Which Chinese EV Stocks Could Challenge Tesla in Europe?

Consumers in Europe seem to be turning their back on Tesla; could a Chinese automaker surge ahead in the EV race?

Key Takeaways

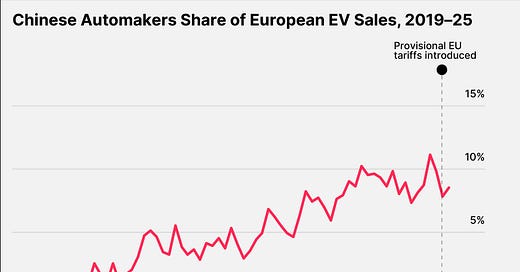

Tesla’s sales in Europe are falling, making room for Chinese automakers to grow their market share;

Nio, XPeng and Zeekr are all targeting an expansion of their product offerings in Europe and the UK, despite increased tariffs;

The price war in the Chinese market continues to impact EV makers’ profit margins.

Consumers in Europe seem to be tur…

Keep reading with a 7-day free trial

Subscribe to Foresight to keep reading this post and get 7 days of free access to the full post archives.