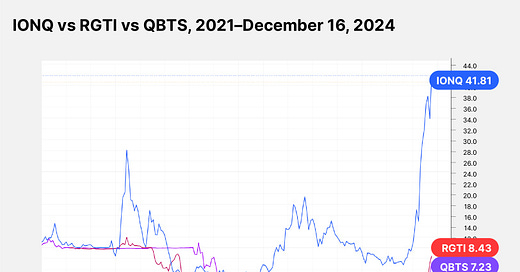

Forget AI: These 3 Quantum Stocks Could Leap in 2025

Forget AI for a moment — quantum computing stocks are the latest to soar.

Key Takeaways

Quantum computing’s applications could include designing nuclear fusion reactors, improving drug development for pharmaceutical companies and developing better car batteries;

The Defiance Quantum ETF gained 4.54% in the week of December 9; the fund is up 53.09%% in the year through December 16;

Due to the early stage of their development, mos…

Keep reading with a 7-day free trial

Subscribe to Foresight to keep reading this post and get 7 days of free access to the full post archives.