What’s Behind This Biotech’s 170% Climb?

Logging impressive growth over the last 12 months, this biotech stock is challenging Roche and Novartis in the relapsing multiple sclerosis therapeutics market.

Key Takeaways

TG Therapeutics is one of just three companies that has an FDA-approved treatment for relapsing multiple sclerosis that specifically targets the CD20 protein.

TG Therapeutics was the third to market and, while it accounts for a single-digit percentage of the market, sales of its drug Briumvi surged 250% in 2024.

TG Therapeutics is hoping to grow its presence with a new version of the drug that can be delivered under the skin through an injection pen, making treatment more accessible.

1. A Biotech Stock Bucking the Sell-Off Trend

TG Therapeutics [TGTX] is a North Carolina-headquartered biotech company.

Founded in 1993, TG Therapeutics’ original focus was on cancer drug research, but it pivoted to multiple sclerosis (MS) in 2022, after the US Food and Drug Administration (FDA) withdrew its approval for the cancer medicine Ukoniq earlier in the year.[1]

This deep dive will look at how TG Therapeutics is growing its presence in the competitive MS cell therapy market, and how it could be in a strong position to fend off competition from Roche [RHHBY] and Novartis [NVS].

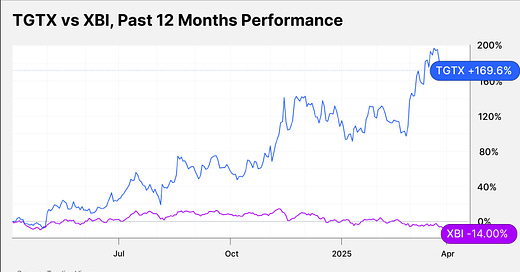

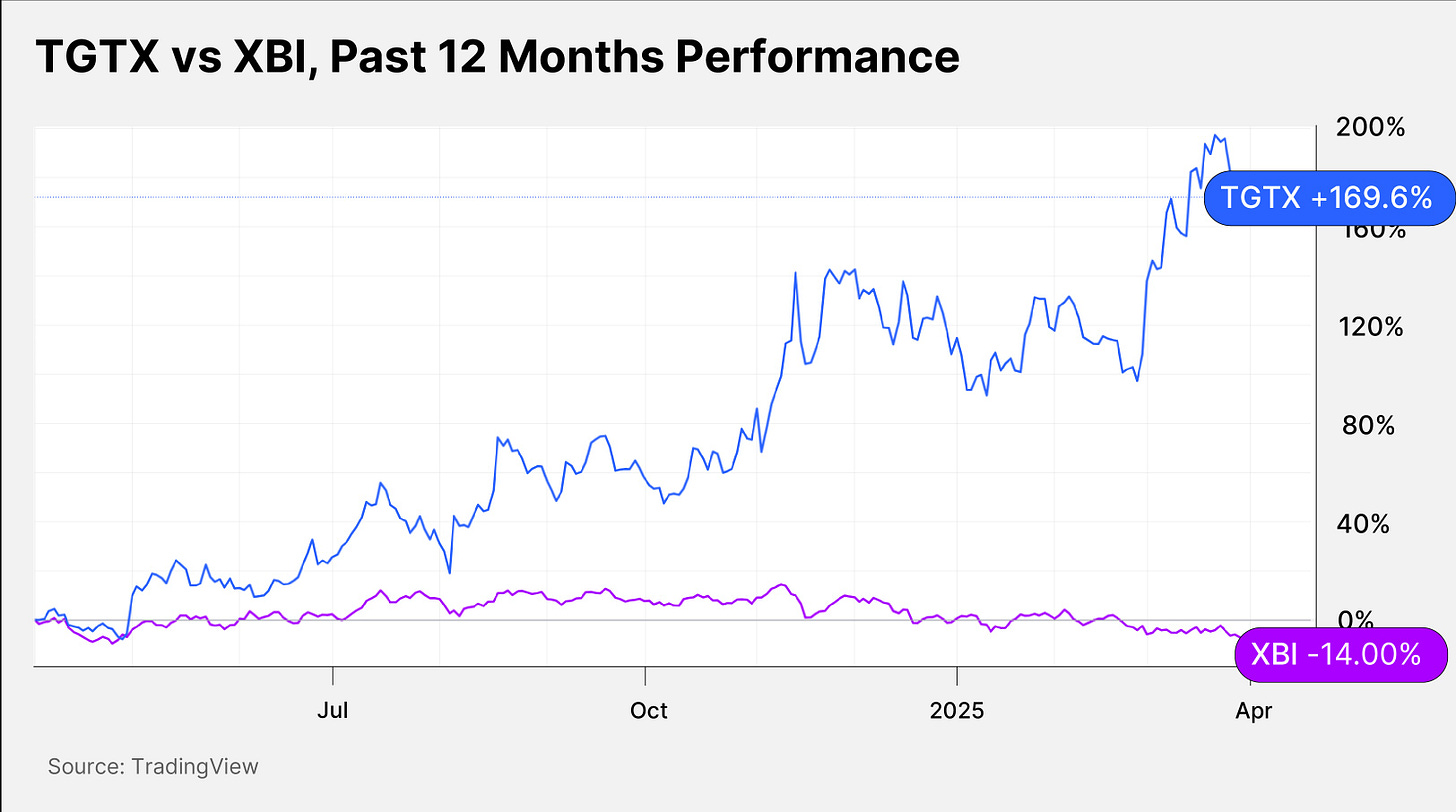

The TG Therapeutics share price is up 32.29% year-to-date, bucking the downward trend that the broader biotech theme has been on.

Drugmakers and pharmaceuticals have sold off this year due to concerns about Robert F. Kennedy Jr.’s appointment as US Secretary of Health. They have also been dragged down by the market’s jitters around the US economy.

For comparison, the SPDR S&P Biotech ETF [XBI], which holds TG Therapeutics, is down 10.51% since January 1.

TGTX stock has gained 74.42% in the past six months and 169.6% in the past 12 months. XBI has fallen 17.73% and 14% in the respective periods.

2. The Competitive MS Therapy Market

MS is a neurological disease where the immune system attacks itself, affecting the brain and spinal cord. There is no cure, but treatment can help to manage pain, which can be unpredictable. According to the National Multiple Sclerosis Society, approximately 2.9 million people worldwide are living with the condition — 1 million in the US alone.[2]

The most common form of MS is relapsing MS, where symptoms can flare up for a period of time — anywhere from a couple of days to a couple of months — before subsiding. TG Therapeutics’ drug ublituximab, sold under the brand name Briumvi,[3] treats relapsing MS by targeting CD20, a protein found on the surface of some blood cells. Anti-CD20 therapies help to reduce the likelihood of flare-ups.

Briumvi, which received FDA approval in December 2022,[4] is administered intravenously. After the first two doses two weeks apart, patients are then dosed with the drug by intravenous (IV) every 24 weeks. These infusions take about an hour.

In September, TG Therapeutics published data which showed that 92% of patients with relapsing MS were free from disability progression after five years of continuous treatment.[5]

Other FDA-approved relapsing MS treatments targeting CD20 include Roche’s ocrelizumab, sold as Ocrevus and Ocrevus Zunovo, and Novartis’ ofatumumab, sold as Kesimpta.

Roche’s Ocrevus, approved in March 2017,[6] is given every six months following two initial doses, although infusion takes at least two hours. At the end of last year, the FDA gave the nod to Ocrevus Zunovo,[7] a subcutaneous version — doses are delivered into the fatty tissue under the skin — that has to be administered by a healthcare professional twice a year.

Novartis’ Kesimpta was approved in August 2020[8] and offers a more convenient subcutaneous option — doses come in pre-filled injection pens that can be self-administered every month.

Anti-CD20 drugs have “transformed” the treatment of relapsing MS, said TG Therapeutics CEO Michael S. Weiss at the JPMorgan Health Conference in January. Annualized sales of anti-CD20 drugs in the US totaled $8bn at the end of Q3, he added.

“Admittedly, as third to market, we’re not a huge portion of that $8bn just yet, but we do expect to participate in the growth of this area.”[9]

Keep reading with a 7-day free trial

Subscribe to Foresight to keep reading this post and get 7 days of free access to the full post archives.