What’s Behind This Bitcoin Miner’s 128.45% Rally?

Bitcoin stocks are climbing on hopes of a Trump White House creating a crypto-friendly environment. But it’s Iren’s investment in power and land that is catching investors’ eyes.

Key Takeaways

Iren’s stock has more than doubled over the past 12 months as it pivots to AI;

The bitcoin miner has locked up 2.3GW of power and land over recent years to help meet data center demand;

Its 1.4GW facility in Sweetwater, Texas, alone is larger than London’s data center market;

Iren is one of five bitcoin miners with the working HPC capacity needed to scale AI workloads.

1. Iren Shakes Off Short Report

Iren [IREN], known as Iris Energy until February this year,[1] is a Sydney-based, Nasdaq-listed bitcoin miner.

Founded in 2018 by brothers Daniel and Will Roberts, the company owns and operates data centers powered by renewable energy. It is also investing in land and ramping up its power capacity to meet demand for artificial intelligence (AI).

The Iren share price tumbled back in July after the short-seller Culper Research raised concerns about its AI pivot, describing it as “contrived nonsense” that is “reminiscent of Covid-19 era biotech scams.”[2]

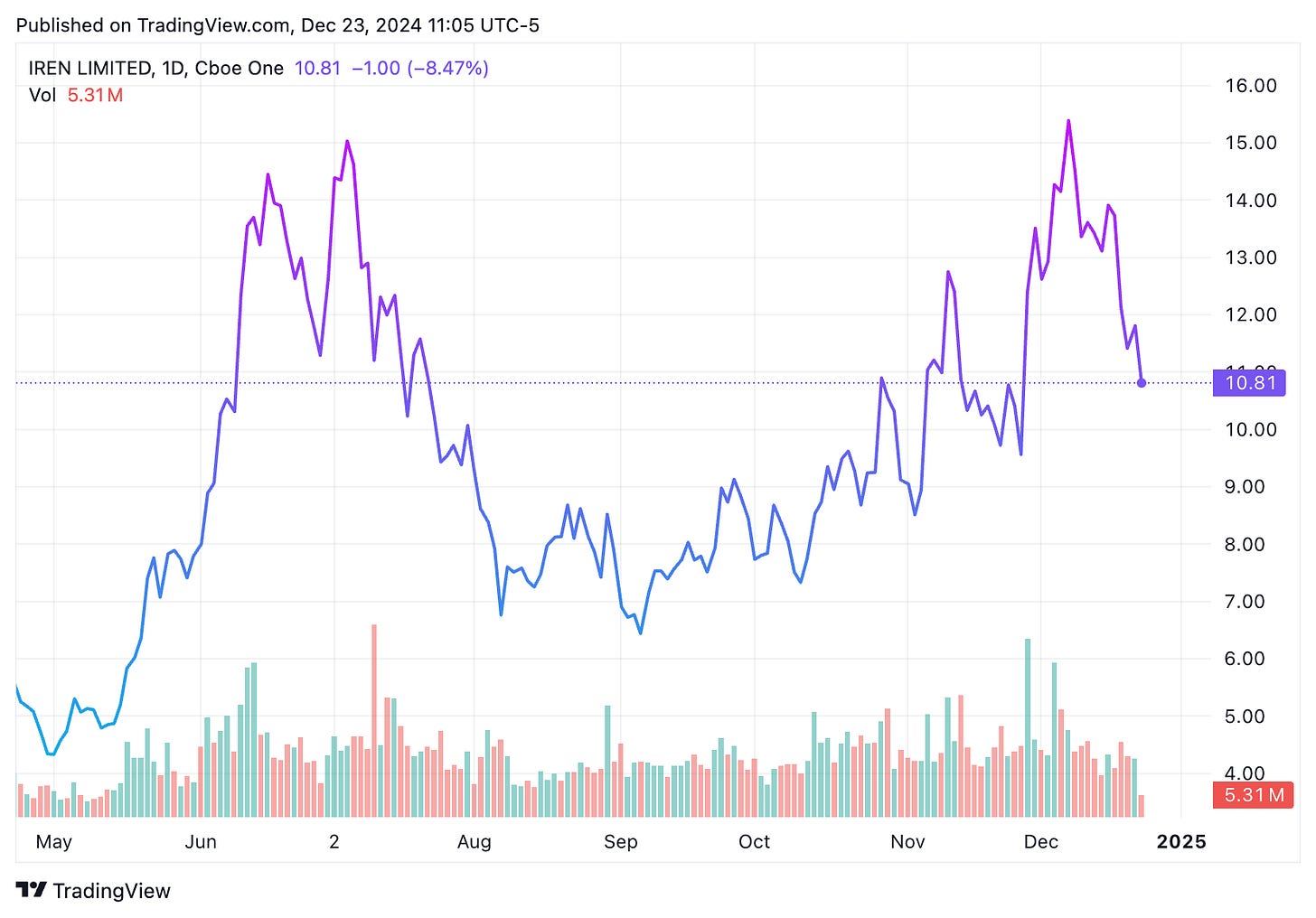

Nevertheless, the Iren share price has recovered since the release of the short report on July 11,[3] setting an all-time high of $15.92 on December 6. The stock set a 52-week low of $3.56 back on February 5. It has gained 92.03% in the year to date through December 17 and 128.45% in the past 12 months.

Iren has outperformed the broader crypto theme. The Schwab Crypto Thematic ETF [STCE], which has the stock in its top-10 holdings, has posted gains of 73.22% and 87.59% in the respective periods.

Here, we take a look at Iren’s pivot to AI and how the bitcoin miner is locking up power and land to meet data center demand. We will also look at its recent financial performance and highlight how an AI slowdown could have a negative impact on its revenue and profitability.

Keep reading with a 7-day free trial

Subscribe to Foresight to keep reading this post and get 7 days of free access to the full post archives.