What’s Behind This Medical Device Maker’s 70% Rally?

Key Takeaways

Globus has a 17.9% share of the spine implants and devices market, thanks to the $3.1bn acquisition of a rival firm in Q3 2023;

The company’s revenue has grown at a CAGR of 38.76% between 2021 and 2024, a significantly faster rate than competitors Medtronic and Stryker;

Management remains optimistic about 2025 and plans to add new products to its burgeoning portfolio.

1. Globus Medical

Globus Medical [GMED] is one of the leading medical device makers in the US specializing in solutions for musculoskeletal problems.

The Pennsylvania-based company boasts a broad portfolio of products. It includes technologies, implantable devices, surgical instruments and accessories used in spine surgery and other orthopedic and neurosurgical procedures.

The firm has been gaining ground on leading device makers, including Medtronic [MDT] and Stryker [SYK], as well as the Johnson & Johnson [JNJ] orthopedics subsidiary DePuy Synthes. This is largely thanks to the recent acquisition of a rival spine surgery firm and a series of new products.

The release of preliminary Q4 earnings earlier this month helped the Globus share price rally to an all-time high of $93.67 on January 22.

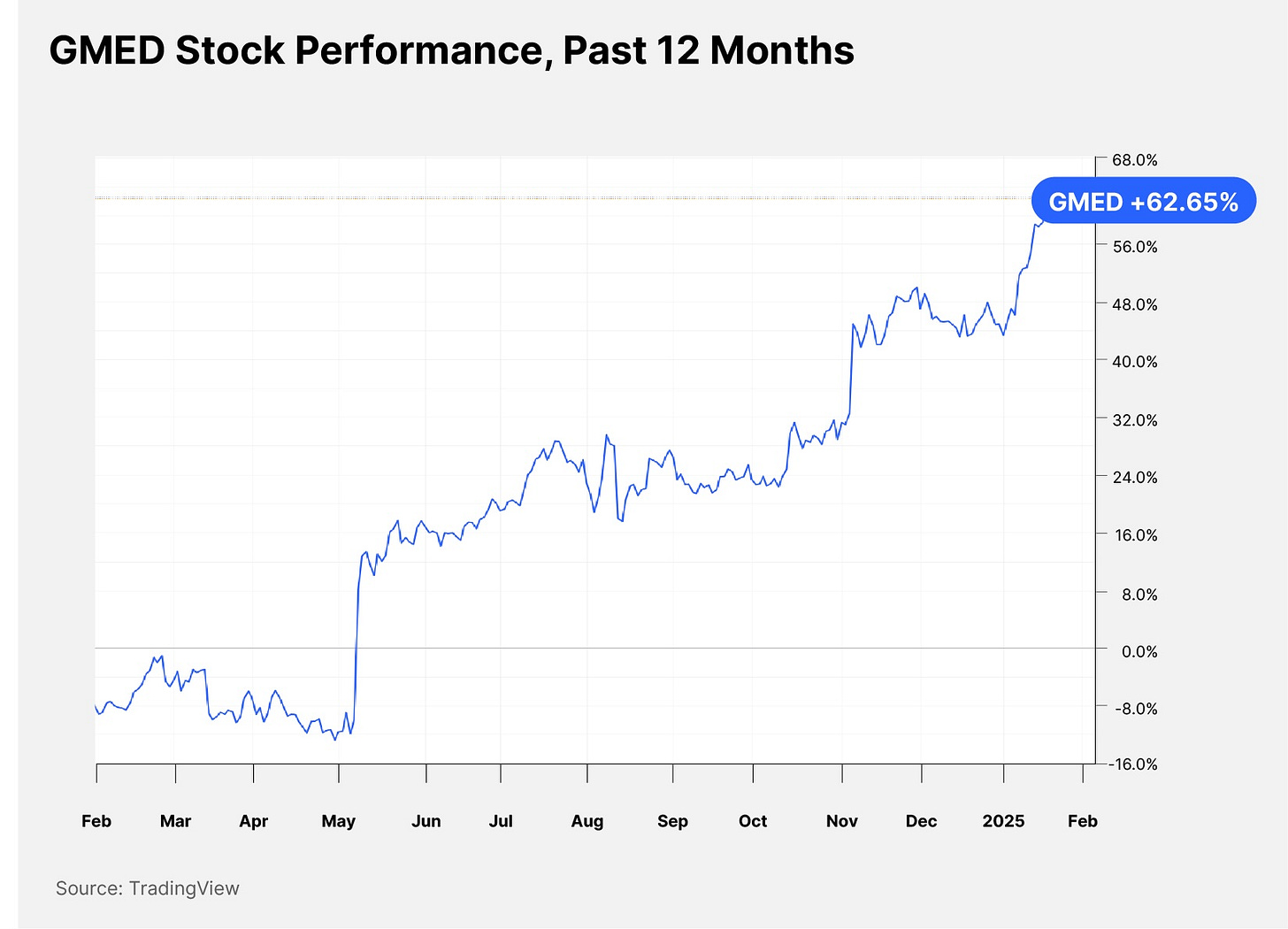

GMED stock has gained 70.07% in the past 12 months through January 24 and 26.52% in the past six months. It is up 12.25% since the start of the year.

The share price has far outperformed the broader medical device market, with the iShares US Medical Devices ETF [IHI] up 15.98% in the past 12 months and up 12.63% in the past six months.

In this deep dive, we take a look at what is behind the Globus share price rally and whether the company is on firm footing to continue its growth.

Keep reading with a 7-day free trial

Subscribe to Foresight to keep reading this post and get 7 days of free access to the full post archives.