How Will Tariff Fall-out Impact These 3 Fintech Stocks?

The fintech theme has been hit hard by falling consumer sentiment. Can AFRM, FI and XYZ weather the storm?

Key Takeaways

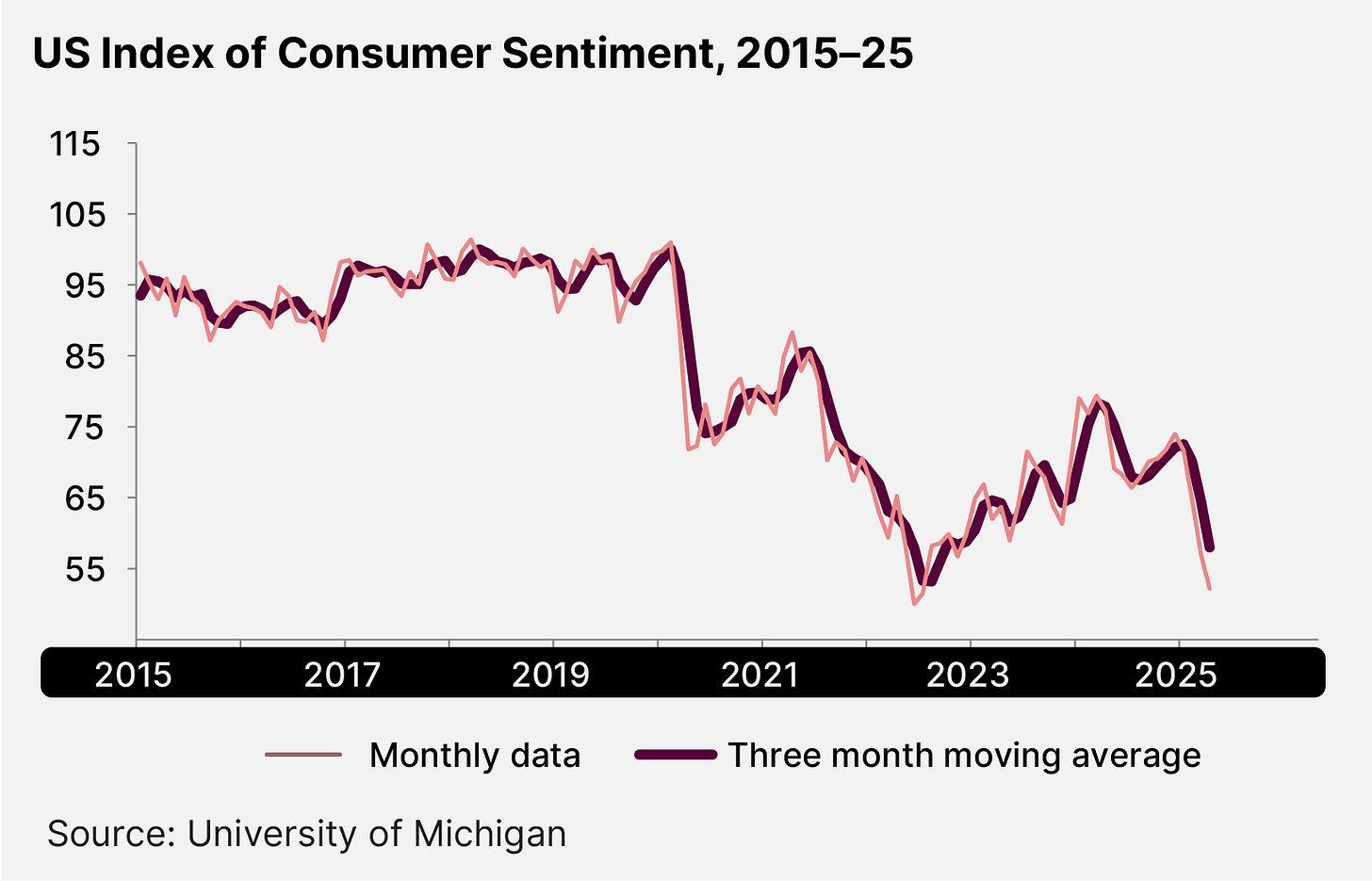

The University of Michigan’s consumer sentiment index has fallen 32% since January, the sharpest three-month decline since the recession in the 1990s.

Many analysts reacted bullishly to Fiserv’s [FI] Q1 earnings despite soft revenue growth.

Investors are looking to see how Affirm [AFRM] and Block [XYZ] can leverage flexible payment services even as economic fears weigh on consumer spending.

Equities have taken a beating over the past month or two, but the fintech theme has been particularly badly affected.

The principal reason for this seems to be the fear that President Donald Trump’s tariffs will push the US into a recession, which could in turn see a slide in consumer spending, lower loan demand and lower interest rates.

This piece will look at three fintech stocks and how they might be impacted by a worsening macro environment: Jack Dorsey’s Block [XYZ], buy now, pay later (BNPL) provider Affirm [AFRM], and payments technology firm Fiserv [FI].

Consumer Confidence Slumps

President Trump’s tariffs have not only spooked investors, but also driven US consumer confidence lower.

The University of Michigan’s consumer sentiment index, a score based on Americans’ view of the economy and their finances, fell to 52.2, down from 57 in March. It has dropped 32% since January, the sharpest three-month decline since the recession in the 1990s, as shown in the graph below.[1]

“Expectations worsened for vast swaths of the population across age, education, income and political affiliation,” said Joanne Hsu, Director of the Surveys of Consumers, in a statement.

“Consumers perceived risks to multiple aspects of the economy, in large part due to ongoing uncertainty around trade policy and the potential for a resurgence of inflation looming ahead.”

Stocks Drop

The Block share price has tumbled 29.92% since the start of the year through April 29, while the Affirm share price has fallen 17.24% since January. The Fiserv share price has declined 9.8% over the same period, though it fell 18.23% between April 23 and April 25 following its Q1 earnings, which logged disappointing revenue.

The Global X Fintech ETF [FINX], which holds all three stocks,[2] is down 8.46% year-to-date, underperforming the S&P 500’s 5.45% decline.

Fundamental Rethink

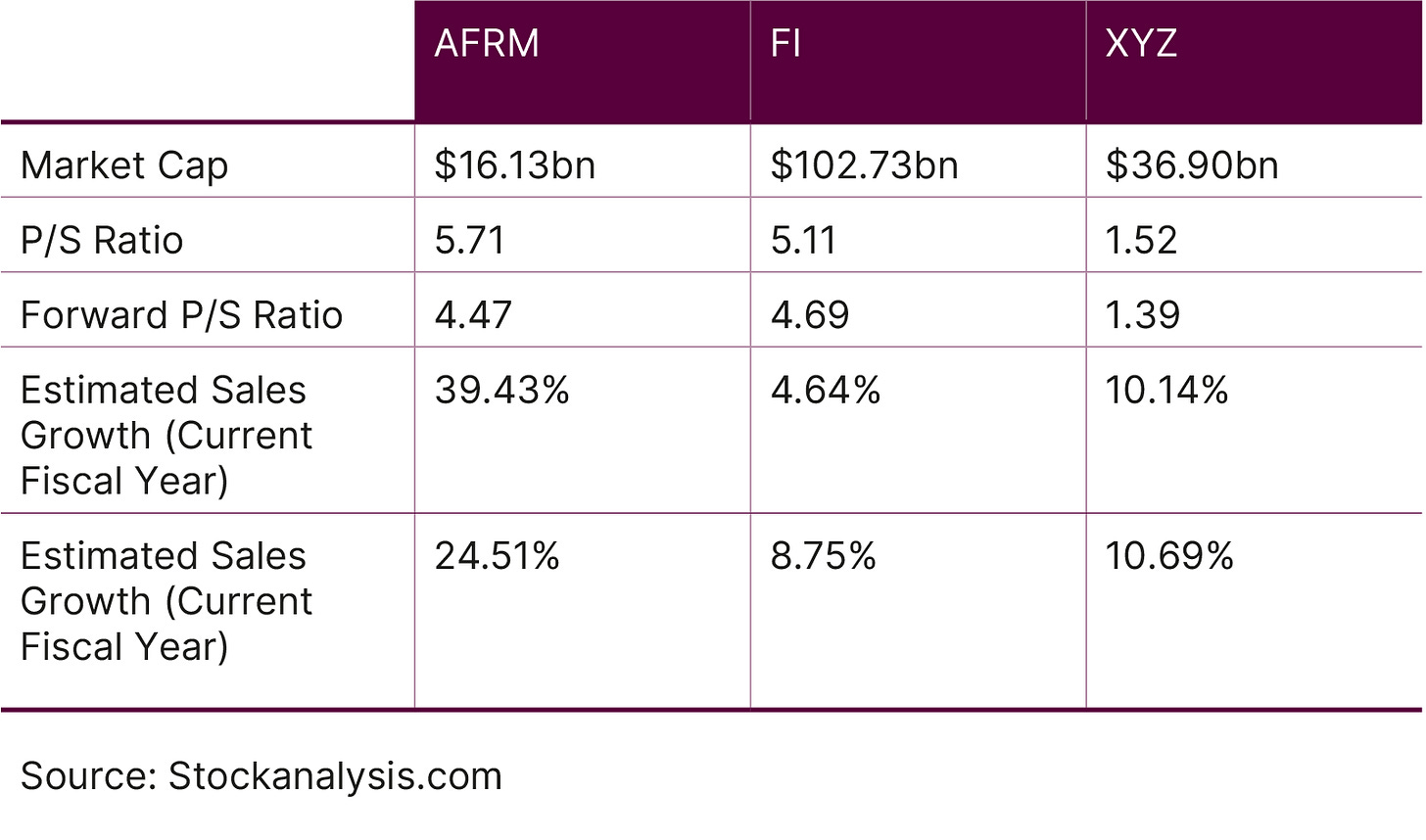

The recent selloff has presented investors with an opportunity to reevaluate stocks’ fundamentals. Here is how those of Affirm, Block and Fiserv compare.

Both Affirm and Block are listed within the internet software category, which has an industry P/S average of 3.62, according to Zacks.[3] Fiserv is listed in the financial transactions services category, which has an industry P/S average of 2.14.[4]

Of the three, XYZ stock currently looks the most attractive given its very low P/S ratio and consistent revenue growth over the next couple of years.

Fiserv

Potentially setting the tone for subsequent earnings calls from its peers, Fiserv’s Q1 results showed soft revenue and volume growth in its merchant point-of-sale solution Clover, which competes with Block’s Square Seller. Fiserv earns fees from merchants for processing payments.

Clover saw revenue rise 27% year-over-year in the first three months for 2025, down from 29% in Q4 2024. Gross purchase volume grew 8% versus 14% in the prior quarter.[5]

Fiserv CFO Bob Hau said on the earnings call on April 24 that one of the factors contributing to the lower growth was a slowdown in discretionary spending in Canada, Clover’s largest international market.[6]

The company reiterated its previously issued full-year guidance of 12–15% revenue growth in its merchant solutions segment. This includes an acceleration in international expansion efforts for Clover, as well as new product development.

Many analysts reacted bullishly to the earnings, reiterating ‘buy’ and ‘outperform’ ratings,[7] including BTIG’s Andrew Harte.

Nevertheless, Harte wrote in a note to clients that “the Clover softness warrants pressure” on FI stock and “unfortunately is going to raise questions on [Fiserv’s] ability to meet its reiterated guidance”.[8]

Affirm

When fears of a recession grow, as they have done on the back of Trump’s tariffs, so do concerns around loan demand and credit ratings.

This will be in focus when Affirm delivers its Q3 2025 earnings on May 8. More and more consumers have been turning to BNPL as they want flexible payment options, but an economic slowdown could mean fewer consumers will be willing to take on the risk that comes with a BNPL loan.

Back in February, Affirm said it expected Q3 revenue to be in the $755m–785m range. The company also reiterated its goal of turning profitable on a GAAP basis in Q4 2025, which ends June 30.[9]

“Affirm is in the strongest shape it’s ever been. Challenges met, competitors bested: excellent growth in a rapidly expanding segment, on-target unit economics, robust operating leverage,” said CEO Max Levchin in the Q2 shareholder letter. It remains to be seen whether this confidence is justified.

Block

While Dorsey’s company missed bottom-line estimates in Q4 2024, reported in February,[10] it has been shifting its focus to bringing its services together under one roof.

“In 2024, we expanded Square from a payments tool into a full commerce platform, [and] enhanced Cash App’s financial services offerings,” said Dorsey on the earnings call.[11]

Block’s strategic shift could impact income in the near term and, along with concerns around US consumer spending, could continue to weigh on XYZ stock. Nonetheless, the fintech is committed to becoming the go-to destination for digital banking.

“We see a significant opportunity to grow actives, particularly among that digital native audience like Millennials and Gen Zs,” said CFO Amrita Ahuja.

Block reports Q1 2025 results on Thursday.

Conclusion

Fintech stocks like Affirm, Block and Fiserv should enjoy long-term growth as transformative technologies continue to revolutionize financial services, and consumers turn away from traditional banking. However, lower consumer spending in the near term could have a negative impact on the top and bottom lines across the industry.

This is for informational purposes only. OPTO Markets does not recommend any specific securities or investment strategies. Investing involves risk and investments may lose value, including the loss of principal. Past performance does not guarantee future results.

[1] https://www.sca.isr.umich.edu/

[2] https://www.globalxetfs.com/funds/finx

[3] https://www.zacks.com/stocks/industry-rank/industry/internet-software-214

[4] https://www.zacks.com/stocks/industry-rank/industry/financial-transaction-services-282

[5]https://d1io3yog0oux5.cloudfront.net/_ead7776f06eb961baa35019546ca3c9e/fiserv/db/2288/21748/presentation/Q1+2025+Earnings+Presentation+final.pdf

[6] https://seekingalpha.com/article/4777661-fiserv-inc-fi-q1-2025-earnings-call-transcript

[7] https://www.marketscreener.com/quote/stock/FISERV-INC-4873/news-broker-research/

[8] https://www.msn.com/en-us/money/markets/fiserv-stock-plunges-as-clover-growth-softened-in-q1/ar-AA1Dyv1A

[9] https://investors.affirm.com/static-files/9d87b3d5-c55b-4e1d-acc7-5a09da53c4a6

[10] https://www.reuters.com/business/blocks-profit-jumps-robust-consumer-spending-2025-02-20/

[11] https://www.fool.com/earnings/call-transcripts/2025/02/21/block-xyz-q4-2024-earnings-call-transcript/