These 5 Value Plays Could Offer an Affordable Stake in AI

These IT and software stocks are incorporating generative AI into their products and services; they could be the next big winners of the theme.

This piece is normally behind the paywall but today, we’re sharing it with everyone. It’s a glimpse of the depth and insight we aim to bring to every piece for our paying subscribers.

If you enjoy it, consider subscribing for full access to exclusive investment cases, our archive, and more.

Key Takeaways

Cognizant Technology Solutions has been betting on AI to catch up to India’s top IT companies.

MongoDB has spent $220m on a start-up to help enterprise customers reduce the risk of AI hallucinations.

UiPath has launched an agentic automation platform that can be used to manage and orchestrate AI agents.

Artificial intelligence (AI) is still booming, but some of the big names are looking like they might be overvalued.

Take Nvidia [NVDA] and Palantir [PLTR], for example.

The king of chips has skyrocketed 1,575.46% in the past five years through June 25, but is up just 30% in the past 12 months. Meanwhile, the AI software maker has seen its share price surge 491.47% in the past 12 months and has been likened to a meme stock.[1]

Investors will often buy into the likes of Nvidia and Palantir because of the hype surrounding them. But there are dozens, if not hundreds, of stocks that together form the backbone of AI. Without them, the industry would arguably fall apart, yet they tend to fly under the radar.

As Goldman Sachs outlined in April 2024, the development of AI can be split into four phases: Nvidia; AI infrastructure; AI-enabled revenue; and AI productivity gains.[2]

The industry is currently transitioning from AI infrastructure to AI-enabled revenue.

“So far, few companies come close to reflecting AI optimism the way Nvidia has … Many companies in these two phases are necessary for every other company to use the technology to improve productivity,” noted the researchers.

The IT and software stocks that are incorporating generative AI into their products and services may prove to be the next winners.

OPTO has selected five such stocks that look cheap and undervalued relative to their fundamentals. As of June 25, all five had P/S ratios and forward P/S ratios lower than 10.

The stocks in question are Cognizant Technology Solutions [CTSH], Genpact [G], Kyndryl [KD], MongoDB [MDB] and UiPath [PATH].

How These AI Value Plays Have Been Performing

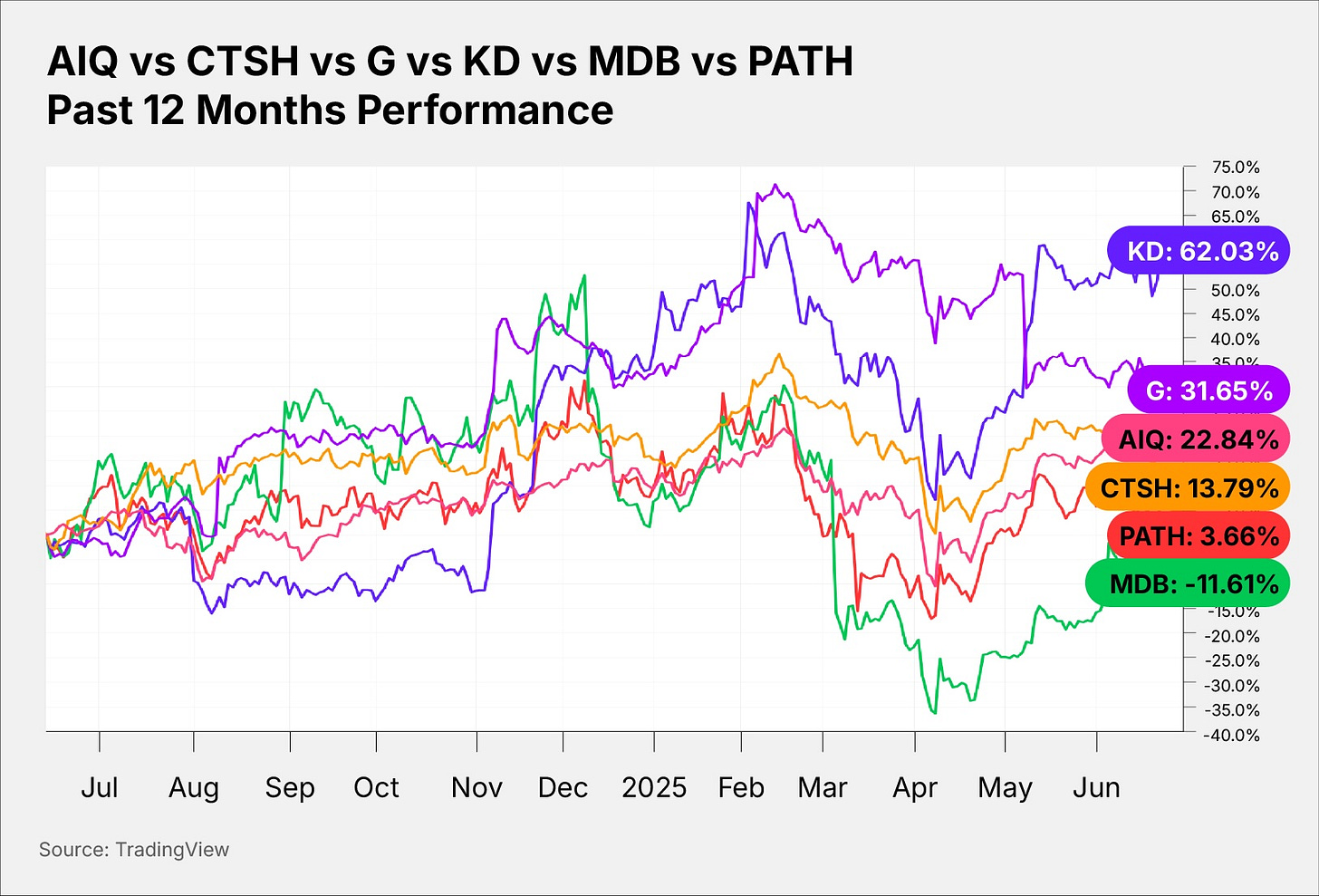

The Cognizant share price is up 0.83% since January 1 through June 25, and up 13.79% in the past 12 months.

The Genpact share price is down 2.52% and up 31.65% in the respective periods. The Kyndryl share price has gained 19.28% and 62.03%. The MongoDB share price has fallen 11.19% and 11.61%. The UiPath share price is down 1.89 and up 3.66%.

For comparison, the Global X Artificial Intelligence & Technology ETF [AIQ], which currently holds Genpact and UiPath, has logged gains of 11.49% and 22.84%.

Cognizant

CTSH’s Role in the AI Universe

New Jersey-based Cognizant has long been one of India’s top IT companies, but has fallen behind its peers like Tata Consultancy Services [TCS:NS] in recent years. Now, Cognizant is betting on AI to help it access “the winner’s circle” by 2027, as CEO Ravi Kumar told analysts at its investor day in March.[3]

The company has bagged two mega deals — defined as being at least $500m in value — in the current quarter, on top of one secured in Q1.

CFO Jatin Dalal told attendees at the Nasdaq Investor Conference on June 11 that “AI is front and center” of these deals.[4]

CTSH’s Recent Financial Performance

Cognizant’s Q1 earnings were modest. Revenue came in at $5.12bn, just above the analyst consensus of $5.11bn and up 7.5% year-over-year. Adjusted profit was $1.23 per share, beating the consensus of $1.20 per share.[5]

“Today, productivity, cost reduction and resiliency are especially important, and we believe our differentiated AI and platform capabilities are helping clients navigate the near-term uncertainty while embarking on longer-term AI-led transformation,” Kumar said in the Q1 earnings release.[6]

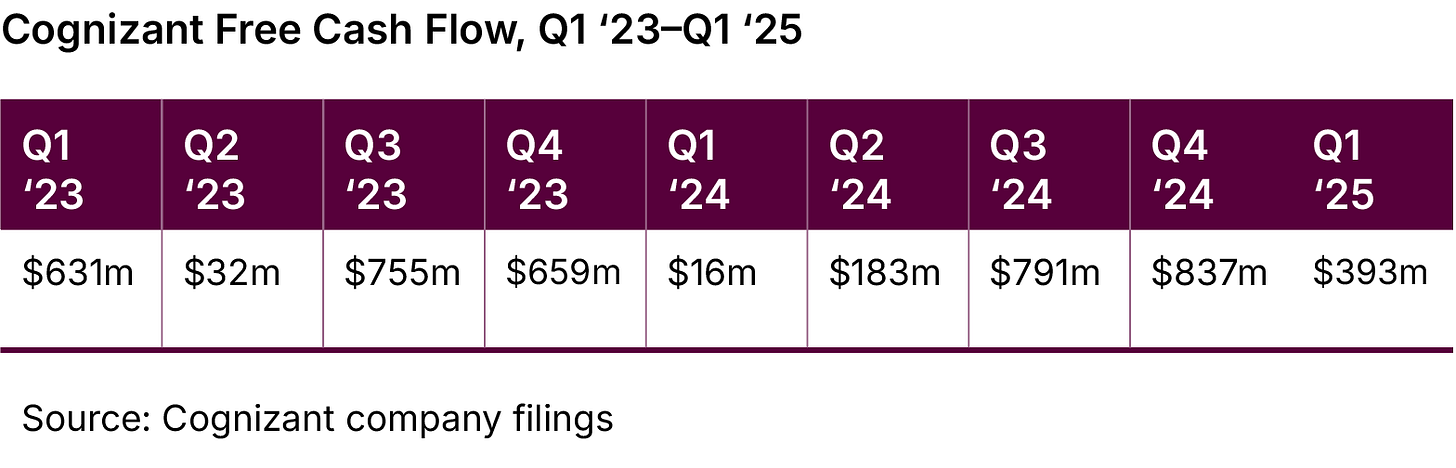

Despite the challenging environment, there are signs that the company’s AI bet could be starting to pay off. Free cash flow has ballooned year-over-year from $16m to $393m, which might be a sign of strong execution of its AI strategy.

Why CTSH Could Be Undervalued

Free cash flow could accelerate as Cognizant continues to secure more mega deals, driving revenue growth, and enterprises boost their AI investments.

JPMorgan analysts are confident about the company’s financial performance and outlook. They upgraded CTSH from ‘neutral’ to ‘overweight’ following the Q1 earnings.[7] Their price target was raised from $88 to $98, which implies an upside of 27.31% from its most recent closing price of $76.98.

According to S&P Global Market Intelligence, CTSH stock has four ‘buy’ ratings, three ‘outperform’ ratings, 19 ‘hold’ ratings, and a single ‘sell’ rating. The average price target of $87.21 implies an upside of 13.29% from the most recent closing price.[8]

Genpact

G’s Role in the AI Universe

Genpact is a New York-based company that helps businesses around the world to automate workflows and deliver operation efficiencies across their various departments, from accounting to finance to human resources. Approximately two-thirds of its employee base is located in India.

In June, Genpact announced that it was partnering with Amazon [AMZN] Business to speed up personal insurance claim settlements from weeks to days — 22% of Americans will often avoid filing claims because of frustrating digital processes.[9]

“When individuals lose belongings to fires, floods, or theft, they expect immediate and accurate claims resolution … Through our collaboration with Amazon Business, we’re bringing a simple and convenient customer experience to claims management,” said Adil Ilyas, Global Business Leader for Insurance at Genpact.[10]

Amazon and Genpact have a good relationship. In June 2024, the e-commerce giant outsourced its repair service for out-of-warranty devices in Europe to Genpact, which uses AI to handle the regulatory requirements, spare parts management and customer service.[11]

G’s Recent Financial Performance

Genpact’s push into AI, data and other digital technologies has been picking up momentum in recent quarters. The data-tech-AI segment brought in $582m in Q1 2025, up 12% year-over-year on a constant currency basis and accounting for 48% of total revenue, which crept up 8.3% from Q1 2024.[12]

The segment’s growth may be incremental, but it has picked up steam in the past few quarters.

Revenue guidance for the quarter ending June 30 was lowered, with the data-tech-AI segment now expected to see growth of just 5.1%, which would be the slowest rate in a year.

“Although the strong momentum has been built and we have not observed any slowdown year-to-date, with strong demand and conversion rate continuing through the end of April, we are lowering numbers for data-tech-AI out of an abundance of caution,” said CEO Balkrishan Kalra on the Q1 earnings call.[13]

Why G Could Be Undervalued

Despite the expected slowdown in Q2, analysts have forecast that Genpact’s EPS for the full year will jump 23.69%, followed by a slower 8.22% rise in 2026.[14]

However, expectations for next year could quite easily change as demand for AI Gigafactory picks up. Launched in January, it is apparently the first AI accelerator designed to scale enterprise AI solutions from pilot to production.[15]

“We are seeing strong engagement with our AI Gigafactory as well … It is now live across manufacturing, retail and financial services with additional vertical service offerings coming in Q2. Since launch, we have onboarded more than 30 existing clients looking to scale AI more broadly across their operation,” said Kalra on the earnings call.[16]

According to S&P Global Market Intelligence data, G stock currently has four ‘buy’ ratings, one ‘outperform’ rating, and six ‘hold’ ratings. The average price target of $50.98 implies an upside of 22.2% from the most recent closing price of $41.72.[17]

Kyndryl

KD’s Role in the AI Universe

The New York-based infrastructure services company was spun out from IBM [IBM] in 2021 and helps clients to migrate to the cloud and manage their data architectures.

In early June, Kyndryl announced a solution that will use agentic AI technology to help enterprises move mainframe applications to the AWS Cloud platform.

“The combination of Kyndryl’s deep mainframe expertise and AWS’s agentic AI capabilities can help customers across various industries streamline mainframe transformation initiatives, increase productivity and drive better business outcomes,” said Hassan Zamat, a member of Kyndyrl’s senior leadership team.[18]

The company has also recently unveiled plans for an AI hub in Liverpool, UK, with the aim of creating more than 1,000 AI and software jobs within three years.[19]

KD’s Recent Financial Performance

Kyndryl has been benefiting massively from the surging demand for AI technology and the need to process the data it generates.

Revenue tied to services from cloud hyperscalers came in at $375m in Q4, which ended March 31, and $1.2bn for the full year, more than double the previous year’s levels and topping its target of approximately $1bn.[20]

“We expanded our capabilities in cloud, modernization, applications, AI and security,” said CEO Martin Schroeter in the Q4 earnings release.

This table shows how revenue from hyperscaler alliances has accelerated in recent quarters.

Why KD Stock Could Be Undervalued

Oppenheimer analysts reiterated an ‘outperform’ rating for KD stock following the Q4 2025 earnings. Their price target for KD stock was raised $43 to $47, implying an upside of 13.88% from the most recent closing price of $41.27.[21]

Oppenheimer also published a bullish note back in March after Kyndryl was the target of a Gotham City Research short report that questioned the company’s financials.[22] The brokerage’s analysts said they found no “smoking gun” to back up the short-seller’s claims.[23]

Kyndryl is not widely covered by analysts, but KD stock does have three ‘buy’ ratings and three ‘outperform’ ratings in total, according to S&P Global Market Intelligence data.[24] The average price target of $45.74 implies an upside of 10.83% from the most recent closing price.

MongoDB

MDB’s Role in the AI Universe

The New York-headquartered software company is best known for its flagship cloud database service Atlas, which generates the bulk of quarterly revenue.

In February, MongoDB spent $220m on start-up Voyage AI to help its customers to develop AI applications more easily. Voyage’s models will be made available through Atlas later this year.

The acquisition is going “to help customers reduce their risk of hallucination, so that they can really trust the output of these applications,” MongoDB CEO Dev Ittycheria told Bloomberg in an interview.[25]

Adobe [ADBE], Autodesk [ADSK], eBay [EBAY], Alphabet [GOOGL] and Novo Nordisk [NVO] are just some of the big names that use MongoDB to develop applications and store data.[26]

MDB’s Recent Financial Performance

MongoDB has had a strong start to fiscal 2026, with revenue up 22% to $549m in Q1, comfortably beating the $528m consensus of analysts polled by FactSet.[27] Adjusted earnings doubled from $0.51 per share in Q1 2025 to $1 per share.[28]

“We are confident in our position to drive profitable growth as we benefit from this next wave of application development,” said Ittycheria in the earnings press release.

Growth in the three months to April 30 was driven by Atlas subscriptions, with the segment’s revenue up 26% to $395m. Full-year guidance for 2026 had been lowered back in March on the back of what seemed to be slowing growth in the segment.[29] However, Q1 2026 could be a turning point, as this table shows.

Why MDB Stock Could Be Undervalued

It is hard to say for sure whether Atlas’ revenue is seeing a reversal in fortune until Q2’s results are in, but Guggenheim analysts are confident this will be the case. They reiterated a ‘buy’ rating and raised their price target for MDB stock from $235 to $260 to reflect Q1’s Atlas growth. This implies an upside of 25.75% from the most recent closing price of $206.76.[30]

Wedbush analyst Dan Ives published a note following the Q1 results arguing that MongoDB is “finding its AI mojo”.[31] Ives’ price target of $300 implies an upside of 45.1% from the most recent closing price.

According to S&P Global Market Intelligence, MDB stock has 21 ‘buy ratings’, eight ‘outperform’ ratings, and 10 ‘hold’ ratings.[32]

UiPath

PATH’s Role in the AI Universe

This New York-headquartered company is a leader in the robotic process automation, or RPA, industry. It develops and sells tools that its customers can use to automate tasks, such as data entry, reducing operational errors and lowering costs.

UiPath recently moved into the agentic automation market with its Maestro platform, which allows users to orchestrate and manage a team of AI agents.

CEO Daniel Dines told analysts on the Q1 2026 earnings call in May that Maestro, which launched last December, is “one of the most important and successful product introductions in our history”.[33]

PATH’s Recent Financial Performance

Adoption of Maestro is still in its early stages and the company is not expecting the platform to have a material revenue contribution in the 2026 fiscal year.

“We view fiscal 2026 as a foundational year that will position us to drive meaningful new revenue streams in fiscal 2027 and beyond,” said CFO and Chief Operating Officer Ashim Gupta on the earnings call.

Revenue for the three months to April 30 nudged up 6% year-over-year to $356.6m, while annual recurring revenue rose 12%.[34]

UiPath’s revenue growth may appear underwhelming — analysts are expecting a modest 10.73% growth this year and 8.46% in fiscal 2027[35] — but there’s potential for acceleration once Maestro’s impact is factored in.

On top of this, the company is inching closer to break-even, as the table below shows. Q1 2026’s loss came in at $22.5m, down from $28.7m the year-ago quarter.

Why PATH Stock Could Be Undervalued

Analysts believe the company could break even in fiscal 2026 or fiscal 2027.

Canaccord Genuity analysts reiterated their ‘buy’ rating following the Q1 earnings and raised their price target from $14 to $16, which implies an upside of 28.31% from the most recent closing price of $12.47.[36]

According to S&P Global Market Intelligence data, PATH stock currently has three ‘buy’ ratings, one ‘outperform’ rating, 18 ‘hold’ ratings, and a single ‘underperform’ rating.[37]

Conclusion

The many stocks that form the backbone of the AI industry may not be glamorous, but it could be argued that they’re also undervalued.

If you’re looking for opportunities beyond Nvidia and Palantir, then the five highlighted stocks could be good plays on the AI theme. Cognizant, Genpact, Kyndryl, MongoDB and UiPath are all showing signs of growth and improving financials, with significant upsides to their current share prices.

This is for informational purposes only. OPTO Markets does not recommend any specific securities or investment strategies. Investing involves risk and investments may lose value, including the loss of principal. Past performance does not guarantee future results.

[1] https://www.bloomberg.com/news/articles/2025-06-10/coreweave-and-palantir-get-meme-stock-comparisons-as-shares-soar

[2] https://www.goldmansachs.com/insights/articles/ai-infrastructure-stocks-poised-to-be-next-phase

[3] https://www.marketscreener.com/quote/stock/COGNIZANT-TECHNOLOGY-SOLU-23219296/news/Transcript-Cognizant-Technology-Solutions-Corporation-Analyst-Investor-Day-49431298/

[4] https://www.marketscreener.com/quote/stock/COGNIZANT-TECHNOLOGY-SOLU-23219296/news/Transcript-Cognizant-Technology-Solutions-Corporation-Presents-at-Nasdaq-Investor-Conference-2025-50215574/

[5] https://www.reuters.com/sustainability/sustainable-finance-reporting/cognizant-lifts-annual-revenue-forecast-strong-ai-demand-2025-04-30/

[6] https://investors.cognizant.com/news-and-events/news/news-details/2025/Cognizant-Reports-First-Quarter-2025-Results/default.aspx

[7] https://uk.investing.com/news/analyst-ratings/jpmorgan-lifts-cognizant-stock-rating-raises-target-to-98-93CH-4092562

[8] https://uk.marketscreener.com/quote/stock/COGNIZANT-TECHNOLOGY-SOLU-23219296/consensus/

[9] https://www.businesswire.com/news/home/20250527554188/en/1-in-5-Consumers-Avoid-Filing-Claims-Due-to-Frustrating-Digital-Processes-According-to-Insuritys-Latest-Survey

[11] https://aws.amazon.com/blogs/apn/genpact-ai-powered-solution-helps-amazon-outsource-its-device-repair-service-in-europe/

[12] https://genpact.gcs-web.com/news-releases/news-release-details/genpact-reports-first-quarter-2025-results

[13] https://www.marketscreener.com/quote/stock/GENPACT-LIMITED-57248/news/Transcript-Genpact-Limited-Q1-2025-Earnings-Call-May-07-2025-49866756/

[14] https://stockanalysis.com/stocks/g/forecast/

[15] https://media.genpact.com/2025-01-28-Genpact-Launches-AI-Gigafactory-to-Accelerate-Enterprise-Value

[16] https://www.marketscreener.com/quote/stock/GENPACT-LIMITED-57248/news/Transcript-Genpact-Limited-Q1-2025-Earnings-Call-May-07-2025-49866756/

[17] https://www.marketscreener.com/quote/stock/GENPACT-LIMITED-57248/consensus/

[18] https://www.kyndryl.com/us/en/about-us/news/2025/06/mainframe-modernization-aws-agentic-ai

[19] https://investors.kyndryl.com/news-releases/news-release-details/kyndryl-establishes-technology-hub-liverpool-create-1000-ai

[20] https://investors.kyndryl.com/new s-releases/news-release-details/kyndryl-reports-fourth-quarter-and-full-year-2025-results

[21] https://uk.marketscreener.com/quote/stock/KYNDRYL-HOLDINGS-INC-128528611/news/Oppenheimer-Adjusts-Kyndryl-Holdings-Incorporation-Price-Target-to-47-From-43-Maintains-Outperfor-49929895/

[22] https://www.gothamcityresearch.com/post/kyndryl-a-melting-ice-cube-with-a-consulting-miragepart-ii

[23] https://uk.investing.com/news/analyst-ratings/oppenheimer-maintains-kyndryl-stock-outperform-amid-short-report-93CH-4002680

[24] https://www.marketscreener.com/quote/stock/KYNDRYL-HOLDINGS-INC-128528611/consensus

[25] https://www.bloomberg.com/news/articles/2025-02-24/mongodb-buys-voyage-ai-for-220-million-to-bolster-ai-search

[26] https://www.mongodb.com/solutions/customer-case-studies?industries=computer-software#pf-content-section

[27] https://www.investors.com/news/technology/mongodb-stock-earnings-jump-ai-q1-2025/

[28] https://investors.mongodb.com/news-releases/news-release-details/mongodb-inc-announces-first-quarter-fiscal-2026-financial

[29] https://www.cnbc.com/2025/03/06/mongodb-shares-crater-20percent-as-weak-outlook-overshadows-strong-results.html

[30] https://uk.investing.com/news/analyst-ratings/guggenheim-raises-mongodb-stock-price-target-to-260-on-atlas-growth

[31] https://www.investors.com/news/technology/mongodb-stock-earnings-jump-ai-q1-2025

[32] https://www.marketscreener.com/quote/stock/MONGODB-INC-45064741/consensus/

[33] https://uk.marketscreener.com/quote/stock/UIPATH-INC-121662826/news/Transcript-UiPath-Inc-Q1-2026-Earnings-Call-May-29-2025-50106874/

[34] https://ir.uipath.com/news/detail/394/uipath-reports-first-quarter-fiscal-2026-financial-results

[35] https://stockanalysis.com/stocks/path/forecast/

[36] https://uk.investing.com/news/analyst-ratings/canaccord-genuity-raises-uipath-stock-price-target-to-16-93CH-4114376

[37] https://www.marketscreener.com/quote/stock/UIPATH-INC-121662826/consensus/