Is This Biopharma Stock the “Nvidia of Weight Loss”?

The world’s largest biotech company by market cap, Eli Lilly’s recent performance has engendered comparisons to Nvidia. But is LLY stock overpriced?

Key Takeaways

With gains of 60% over the last year, Eli Lilly stock is one of the world’s 15 most valuable companies.

An earnings beat and guidance raise, based on stellar growth in new product categories, has driven up the stock.

However, based on its fundamentals, Eli Lilly might be overpriced compared to its competitors.

1. Eli Lilly: Biotech Behemoth

Eli Lilly [LLY] is one of the US’ largest biopharmaceutical companies. Headquartered in Indianapolis, it employs over 45,000 people globally.

Its share price has gained 51.32% in the year to September 27 and 60.67% in the preceding 12 months.

As of September 27, it is the world’s largest biotech company by market cap, valued at $790.38bn. This makes it one of the 15 most valuable companies in the world.

Nevertheless, LLY could still be a growth stock.

It had been on the decline between July and August, but rallied sharply on the announcement of a strong set of results that suggested a new product category could drive outsized future gains.

2. A Healthy Market

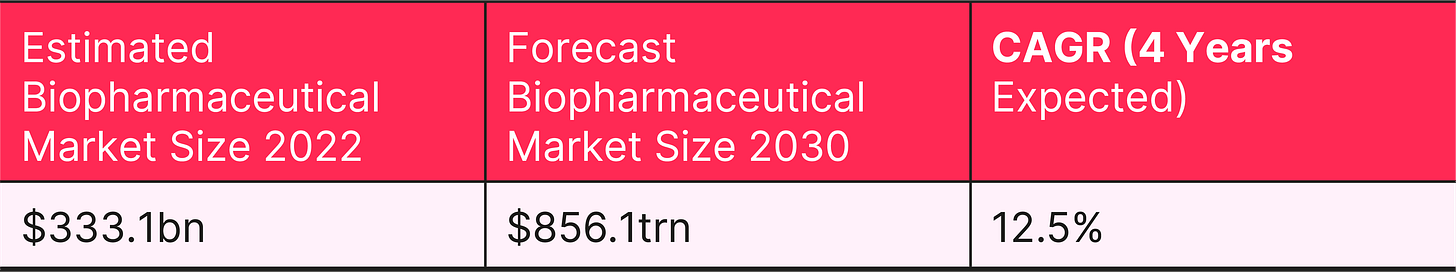

Research from Towards Healthcare published in May 2024 estimates the global biopharmaceutical market at $333.1bn in 2022, and envisages it increasing to over $856.1bn by 2030. This implies a CAGR of 12.5% during those eight years.

Source: Towards Healthcare

Demand for biopharmaceutical products has been driven, according to the report, by aging populations and an increase in chronic diseases. Additionally, the development of new drugs to treat previously untreatable conditions is expected to be another driver. For example, monoclonal antibodies have seen an expansion in use cases to treat cardiovascular disease, cancer, rheumatoid arthritis and multiple sclerosis.

Lilly markets Omvoh, a medicine licensed for the treatment of moderately to severely active ulcerative colitis (UC). Omvoh is based on mirikizumab, a monoclonal antibody being developed by Lilly for the treatment of UC and Crohn’s disease.

Given its biopharmaceutical credentials, how relevant is Eli Lilly to the larger biotech theme?

3. Biotech in the Blood

OPTO’s proprietary ‘Relevance Score’ aims to assess a public company’s alignment with a primary investment theme; it does not aim to measure the strength of the company or investment.

The overall score is based on four key criteria:

Product and Services (Score: 38/40)

A review of the company’s current product/services suite, and its alignment with the primary theme.

Lilly has a strong focus on biotechnology-derived products. Effectively, all of its revenue comes from biopharmaceuticals, including biologics for cancer, such as Verzenio; diabetes, such as Mounjaro, Trulicity, Humalog and Humulin; and immunology, such as Taltz and Olumiant.,

Some 6.93% of Lilly’s total revenue in 2023 was attributed to “Other products” as opposed to any specific medication. It is likely, but not certain, that these products are also biotechnology-derived.

Innovation and Development (Score: 25/30)

An analysis of the company’s activities related to innovation, within the selected theme.

“Our commitment to research and development dates back more than 140 years. We invest heavily in research and development because we believe it is critical to our long-term competitiveness.” — Eli Lilly’s Annual Report, 2023.

On this front, Lilly’s money is where its mouth is. The company spent $9.31bn on R&D in 2023, 27.29% of total revenue and its largest single cost. According to data from Statista, this puts Lilly well ahead of the average for the US pharmaceutical industry, which spent 21.4% of revenue on average on R&D in 2023.

It holds patents on numerous drugs — indeed, its business is dependent on them.

Market Influence and Leadership (Score:12/15)

An evaluation of the company’s influence within the chosen theme, and its capacity to dictate theme-wide change and performance.

Lilly is a prominent player in the biotech industry, particularly in the areas of diabetes, oncology and immunology. The company has a strong market presence and is among the top pharmaceutical companies in terms of revenue and market share in several theme-related sectors. For example, Towards Healthcare’s estimate of $373.6bn for the total biopharmaceutical market in 2023 implies a 9.13% market share for Eli Lilly based on its revenue that year.

Additionally, Eli Lilly has a significant media presence and is frequently mentioned in leading industry reports and analyst coverage.

Financial Commitment (Score: 12/15)

The company’s financial commitment to the industry, assessed by fundamental metrics, including R&D spend.

All of Lilly’s revenue pertains to the biotech theme, and the majority of its costs are also directed towards R&D and other initiatives that support the biotechnology theme’s development. These include licensing arrangements, co-development agreements, co-promotion arrangements, joint ventures, acquisitions and equity investments with or into hospitals, medical schools and other research organizations.

Based on the total score of 87/100, Eli Lilly can be considered a core player within the biotechnology theme. The company’s strong focus on biotechnology-derived products, substantial R&D investment, market influence and financial commitment to the theme solidify its position as a key player in the biotechnology industry.

Keep reading with a 7-day free trial

Subscribe to Foresight to keep reading this post and get 7 days of free access to the full post archives.