look at why LAM Research is reportedly exploring alternatives to its Chinese suppliers and what this might mean for LRCX stock. It will also look at the company’s recent financial performance.

Lam Research to Shift Supply Away from China

Ahead of the US election, the Wall Street Journal reported that chip toolmakers, including Lam Research and Applied Materials, have been asking suppliers to find alternatives to components sourced from China. Suppliers have also been advised that they should not have Chinese investors or shareholders.

Lam Research told the paper that it complies with US export restrictions for chip-related supply chains.[iii]

While a shift away from Chinese alternatives would help Lam Research to meet US guidelines, the alternatives are likely going to be expensive and, potentially, in limited supply.

LRCX Stock Slides

China concerns have seen the Lam Research share price slide 7.87% in the past month through November 27. Its most recent close of $71.57 is 4.15% above its 52-week low of $68.72, set on December 5, 2023, and 36.67% down from its 52-week high of $113, set on July 11.

LRCX stock is down 7.98% in the year to date and up 0.73% in the past year.

Lam Research and ASML

Lam Research reported a strong set of Q1 2025 results in October.

Adjusted earnings of $0.86 per share on revenue of $4.17bn came in ahead of the analyst consensus of $0.81 per share on revenue of $4.01bn. Gross margin improved to 48% from 47.5% in the previous quarter.[iv]

“With continued strong execution, Lam delivered financial performance ahead of expectations,” said CEO and President Tim Archer in the earnings press release. “Our investments in key technology inflections position us well to outperform WFE growth in 2025 and beyond.”[v]

The company has guided towards earnings of $0.77–0.97 per share on revenue between $4bn–4.6bn for Q2. Analysts are expecting $0.85 per share on revenue of $4.22bn.

ASML’s Q3 2024 results disappointed investors with a huge bookings miss, warning that the recovery of the semiconductors market beyond artificial intelligence is proving to be “more gradual than previously expected”.[vi] Applied Materials reported record revenue for Q4 of its fiscal 2024.[vii]

Here’s how Lam Research’s fundamentals compare with those of ASML and Applied Materials.

All three companies have a higher P/S ratio than the semiconductors industry average of 4.98.[viii] However, given Lam Research’s healthier revenue forecast, LRCX could be considered better value than the other two.

LRCX Stock: The Investment Case

The Bull Case for Lam Research

Several analysts reiterated their bullish view on LRCX stock following Lam Research’s Q2 results on October 18.[ix]

Needham’s Charles Shi reiterated his ‘buy’ rating with a price target of $100, implying an upside of 39.72% from the most recent closing price. In a note to clients seen by Barron’s, Shi argued that any concerns around China have largely been priced into the stock already. “We think there is limited downside from here,” he wrote.[x]

China accounted for 37% of sales in Q1 2025, down from 39% in Q4 2024 and 42% in Q3 2024.[xi] Goldman Sachs’ Toshiya Hari wrote in a note seen by Benzinga that the market could view the reduced exposure to China positively.[xii]

Ray Dalio’s Bridgewater Associates boosted his stake in LRCX stock by 315% in the July–September period, adding 2.1 million shares.[xiii] Investors will be hoping that the next 13F filing does not show the firm has reduced its position on China concerns.

The Bear Case for Lam Research

BofA Securities analyst Vivek Arya reiterated a ‘buy’ rating and raised the firm’s price target from $88 to $92, implying an upside of 28.55%. However, while China’s share of revenue could plateau at around 30% in the current quarter, export controls remain a risk.[xiv] There are also questions about its gross margin, which could come under pressure in the near term.

Meanwhile, analysts at Jefferies have warned that they “have a hard time seeing the overall [semiconductor] cap group working, given this [tariff] backdrop”.[xv]

Conclusion

Lam Research is taking steps to reduce its revenue exposure to China, as reflected in its recent earnings. If the toolmaker can persuade its suppliers to shift its supply chain away from China, then it could minimize the impact of any future tariffs that may be imposed. Nevertheless, its gross margin could come under pressure in the near term.

-

OPTO’s proprietary theme relevance system maps the world’s biggest investing megatrends. For in-depth analyses of stocks with high growth potential, subscribe to OPTO Foresight.

This is for informational purposes only. OPTO Markets LLC does not recommend any specific securities or investment strategies. Investing involves risk and investments may lose value, including the loss of principal. Past performance does not guarantee future results.

[i] https://www.yolegroup.com/strategy-insights/semiconductor-equipment-market-share-reshuffles-amid-memory-demand-decline

[ii] https://www.grandviewresearch.com/industry-analysis/wafer-processing-equipment-market-report

[iii] https://www.wsj.com/tech/u-s-chip-toolmakers-move-to-cut-china-from-supply-chains-6ad44c98

[iv] https://www.investing.com/news/stock-market-news/lam-research-beats-q1-expectations-shares-rise-on-strong-outlook-3678555 + https://filecache.investorroom.com/mr5ir_lamresearch2/1372/LRCX_Exhibit_99.1_Q1_2024.pdf

[v] https://filecache.investorroom.com/mr5ir_lamresearch2/1423/LRCX_Exhibit_99.1_Q1_2025.pdf

[vi] https://www.bloomberg.com/news/articles/2024-10-15/asml-orders-miss-as-chip-industry-weakness-weighs-on-demand?srnd=undefined&sref=AaLF1RVh + https://ourbrand.asml.com/m/4aa4442b0ef28b4f/original/Press-Release-Quarterly-Results-Q3-2024.pdf

[vii] https://ir.appliedmaterials.com/news-releases/news-release-details/applied-materials-announces-fourth-quarter-and-fiscal-year-2024

[viii] https://fullratio.com/ps-ratio-by-industry

[ix] https://www.marketbeat.com/stocks/NASDAQ/LRCX/forecast/

[x] https://www.msn.com/en-us/money/topstocks/lam-research-stock-rises-after-earnings-it-s-a-different-story-than-at-asml/ar-AA1sQUzi

[xi] https://filecache.investorroom.com/mr5ir_lamresearch2/1404/LRCX_Exhibit_99_1_Q4_2024.pdf + https://newsroom.lamresearch.com/2024-04-24-Lam-Research-Corporation-Reports-Financial-Results-for-the-Quarter-Ended-March-31,-2024

[xii] https://www.benzinga.com/government/24/11/41726213/applied-materials-and-lam-research-shift-supply-chains-away-from-china-to-meet-new-us-guidelines

[xiii] https://stockcircle.com/portfolio/ray-dalio/lrcx/transactions

[xiv] https://finance.yahoo.com/news/lam-research-positioned-growth-amid-190931530.html

[xv] https://uk.investing.com/news/stock-market-news/lam-research-beats-q1-expectations-shares-rise-on-strong-outlook-3749976