Why Is This Fintech Sizzling?

This buy now, pay later provider has seen its share price rocket 896.20% in the past 12 months despite a short report questioning its lending practices.

Key takeaways

BNPL transactions in the US are forecast to total $144.9bn in 2028, up from $94.3bn in 2024;

BNPL provider Sezzle has launched a number of tools and products in recent months that are helping to drive user engagement;

Sezzle’s revenue, net income and GMV — a key industry metric — all saw robust growth in Q1.

1. Sezzle’s Red-Hot Streak

Sezzle [SEZL] is a Minnesota, Minneapolis-headquartered fintech that offers buy now, pay later (BNPL) services.

Sezzle first listed on the Australian Securities Exchange (ASX) back in July 2019, but was added to the Nasdaq in August 2023. At the time, CEO Charlie Youakim said that the Nasdaq listing was “a natural evolution for Sezzle given the Company is already filing the necessary reports with the SEC” and that the move would “expand the universe of potential investors to the US”.[1] The company stopped trading on the ASX in January 2024.[2]

This stock deep dive will take a look at how Sezzle has established itself on the digital payments scene and is driving momentum with new product offerings.

First, there is the elephant in the room to address. Back in December, Sezzle was the target of a short report from Hindenburg, which accused it of “borrowing expensive capital to make extremely risky loans through a struggling platform that is rapidly losing customers and merchants”.[3] The report also argued that it is losing customers and merchants. Sezzle did not issue an official response addressing the allegations, but told Capital Brief that it believes its “results speak for themselves”.[4]

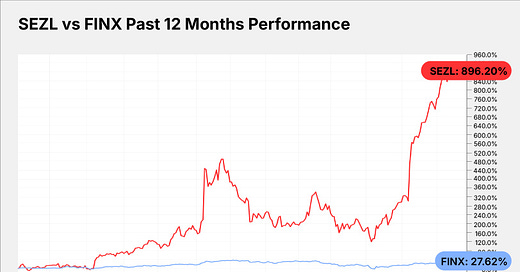

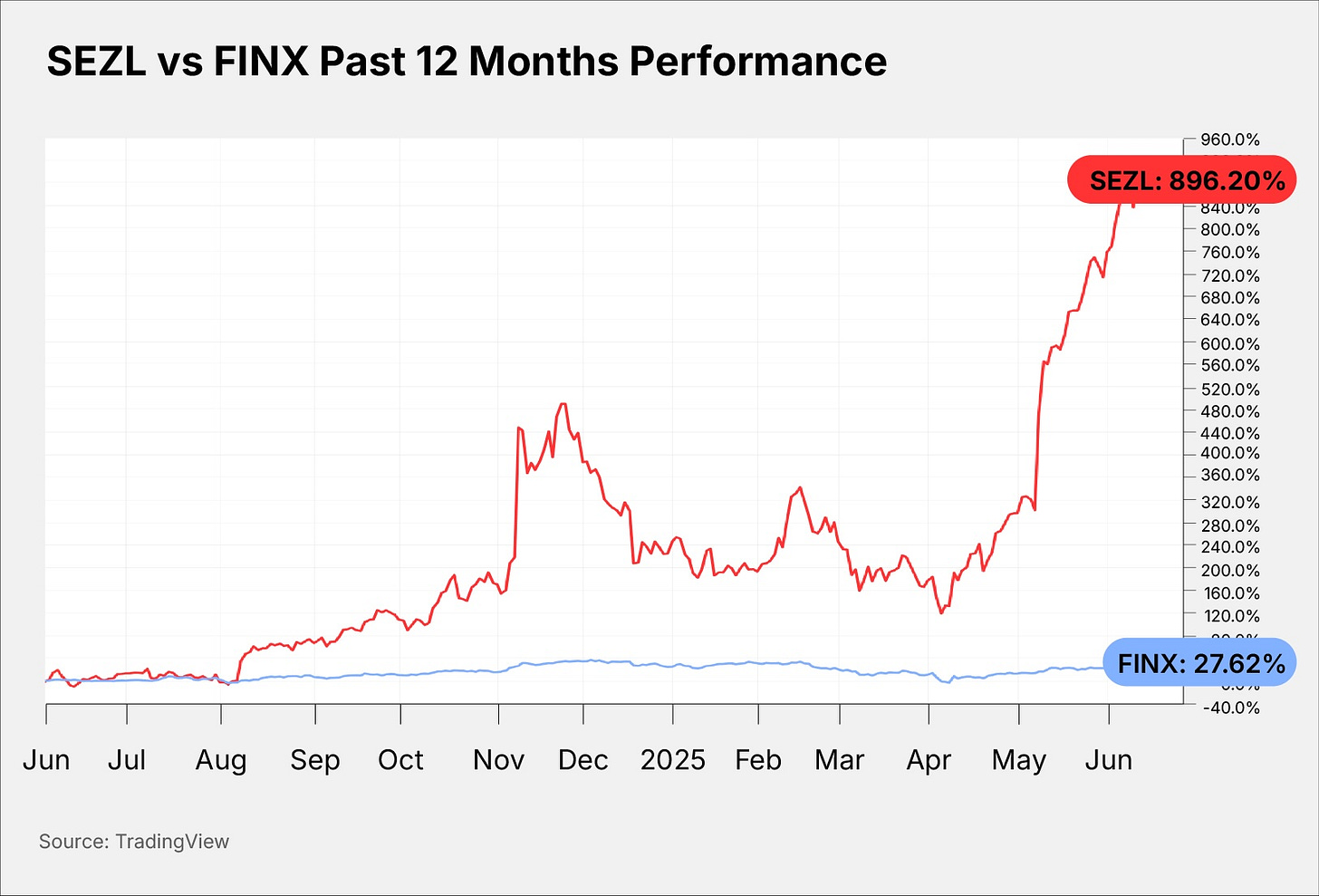

The Sezzle share price tumbled back in December following the release of the report, but has since shaken off any concerns and continues to power on to new highs. The stock closed on June 11 at $131.20, up 207.76% since January 1, having surged 896.20% in the past 12 months.

For comparison, the Global X Fintech ETF [FINX], which holds Sezzle with a weighting of less than a single percentage point,[5] is up 3.59% year-to-date and up 27.62% in the past 12 months.

2. BNPL’s Controversial Popularity

Keep reading with a 7-day free trial

Subscribe to Foresight to keep reading this post and get 7 days of free access to the full post archives.