The Satellite Stocks Challenging Starlink

Starlink is the dominant firm in the space, but it is under pressure due to its owner’s political endeavors. Can these competitors rise to the challenge?

Key Takeaways

Starlink remains the dominant firm in the satellite space, operating an estimated two-thirds of active satellites.

Other companies, notably Telesat and Amazon, are expanding their low earth orbit constellations to compete as users look for alternatives.

Providing internet connectivity to maritime and aviation clients also offers a valuable and expanding business for satellite companies.

Satellite company Starlink has attracted increased scrutiny in recent months over Founder Elon Musk’s alignment to right-wing politicians around the globe.

From a spat with a Brazilian judge to its much-publicized role in the Russia-Ukraine war, the telecommunications subsidy of SpaceX — the world’s largest private company, valued at $350bn in December 2024[1] — has attracted its fair share of critics. Most notably, both Europe and Canada have begun weighing other options for satellite-based connectivity as ties with the United States have strained.

Even so, the company’s predominance in the satellite internet market is undeniable. As of March 2025, Starlink internet services were available in 100 countries, with over 7,000 active satellites in orbit — an estimated two-thirds of the world total.

In comparison, the two main US-based competitors, EchoStar’s [SATS] Hughesnet and Viasat [VSAT], operate three satellites each providing internet coverage in North America.[2]

The discrepancy is in part to do with technology. Hughesnet and Viasat primarily operate geosynchronous high Earth orbit (HEO) satellites, orbiting at an altitude of some 36,000km[3] in the same direction and speed as the Earth, allowing them to remain over the same location. Starlink, meanwhile, operates low Earth orbit (LEO) satellites, which orbit at less than 2,000 km[4] from the Earth and continually pass overhead, allowing for lower latency but requiring far more satellites.

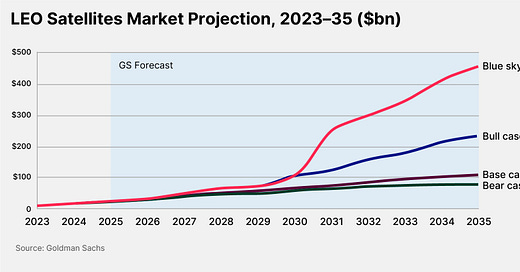

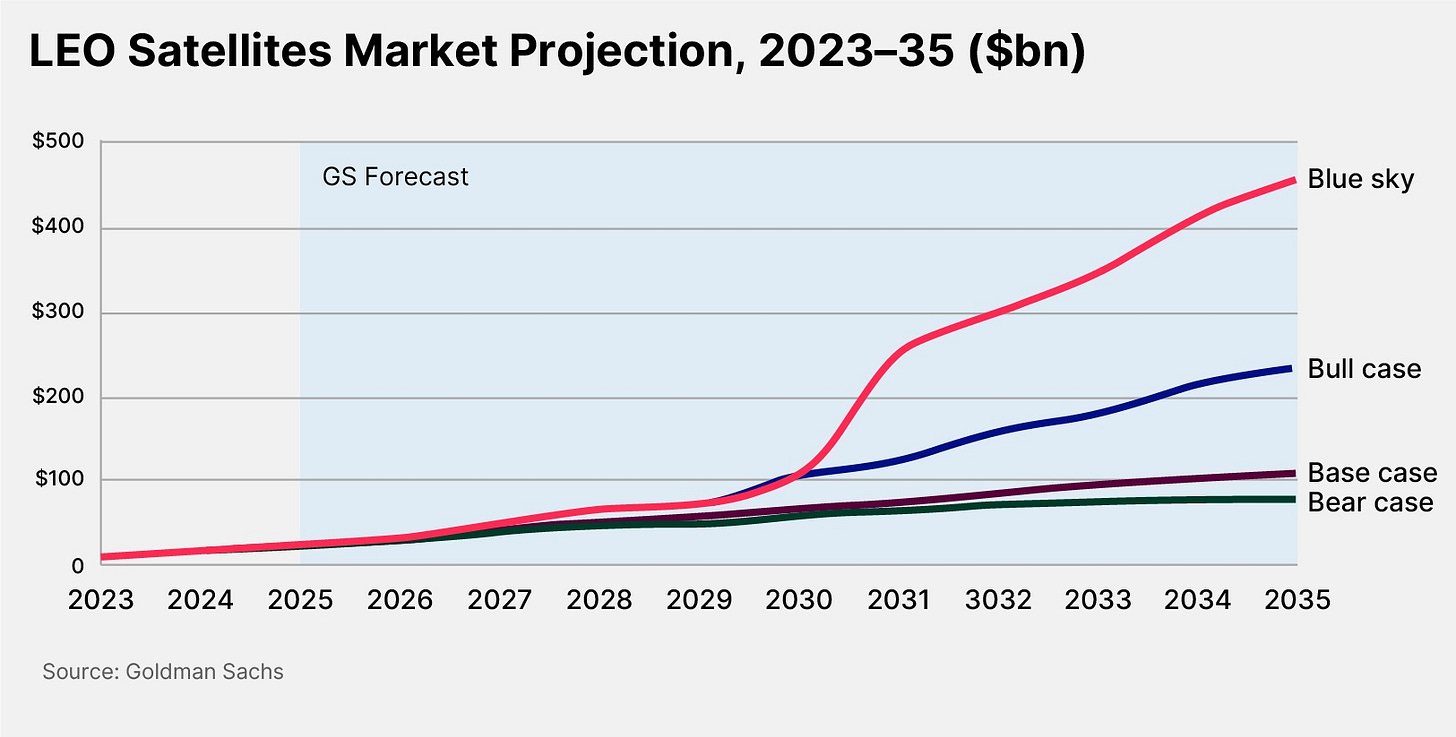

Starlink is unlikely to remain the undisputed LEO leader for long, however. According to Goldman Sachs, decreasing launch costs and the integration of existing satellite constellations could see the LEO satellite market grow from $15bn in 2024 to $108bn in 2035 — or even as much as $457bn, in the most optimistic scenarios.[5]

However, two major potential challengers present something of a wild card.

Amazon’s [AMZN] Project Kuiper delayed its first satellite launch on April 9 due to inclement weather,[6] although the company plans to offer internet services to customers by the end of 2025 and operate a constellation of over 3,200 satellites. Chinese space company SpaceSail, meanwhile, has launched 90 satellites since 2025 and is reportedly in talks with 30-plus countries, making headway in markets such as Brazil, Kazakhstan and Malaysia.[7]

Here are a few companies that could capture increased market share as countries look for alternatives to Musk’s Starlink:

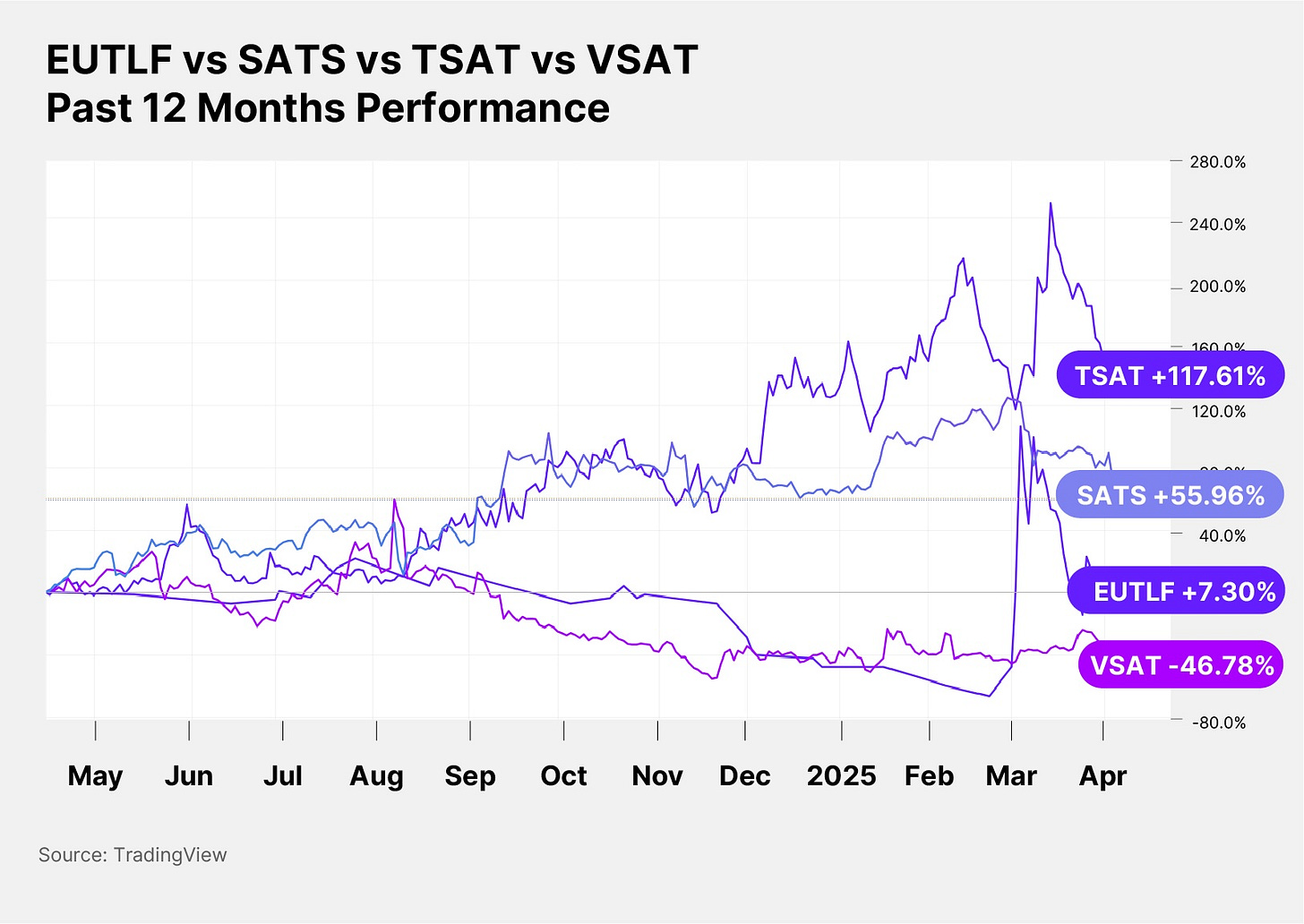

Share price performances through April 16

Telesat [TSAT]

Year-to-date: 5.23%

Past 12 months: 117.61%

As US–Canada relations sour over trade disputes, Ottawa is looking for alternatives to Starlink with less political baggage. One early frontrunner, Telesat, has the benefit of being homegrown.

In September 2024, Telesat received $2.54bn in funding from the Canadian and Quebec governments for Telesat Lightspeed, its LEO broadband satellite constellation, in an attempt to compete with Starlink in remote areas of the country where fiber-optic internet connections are difficult or impossible.[8] Telesat — alongside Amazon’s Project Kuiper — is also one of the candidates Brazil is considering to replace Starlink in the country.[9]

On April 7, Telesat announced it had signed a multi-year contract with fellow satellite company Viasat to provide LEO services for its aviation, maritime, enterprise and defense clients.[10]

Regardless, the company’s revenue for FY 2024 was down 19% year-over year, at CA$571m, when it reported at the end of March.[11]

Eutelsat Communications [EUTLF]

Year-to-date: 96%

Past 12 months: 7.3%

Europe, increasingly anxious about its reliance on the US for defense technology, is also looking to find alternatives to Starlink. EU authorities have tapped France’s Eutelsat, which operates a LEO constellation through its subsidiary OneWeb, to replace Starlink coverage in Ukraine — a potential vulnerability given the US’ seeming rapprochement with Russia.[12]

As of early 2025, OneWeb operated 1,000 terminals in Ukraine, although it could have 10,000 running by the end of the year. Additionally, being “the only non-US, non-Chinese constellation that’s going to be out there … [has] become a stronger selling point”, according to Eutelstat CEO Eva Berneke.

The firm is also poised to benefit as a provider of LEO satellite internet connectivity for airlines. The service went live on April 2, with 100 antenna installed to provide connectivity on flights for clients such as Air Canada [ACDVF].[13]

Viasat

Year-to-date: -4.00%

Past 12 months: -46.78%

California-based satellite internet provider Viasat was perhaps the biggest victim of Starlink’s meteoric rise, losing nearly two-thirds of its subscribers between Starlink’s launch in November 2020 and December 2024.[14] However, recent service expansions — and increased investor interest — could help VSAT stock rally.

Despite its struggles in the consumer market, the company has recently grown its presence in both the maritime and aviation connectivity markets, with clients ranging from Caribe Tankers[15] to Riyadh Air[16] and American Airlines [AAL].[17] Additionally, in December 2024 it was awarded a $568m contract to support the US Department of Defense in satellite communication and cybersecurity.[18]

On March 24, Deutsche Bank analyst Edison Yu upgraded his rating for VSAT from ‘hold’ to ‘buy’, citing its potential to create equity value through asset monetization, adding that it “may take 12–18 months to fully play out but we see the risk/reward profile at current levels being increasingly compelling”.[19]

EchoStar

Year-to-date: -3.49%

Past 12 months: 55.96%

EchoStar, which acquired HughesNet in February 2011, has also lost out as Starlink expands, dropping two-fifths of its subscribers between November 2020 and December 2024. Apart from its satellite internet subsidiary, EchoStar also wholly owns satellite TV company Dish Network and mobile connectivity company Boost Mobile following a merger completed in January 2024.[20]

Following the July 2023 launch of its Jupiter 3 satellite, the company offers both cheaper plans and faster connection speeds than Starlink, with its latest financial statements indicating positive trends. In its Q4 2024 earnings release on February 27, the company reported revenue of $3.97bn, down 4.7% year-over-year but above analyst expectations. Its fall in subscribers is most evident in its TV segment, with a rise in wireless subscribers and a lower year-over-year fall in broadband satellite subscribers in Q4, along with a return to net-positive cash flow by the end of FY 2024.

Conclusion

For the time being, Starlink remains the biggest name in the LEO satellite internet game. However, as countries look for alternatives, competitors are expanding their offerings to be able to capture a larger part of a growing market.

This is for informational purposes only. OPTO Markets does not recommend any specific securities or investment strategies. Investing involves risk and investments may lose value, including the loss of principal. Past performance does not guarantee future results.

[1] https://news.crunchbase.com/transportation/spacex-value-stable-tesla-spacetechs-plunge-elon-musk/#:~:text=SpaceX's%20valuation%20hit%20%24350%20billion,closely%20watched%20secondary%20share%20sale.

[2] https://www.pcmag.com/comparisons/starlink-vs-hughesnet-vs-viasat-which-satellite-internet-provider-is-best

[3] https://earthobservatory.nasa.gov/features/OrbitsCatalog#:~:text=Remote%20Sensing-,High%20Earth%20Orbit,its%20orbit%20matches%20Earth's%20rotation.

[4] https://www.nasa.gov/humans-in-space/leo-economy-frequently-asked-questions/#:~:text=Low%20Earth%20orbit%20(LEO)%20encompasses,communication%2C%20observation%2C%20and%20resupply.

[5] https://www.goldmansachs.com/insights/articles/the-global-satellite-market-is-forecast-to-become-seven-times-bigger

[6] https://www.aboutamazon.com/news/innovation-at-amazon/project-kuiper-satellite-internet-first-launch

[7] https://restofworld.org/2025/chinas-spacesail-is-expanding-where-elon-musk-is-stumbling/

[8] https://www.ft.com/content/c58b6633-8b64-4b79-b35b-d00f380b5c3a

[9] https://www.reuters.com/technology/musks-starlink-races-with-chinese-rivals-dominate-satellite-internet-2025-02-24/

[10] https://www.telesat.com/press/press-releases/telesat-secures-substantial-multi-year-contract-with-viasat-for-telesat-lightspeed-services/

[11] file:///C:/Users/gball/Downloads/24Q4-release-FINAL.pdf

[12] https://www.wsj.com/world/europe/europe-eutelsat-elon-musk-starlink-c283c4c8?siteid=yhoof2

[13] https://www.eutelsat.com/en/news/press.html#/pressreleases/eutelsat-ramping-up-leo-enabled-aviation-services-with-high-speed-low-latency-connectivity-3378987

[14] https://frankrayal.com/2025/02/12/the-disruptive-nature-of-starlink/

[15] https://finance.yahoo.com/news/vsats-nexuswave-enhance-maritime-connectivity-122000092.html

[16] https://www.viasat.com/news/latest-news/aviation/2025/riyadh-air-selects-viasat-to-power-full--fast--free-streaming-co/

[17] https://news.aa.com/news/news-details/2025/Connecting-the-world-American-Airlines-to-provide-complimentary-inflight-Wi-Fi-sponsored-by-ATT-MKG-OB-04/

[18] https://www.viasat.com/news/latest-news/government/2024/viasat-awarded-up-to-568-million-idiq-contract-from-general-services-administration-to-support-c5isr-capabilities-for-u-s-defense-forces/

[19] https://www.cnbc.com/2025/03/24/shares-of-starlink-competitor-viasat-pop-more-than-10percent-on-deutsche-bank-upgrade.html

[20] https://www.cnbc.com/2024/09/30/echostars-dish-sale-marks-disappointing-end-to-ergens-strategy-.html