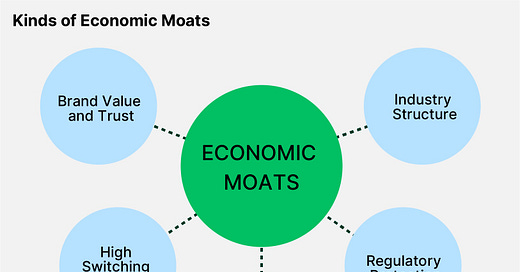

This week, we’ve collaborated with The Weekend Investor to analyze the concept of economic moats and highlight 3 companies that have established market positions so strong they are now integral to the global financial system.

Alexis, the founder of The Weekend Investor, shares his expertise with over 10,000 busy professionals, providing guidance on buil…

Keep reading with a 7-day free trial

Subscribe to Foresight to keep reading this post and get 7 days of free access to the full post archives.