Things Are Not Looking Great for Hydrogen Right Now

With the US clean energy sector threatened by subsidy cuts, how are key hydrogen stocks faring?

Key Takeaways

The US hydrogen sector is largely unprepared as 45V tax credits for clean energy projects look to be scrapped.

Some companies, such as Linde, are establishing blue hydrogen projects, which benefit from carbon-capture related tax credits.

Air Products has shuttered a green hydrogen project, while Plug Power is moving toward profitability thanks to its electrolyzer business.

US President Donald Trump wants to stimulate the US economy with his “one big, beautiful bill”, which includes cutting up Joe Biden’s flagship climate law, the Inflation Reduction Act (IRA).

If President Trump gets his way, the 45V tax credit for green hydrogen projects will be scrapped. Under the IRA, projects could be awarded up to $3 for every kilogram of green hydrogen produced. President Trump wants to bring forward the deadline for qualifying for the tax break, which would require construction to begin by January 1, 2026 and not January 1, 2033.

The bill was passed by the House of Representatives in May, and, on June 16, a US Senate committee released draft legislative text that agreed to the termination of the 45V tax credit. The bill could head to the Senate for its final vote at the end of June.[1]

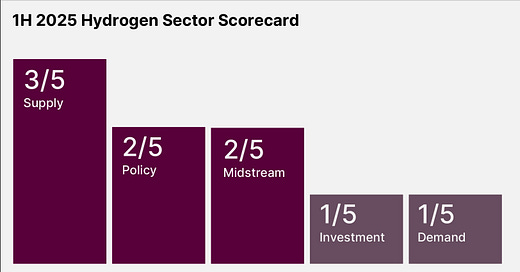

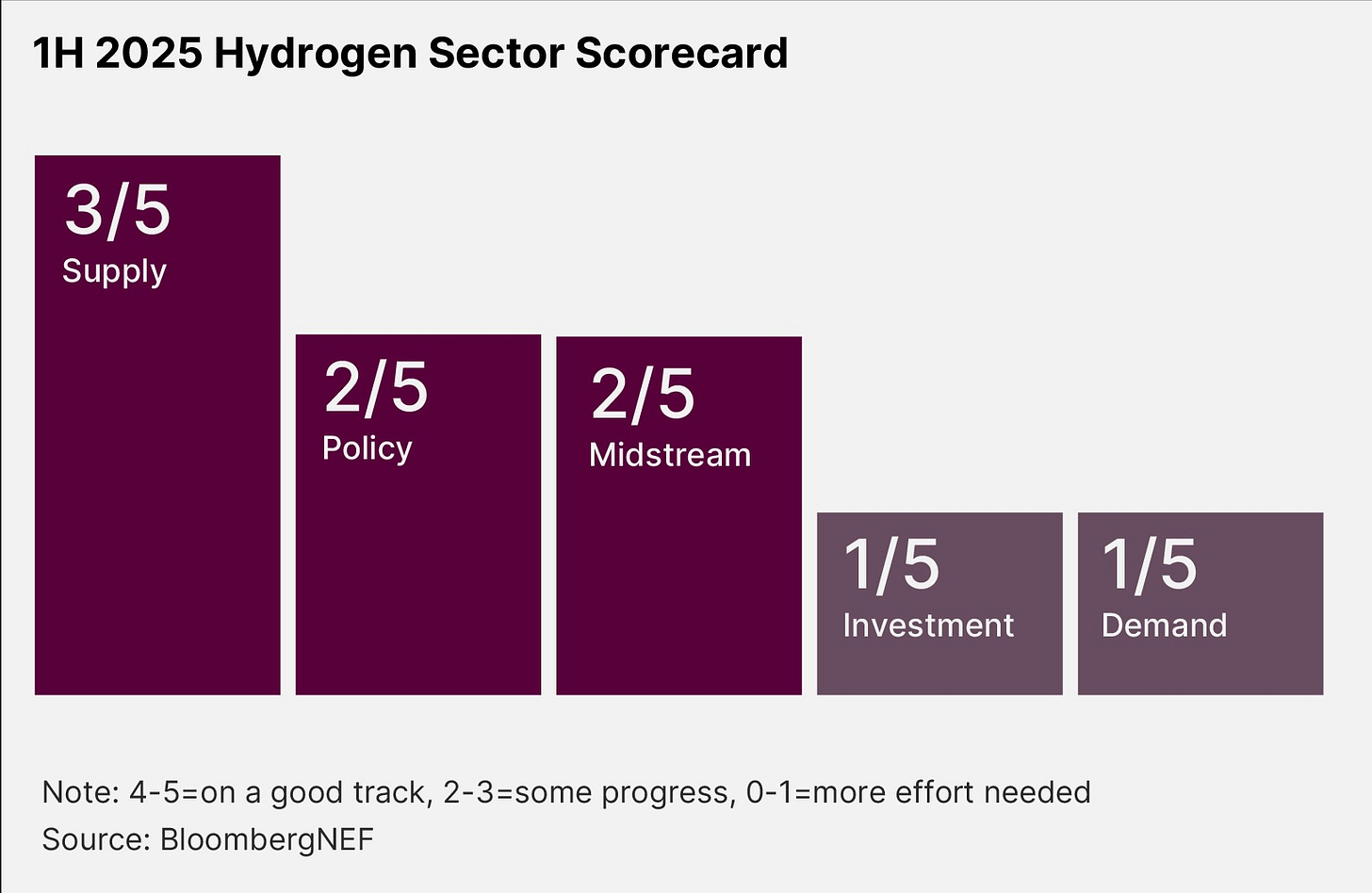

In short, things are not looking great for the hydrogen market right now. BloombergNEF has scored the industry in several areas and, as the following graph shows, more needs to be done.

With this in mind, we take a look at three key players in the US hydrogen industry: Air Products [APD], Linde [LIN] and Plug Power [PLUG].

Recent Green Hydrogen Announcements

Pennsylvania-based Air Products announced in February that it was canceling construction of a New York facility that would have produced 35 metric tons of green liquid hydrogen per day. The project would not have been eligible for the 45V tax credit due to regulatory changes, regardless of the upcoming changes President Trump wants to introduce.[2]

Gas major Linde is currently focusing on blue hydrogen for growth in the US. Blue hydrogen relies on carbon capture technology, whereas green hydrogen uses electrolysis. Linde is thus able to take advantage of the 45Q tax credit, which President Trump has left intact and rewards projects that capture carbon dioxide.

Green hydrogen “isn’t at scale today, doesn’t have the competitive cost base that is necessary … to have significant reduction in capital intensity to get to that point of inflection,” said CEO Sanjiv Lamba on the Q1 earnings call on May 1.[3]

Plug Power is one of dozens of companies in the hydrogen value chain to have urged Congress not to gut the 45V tax credit. “Eliminating Section 45V would be a catastrophic step backward for American energy leadership, job creation and industrial competitiveness,” Frank Wolak, President and CEO of the Fuel Cell and Hydrogen Energy Association, wrote in a statement signed by Plug Power in May.[4]

Hydrogen Stocks Run Out of Steam

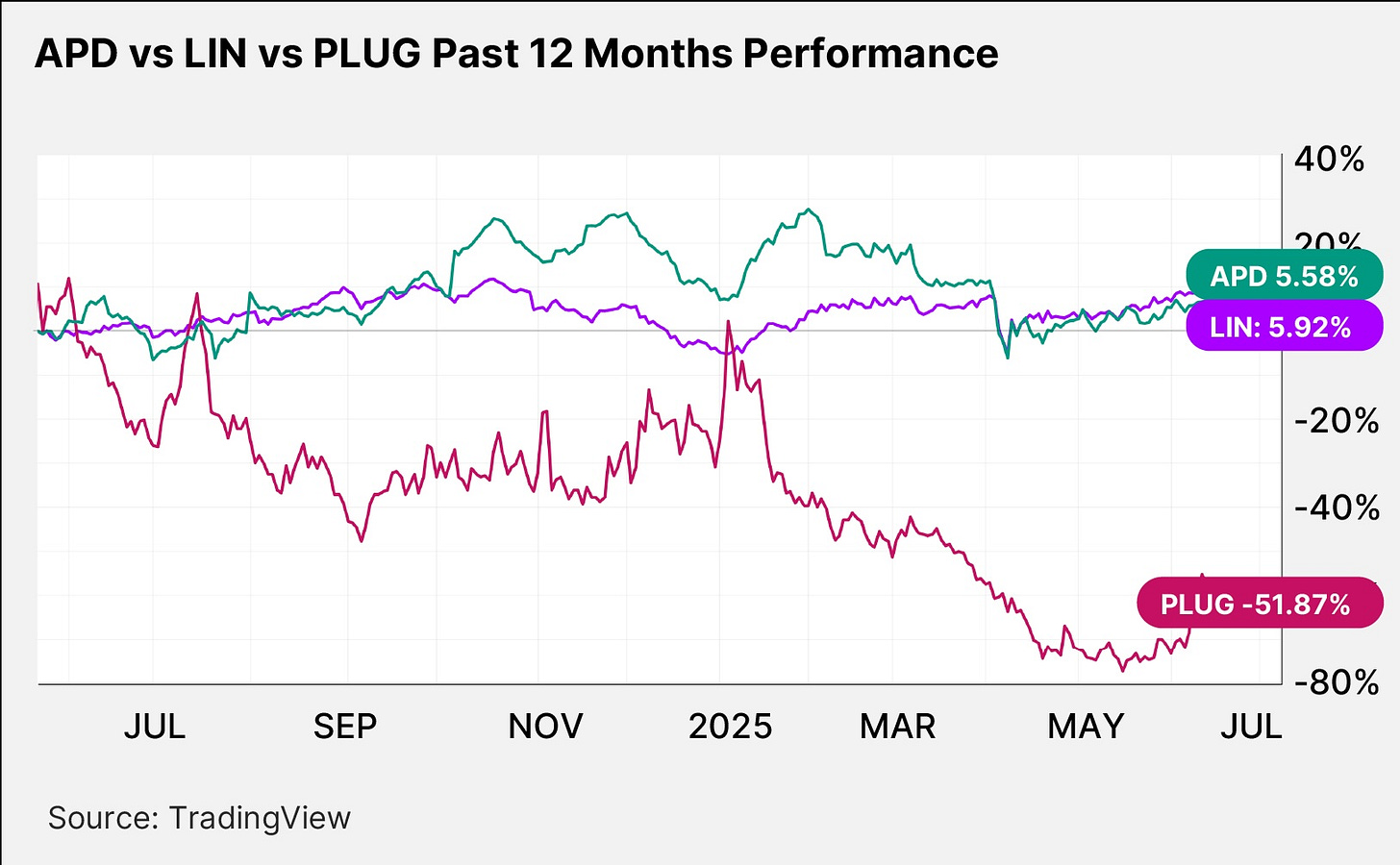

The Air Products share price is down 1.93% since January 1 through June 20 and up 5.58% in the past 12 months.

The Linde share price has risen 11.35% since the start of the year and has gained 5.92% over the past 12 months.

The Plug Power share price has recorded declines of 45.54% and 51.87% over the same periods.

APD, LIN and PLUG Stock: Recent Earnings Performance

Air Product’s decision to cancel the New York facility and two other non-hydrogen projects led to $2.3bn in charges that contributed to a $1.7bn net loss in its fiscal Q2 2025.[5]

Linde’s Q1 2025 sales were flat at $8.1bn, but net income crept up 3% to $1.67bn.[6]

Plug Power slashed its Q1 2025 net loss by a third to $197m from $296m in the year-ago quarter. Revenue was up 11% year-over-year, driven by a 575% jump in its GenEco electrolyzer business.[7]

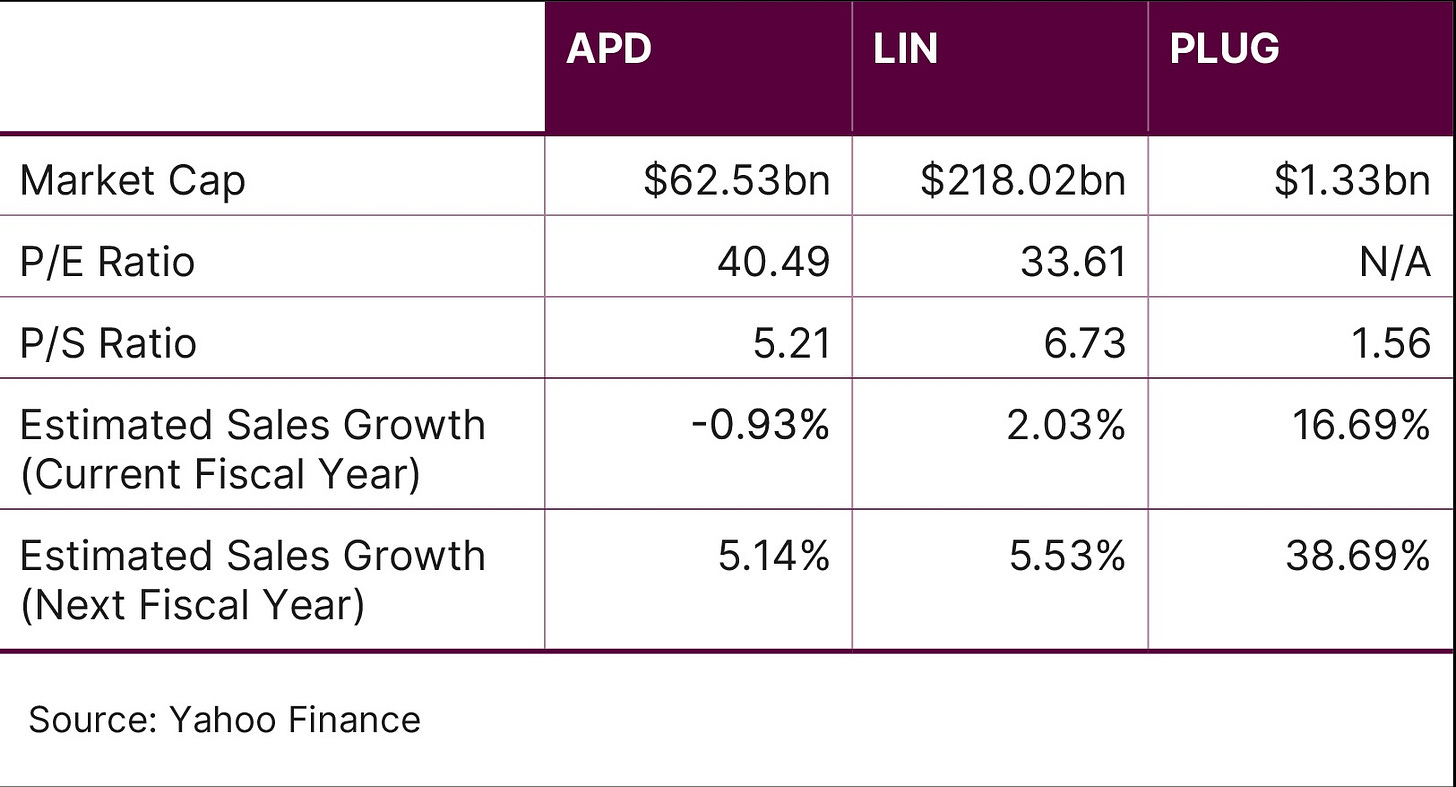

Here are how the three stocks’ current fundamentals compare.

APD stock and LIN stock could be considered fairly valued or overvalued given their respective P/S ratios and underwhelming revenue growth. PLUG stock could be considered cheap due to its much lower P/S ratio and stronger revenue forecast, but it is the only one of the three that is not profitable.

APD, LIN and PLUG Stock: The Investment Case

The Bull Case for Air Products

The company is confident that the decision to cancel clean energy projects in favor of low-risk projects will help it to deliver growth in the near term.

Risky investments had led to a boardroom fight, led by activist Mantle Ridge.[8] Air Products’ long-time CEO was pushed out and replaced in February by former Linde executive Eduardo Menezes.[9]

The Bear Case for Air Products

Lower demand for its products and services resulted in its full-year profit forecast being slashed from $12.70–13.00 per share to $11.85–12.15 per share.[10]

The Bull Case for Linde

The company expects to spend $5bn–5.5bn in the current fiscal year, up from $4.5bn in 2024.[11] This includes a ramp in investments in blue hydrogen infrastructure.

The Bear Case for Linde

Production costs for green hydrogen are unlikely to be viable for five to seven years, Lamba said on the Q1 earnings call.

Profit for Q2 is expected to be lower than expected on the back of weak European demand. Earnings per share are forecast to be between $3.95–4.05, while analysts are expecting $4.09 per share.[12]

The Bull Case for Plug

As well as trimming its losses, the company has been making progress addressing cash usage. It burned $142m in Q1 compared to $268m spent in the year-ago quarter.

“Between strengthening our balance sheet, scaling hydrogen production and streamlining operations, we’ve taken the right steps to position Plug for long-term success in the hydrogen economy,” said CEO Andy Marsh in the earnings release.[13]

The Bear Case for Plug

Despite ballooning losses seeming to come down, PLUG stock has been at risk of being delisted from the New York Stock Exchange due to the share price having traded under $1 for longer than a month.

The company will hold a meeting on July 3 at which shareholders will be asked to approve a reverse stock split to avoid the delisting threat.[14]

Conclusion

A mixture of weak demand, policy uncertainty and the impending cancelation of the 45V tax credit means that the outlook for the hydrogen industry looks uncertain. This means the likes of APD stock, LIN stock and PLUG stock could be risky plays on the theme, at least in the near term, even though they could be long-term beneficiaries of the clean energy transition.

This is for informational purposes only. OPTO Markets does not recommend any specific securities or investment strategies. Investing involves risk and investments may lose value, including the loss of principal. Past performance does not guarantee future results.

[1] https://edition.cnn.com/2025/06/21/politics/senate-trump-agenda-bill

[2] https://www.airproducts.com/company/news-center/2025/02/0224-air-products-to-exit-three-us-based-projects

[3] https://assets.linde.com/-/media/global/corporate/corporate/documents/investors/quarterly-earnings/investor-call-transcript-1q25.pdf

[4] https://fchea.org/wp-content/uploads/2025/05/Urgent-45V-Preservation-Sign-On-Letter-2025-5-13-Final.pdf

[5] https://investors.airproducts.com/static-files/ac8e2261-48f5-4155-a679-073a41ad9e1c

[6] https://assets.linde.com/-/media/global/corporate/corporate/documents/press-releases/2025/linde-1q25-earnings-release-tables.pdf

[7] https://www.ir.plugpower.com/press-releases/news-details/2025/Plug-Reports-First-Quarter-2025-Financial-Results/

[8] https://www.reuters.com/markets/commodities/air-products-investors-elect-three-mantle-ridge-directors-source-says-2025-01-23/

[9] https://www.reuters.com/business/energy/air-products-beats-estimates-quarterly-profit-amid-costly-boardroom-battle-2025-02-06/

[10] https://www.reuters.com/business/energy/air-products-lowers-full-year-profit-forecast-shares-fall-2025-05-01/

[11] https://assets.linde.com/-/media/global/corporate/corporate/documents/press-releases/2024/linde-4q24-earnings-release-tables.pdf

[12] https://www.reuters.com/markets/europe/linde-forecasts-second-quarter-profit-below-estimate-weakness-european-market-2025-05-01/

[13] https://www.ir.plugpower.com/press-releases/news-details/2025/Plug-Power-Signs-525-Million-Secured-Credit-Facility-with-Yorkville-Advisors-and-Reports-Strong-Preliminary-Q1-2025-Results/default.aspx

[14] https://www.plugpower.com/blog/understanding-plug-powers-special-supervoting-preferred-for-the-reverse-stock-split-vote/