Key Takeaways

The gaming sector took a dip in 2022 but is positioned to grow in 2024 and beyond, powered in no small part by AppLovin’s innovative software;

AppLovin itself has been investing substantially into its software division, which offers superior profit margins compared to its apps division;

Analysts — and investors — expect faster earnings growth over the next 12 months than its closest competitors. These expectations have driven the stock up nearly 320% in the year to date.

1. The Two Arms of AppLovin

AppLovin [APP] is a mobile gaming company with two primary business arms.[1]

The first is its software platform, which offers advertising recommendation, analytics and optimization services to its customers — mostly, but not exclusively, gaming app developers — powered by AppLovin’s own artificial intelligence (AI) recommendation engine, AXON.

The second is its apps business, which consists of a portfolio of more than 200 free-to-play mobile gaming apps. These include Game of War, Mobile Strike, Wordscapes and Clockmaker.[2]

AppLovin’s share price has been on a tear this year. The stock has gained 317.01% in the year to date and 358.81% in the last 12 months.

AppLovin’s stock is in uncharted territory, trading at its highest level since its April 2021 IPO.

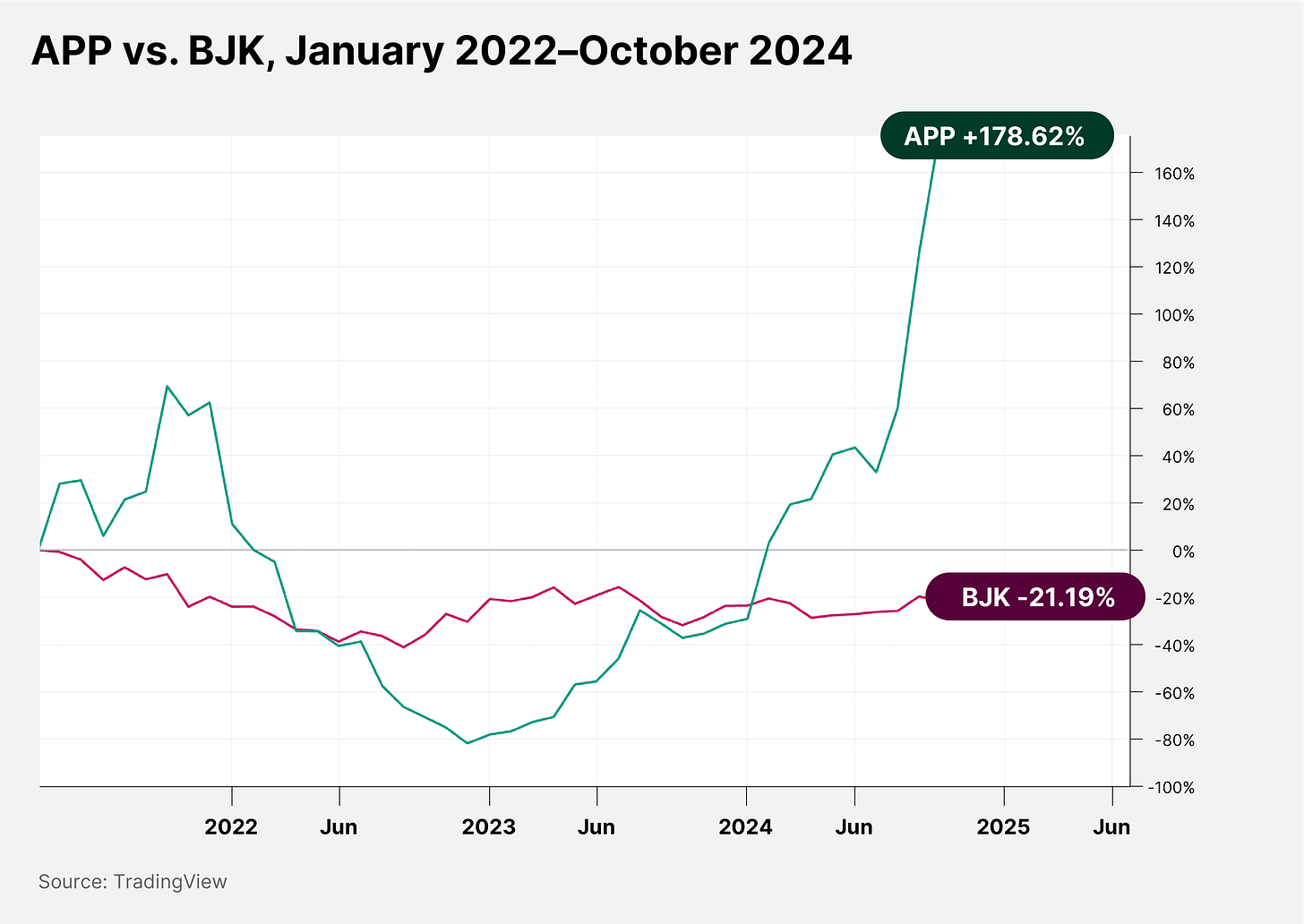

The stock dipped beginning in early 2022, falling 88.83% during the year. The inflationary, high-interest-rate conditions that have prevailed since that year, as well as the end of the pandemic era, dented the mobile gaming market, and with it AppLovin’s stock.[3] The VanEck Gaming ETF [BJK] fell 12.82% during the year.

However, while its declines were steeper than the broader gaming industry, AppLovin’s gains since the start of 2024 are uncorrelated with the ETF, which has traded sideways in the meantime.

Here, we will set out to identify why AppLovin’s share price gains have defied its wider industry, and ask whether or not it can continue its tear.

First, let’s explore its relevance to the broader gaming theme.

Keep reading with a 7-day free trial

Subscribe to Foresight to keep reading this post and get 7 days of free access to the full post archives.