Why are Analysts So Bullish on This AI Data Center Play?

This company’s products help hyperscalers, including Amazon and Microsoft, to scale up their data center networks.

Key Takeaways

Credo provides data center operators with connectivity solutions that support high-data data transmission, which is critical in the AI revolution.

The company’s largest hyperscaler customer is currently Amazon, having previously been Microsoft.

Demand for its products is expected to accelerate as AI moves from training to inference.

1. A Little-Known Stock in the Data Center Infrastructure Space

Credo Technology [CRDO] is a Cayman Islands-headquartered provider of connectivity solutions.

Credo has three key products: active electrical cables (AECs), integrated circuits (ICs) and SerDes (short for ‘Serializer/Deserializer’) chiplets.

This deep dive will focus on AECs and how these critical components in high-speed data transmission have helped Credo to capitalize on the artificial intelligence (AI) revolution’s demand for data center power.

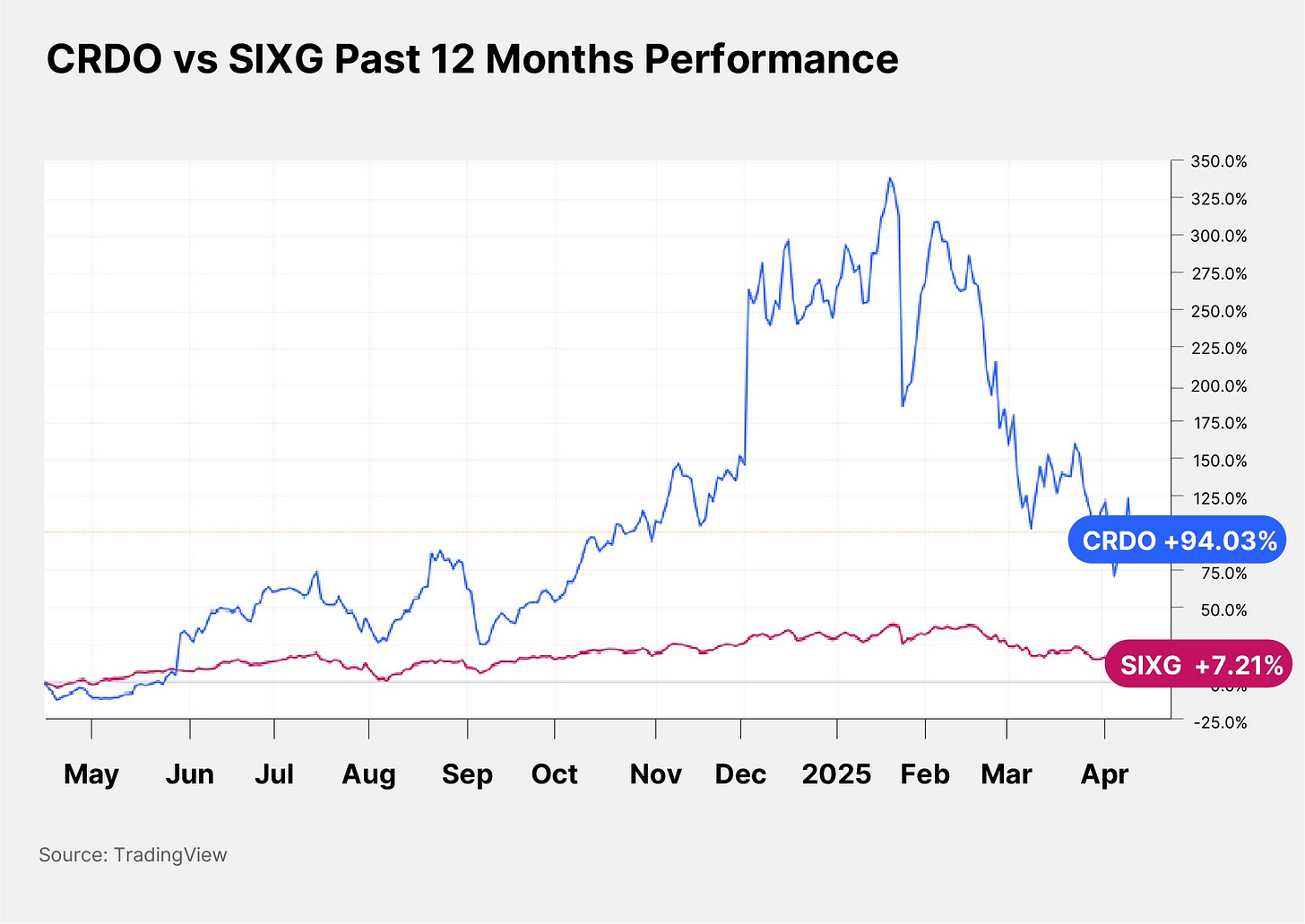

While CRDO stock is up 94.03% in the past 12 months through April 16 to $37.72, the share price is down 43.88% since January 1. It has also more than halved since peaking at an all-time high of $86.69 on January 22.

The bearish movement in the Credo share price is a result of two factors: first, the AI stock selloff sparked by DeepSeek AI at the end of January; and second, US President Donald Trump’s tariff war, which has spooked investors and caused a major rethink of valuations.

For comparison, the Defiance Connective Technologies ETF [SIXG] is down 17.15% since the start of the year, though up 7.21% in the past 12 months. As of April 16, the fund has allocated 1.45% of its portfolio to Credo. Its top holdings include big AI chip names like Apple [AAPL], Nvidia [NVDA] and Qualcomm [QCOM].[1]

Here, we take a closer look at Credo’s role in helping hyperscalers to scale their data center infrastructure.

Keep reading with a 7-day free trial

Subscribe to Foresight to keep reading this post and get 7 days of free access to the full post archives.