Can These 5 Copper Stocks Shine Amid Tariff Turmoil?

The red metal is key to the global economy and its importance looks likely to increase. It is facing a turbulent time, but some companies are positioning themselves for growth.

Key Takeaways

The US accounts for just 5% of copper mining output and imports around 50% of its domestic consumption;

Major copper stocks are on a downward trend but could benefit from US efforts to boost domestic copper mining;

Hitting global electrification goals may require 115% more copper to be mined over the next three decades than has been mined throughout history.

1. Copper is Key

Copper is one the world’s most ubiquitous metals: it is found in everything from laptops to smartphones, to solar panels and wind turbines, to the cables in data center connectivity.

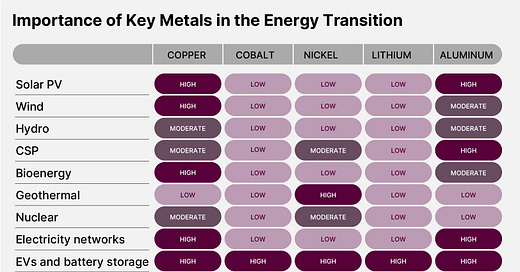

According to the International Energy Agency, copper is critical to the energy transition, more so than aluminum, cobalt, lithium and nickel.[1]

Hitting global electrification goals is likely going to require 115% more copper to be mined over the next three decades than has been mined throughout history, noted a 2024 report by the International Energy Forum.[2] In the near term, however, demand could be squeezed by US President Donald Trump’s tariffs.

2. Are Tariffs Coming?

In February, Trump announced a 25% blanket fee on imports of aluminum and steel. While copper was initially exempt, he launched a 270-day probe into the threat that imports pose to US national security. In an executive action order, he directed the Department of Commerce to come up with ways to mitigate the threat, including “potential tariffs, export controls or incentives to increase domestic production”.[3]

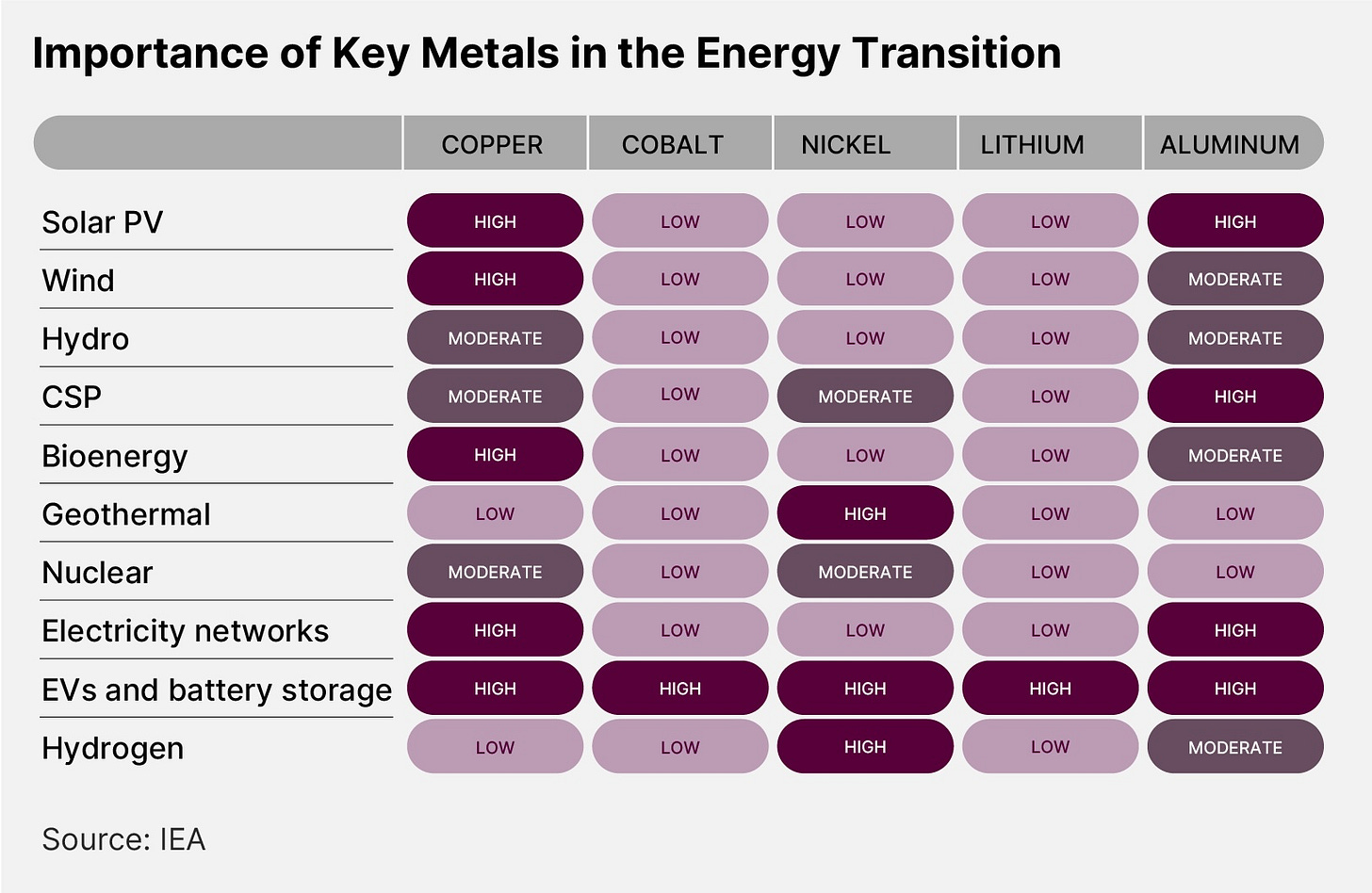

Fears that the red metal could be hit with a 25% tariff triggered the copper price to spike on New York’s Comex in March.

The Comex price peaked at $5.374 per pound, before pulling back slightly to $5.274, Bloomberg data shows. In comparison, the copper price on the London Metal Exchange (LME) was trading at $9,893 per metric ton. The difference between the two was $1,750 per ton.[4]

The disparity between the prices on the two exchanges was down to traders shipping as much of the metal as they could to the US and onto the Comex so they could take advantage of the premium buyers were having to pay. This has caused supply to tighten temporarily, Bloomberg noted.

Prices on both exchanges have since pulled back sharply. As of April 25, the Comex copper price was $4.840 per pound, or approximately $10,670 per metric ton, while the LME copper price was $9,374 per metric ton.

While the gap between the two contracts has narrowed slightly over the past month, it could widen again. Right now, there is a gulf between them because of the uncertainty around potential tariffs and the form they will take, ING analysts noted at the end of March.[5]

If tariffs are imposed, then there would be potential for prices to rise in New York. On the other hand, if any tariffs announced are lighter than expected — say, a 20% levy — then prices could potentially fall.

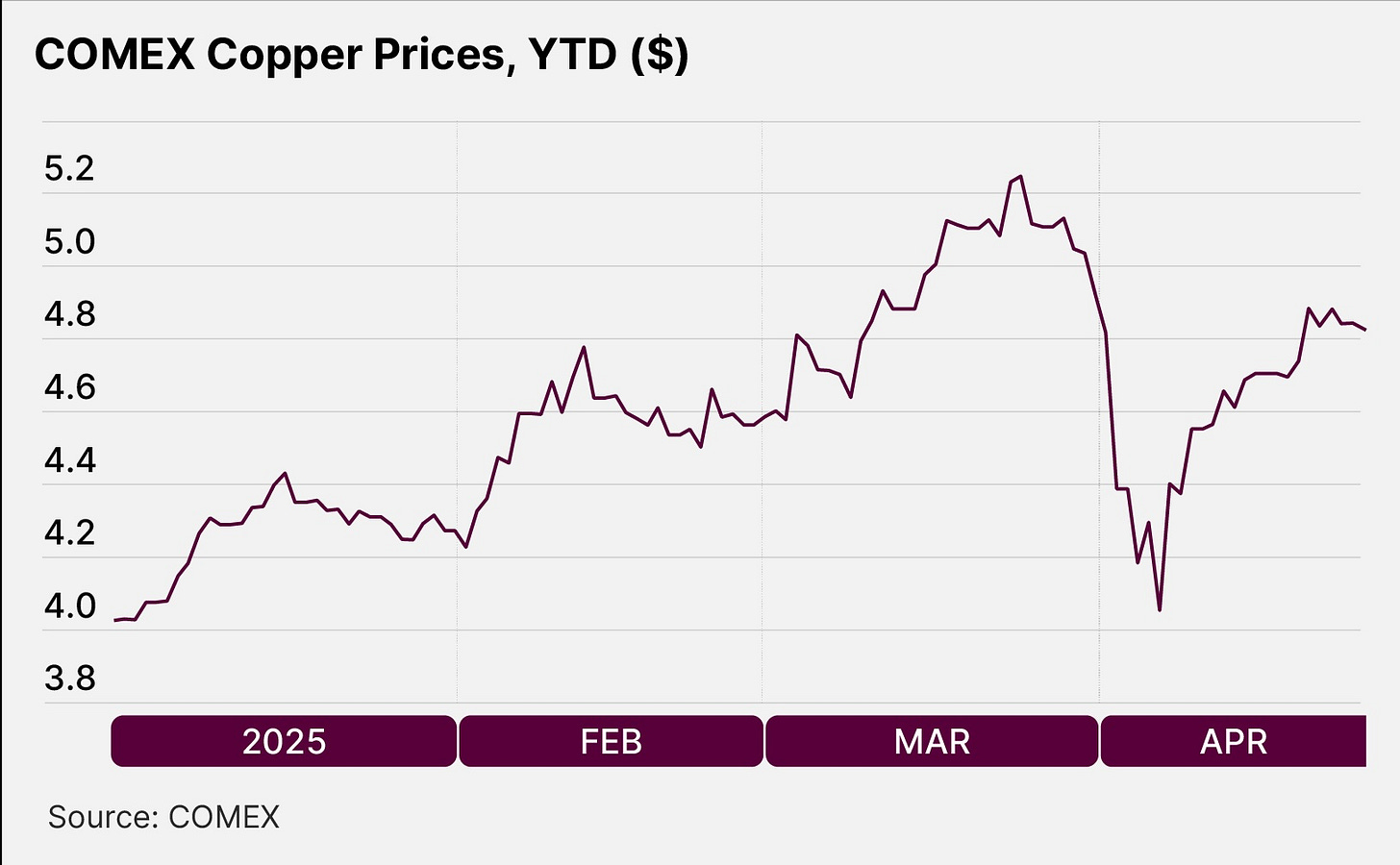

The situation highlights the need for the US to focus on boosting domestic production, which currently accounts for just 5% of total global copper mining output.

The US imported approximately 850,000 tons of refined copper in 2024, primarily from Canada, Chile and Peru, accounting for half of its domestic consumption. Even some of the copper the US does produce needs to be exported in order to be refined, before being shipped back again.

Dependency on other countries for copper supply and copper refining will not be easy to fix, though. For starters, it takes an average of 29 years to get a mine approved and opened in the US, the second-longest development time after Zambia.[6]

In this report, we look at five major copper miners, how they expect to be impacted by Trump’s tariffs, and what they are doing to increase production.

3. Copper Stocks Lose Their Luster

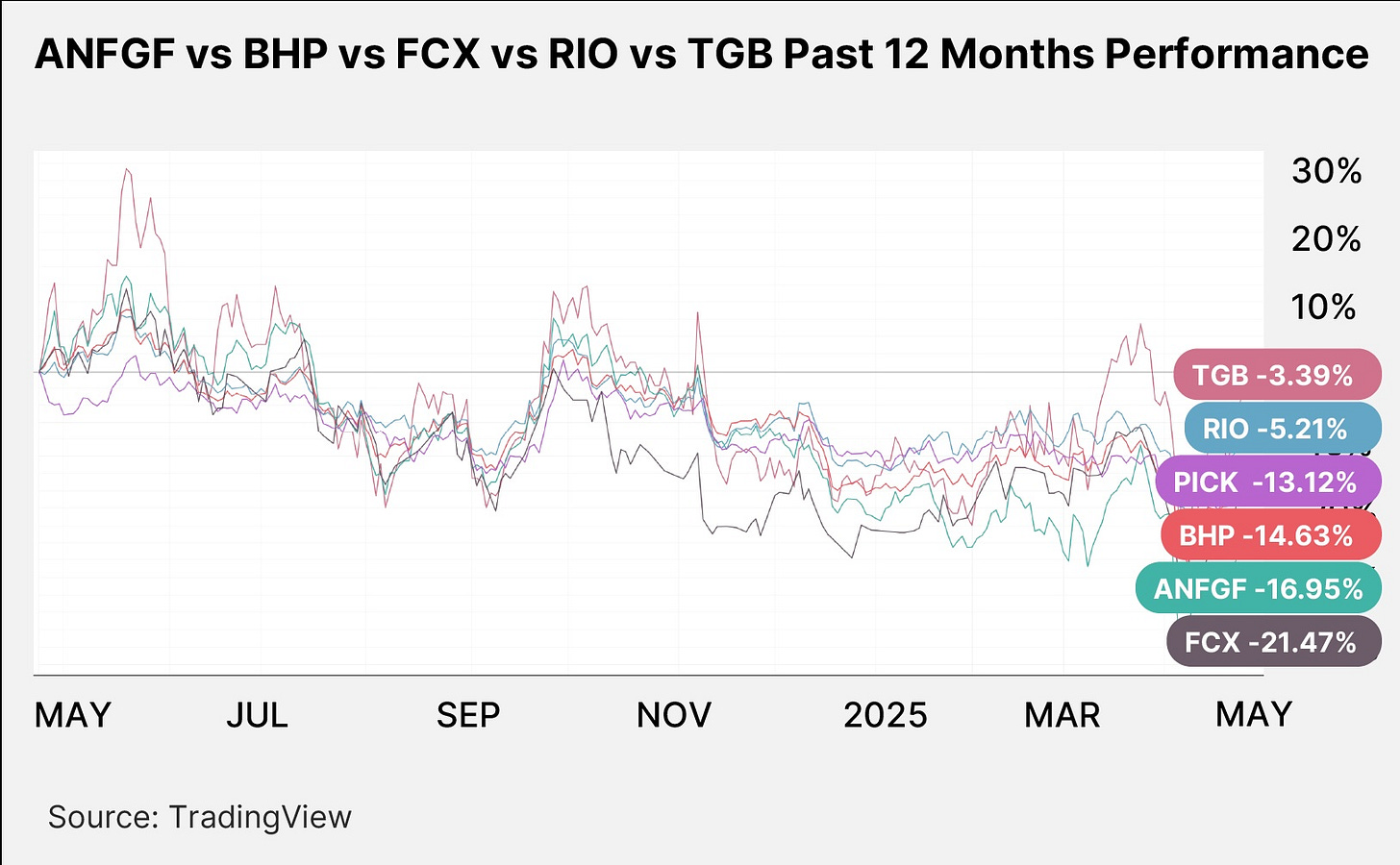

The five copper stocks in focus are: Antofagasta [ANFGF], BHP [BHP], Freeport-McMoRan [FCX], Rio Tinto [RIO] and Taseko Mines [TGB].

Unsurprisingly, given the uncertainty around Trump’s tariffs, all five stocks have been on a downward trend — although most have witnessed a turnaround in the second half of April.

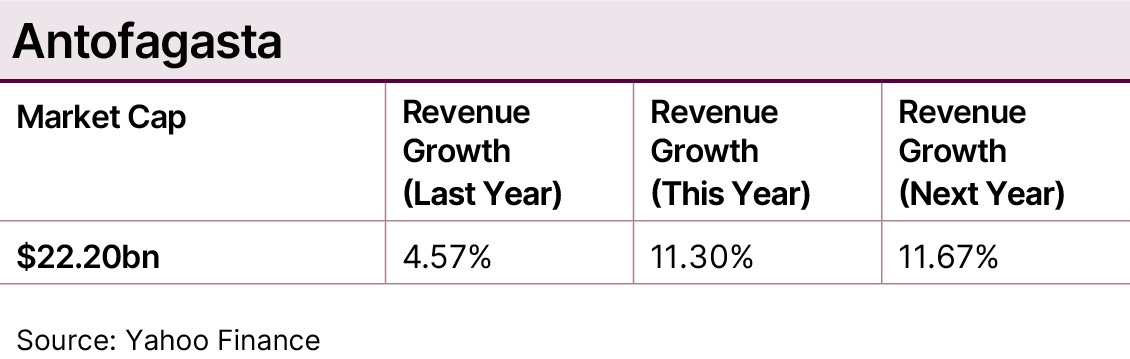

The Antofagasta share price is up 7.74% since the start of 2025 and down 16.95% in the past 12 months.

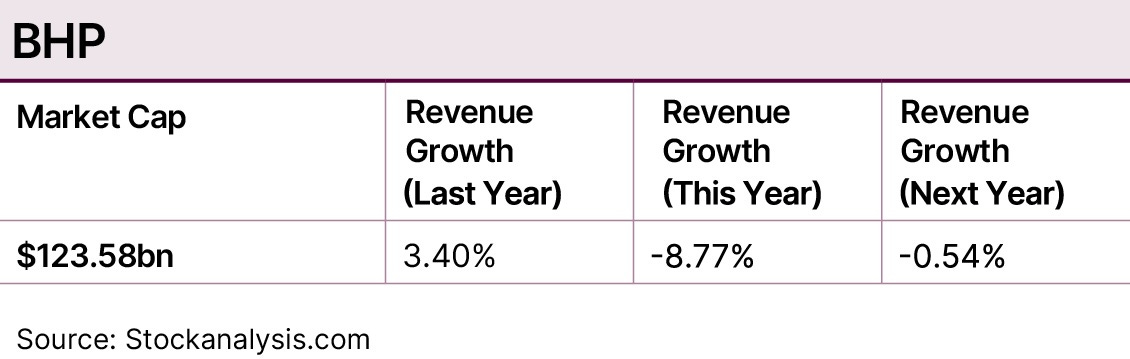

The BHP share price is up 0.71% since January 1 and down 14.63% in the past 12 months.

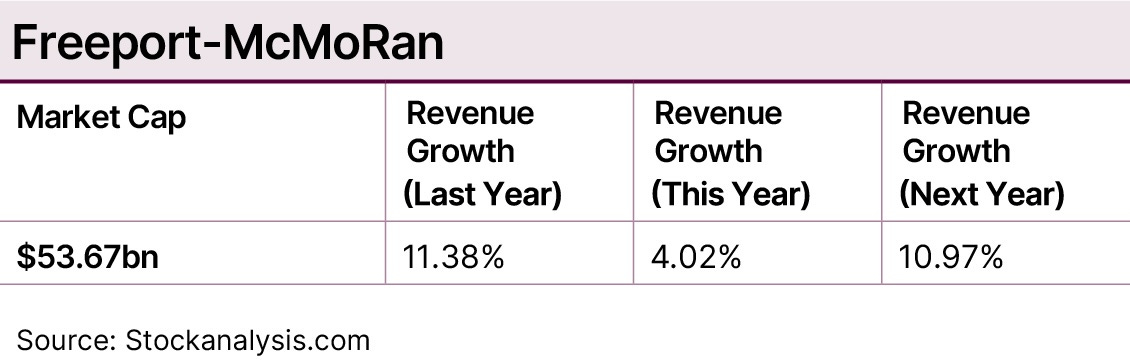

The Freeport-McMoRan share price is down 1.11% since January 1 and down 21.47% in the past 12 months.

The Rio Tinto share price is up 6.73% since January 1 and down 5.21% in the past 12 months.

The Taseko Mines share price is up 17.53% since January 1 but down 3.39% in the past 12 months.

For comparison, the iShares MSCI Global Metals & Mining Producers ETF [PICK], which holds all five stocks,[7] is up 2.23% since January 1 and down 13.12% in the past 12 months.

Antofagasta

Speaking at the annual industry event CESCO in Santiago earlier this month, Iván Arriagada, the CEO of the Chilean mining giant, told Reuters that he does not expect tariffs to have that big an impact on overall demand.[8]

Even if there is lower demand for the metal from the construction and infrastructure industries, the need for copper in data center cabling and to power artificial intelligence applications is unlikely to let up and so would be able to fill any gap, Arriagada explained.

Antofagasta, which has its primary listing in London, currently operates four mines in Chile: its flagship operation is in Los Pelambres and other locations in Antucoya, Centinela and Zaldívar.[9] It produced 663,950 tons of copper in 2024, up by less than 1% from 2023 and missing its guidance of 670,000 tons.

Production for 2025 is forecast to be between 660,000 tons and 700,000 tons. Capital expenditure for the fiscal year, meanwhile, is expected to be $3.9bn, up from $2.4bn in 2024.

This guidance was reiterated when the miner released its quarterly production report for Q1 on April 16, revealing that it produced 154,700 tons of copper in the January–March period, selling 170,200 tons. These figures were up 19.6% and 47.1% year-over-year, respectively.[10]

“With global markets experiencing significant volatility, our efforts remain centered on delivering robust operational performance, continued cost discipline and the timely execution of our growth projects,” Arriagada said in a statement.

“The medium-term outlook for copper remains strong given its fundamental role in energy security and electrification, positioning it as a metal of the future.”

In the long term, the miner is hoping to open a mine in the US — the Twin Metals copper and nickel project in Minnesota. A lawsuit still needs to be resolved in order to revive it after it was blocked by the Biden administration over concerns about potential environmental damage.[11]

“In the current environment, where there is a lot more support for mining investment, it should be easier and should happen,” Arriagada told Reuters.

BHP

Australian mining giant BHP reported a record 1.5 million tons of copper was produced in the first nine months of its fiscal year through March 31, up 10% from the same period in the previous fiscal year.[12] Production for the January–March quarter was flat sequentially.

The strong performance was partly due to operations in South Australia stabilizing following bad weather earlier in the year.

Despite BHP expecting tariffs to have a “limited direct impact” on its business, CEO Mike Henry has warned “the implication of slower economic growth and a fragmented trading environment could be more significant”.

In the quarterly production update released on April 17, Henry said that the outlook for copper and the global economy in general will depend on China’s ability to boost domestic consumption.

“In the face of global volatility and policy uncertainty, BHP is poised to benefit from a flight to quality with tier-one assets, industry-leading margins and high-return organic growth opportunities that will underpin value and returns through the cycle,” Henry added.

Ramping Up Copper Production

Reports emerged earlier in April that BHP was considering offloading its coal and iron ore assets to double down on its copper assets.[13] Though the company declined to comment, the move would make strategic sense.

In May 2024, BHP pulled out of a $39bn deal to acquire Anglo American [NGLOY], including its copper mines in Chile and Peru. The merger would have given BHP control of 10% of global copper production. Following the H1 2025 earnings release in February, Henry reported that the company is currently not thinking about acquisitions: “Our current focus is 100% on organic growth options.”[14]

Copper operations generated $5bn in the first half of the fiscal year, up 44% from H1 2024, contributing 39% of total underlying EBITDA of $12.4bn for the six months to December 31, compared to a 25% share in H1 24.

As the chart below shows, copper shone in the most recent half-year. Coal’s contribution to BHP’s cash profit has dropped dramatically, while the iron ore business has also seen a slow decline.

BHP is to continue doubling down on copper and is expecting to have spent $4.7bn on expanding on its operations in the current fiscal year, which ends June 30.

Last August, the miner announced that it is targeting increased production in South Australia, from 322,000 tons of refined copper cathode to 500,000 tons by the early 2030s, and hopes to ramp this to 650,000 tons by the middle of that decade.[15]

Freeport-McMoRan

The Phoenix, Arizona-based miner currently accounts for approximately 70% of the copper produced in the US.[16]

Trump’s copper tariffs could potentially give its profits a $400m boost and, if he were to classify copper as a critical mineral as part of his bid to boost the domestic industry, then Freeport could potentially receive $500m in tax credits annually through the Inflation Reduction Act.[17]

“Having the incentives and clarity around those would be a big plus for the domestic copper industry,” CEO Kathleen Quirk told Reuters in March.

Nevertheless, its US operations are “highly sensitive to the price of copper,” Quirk told Fastmarkets on the sidelines of the CESCO event in Santiago earlier this month.

“If we end up with an economic recession and a weak price of copper, that could put our US production at risk at a time when we’re trying to find ways to produce more,” she added. The trade war could also cause investors and traders to pause their buying, which would have a knock-on effect on demand.

In its Q1 2025 earnings release on April 24, Freeport announced that copper production totaled 868 million pounds, exceeding expectations outlined in March. The average realized price was $4.44 per pound compared to the LME average quarterly settlement price of $4.24.[18]

Freeport is expecting to produce an extra 300 million pounds by the end of 2025 through leaching — a chemical process — of waste rock at its US mines that would otherwise have been discarded. The aim is to increase this amount to 800 million pounds by 2027.[19]

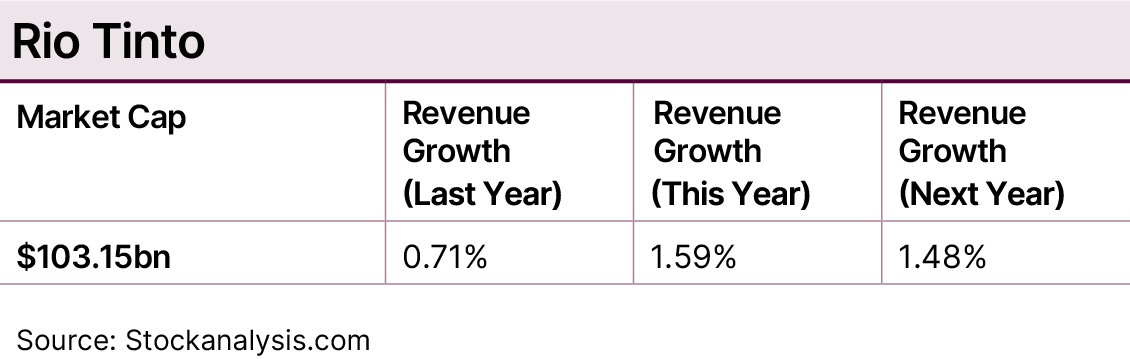

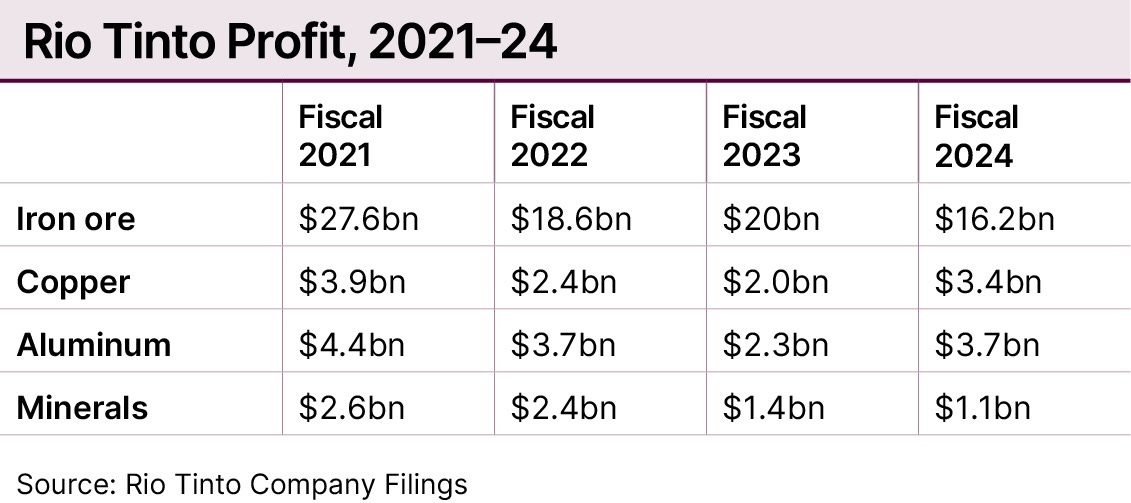

Rio Tinto

The British-Australian miner received a major boost on April 18 after its Resolution Copper project in Arizona won fast-track status after years of delays.[20]

Katie Jackson, CEO of Rio Tinto’s copper division, told Fastmarkets at CESCO earlier this month that “a positive decision would give us the opportunity to commit to a work program, to do more exploration and to really then finalize the mine design to progress”.[21]

Resolution Copper is a joint venture with BHP, with Rio Tinto holding a majority ownership of 55%. Once fully operational, it could potentially supply enough copper to meet 25% of annual US demand.[22]

Like BHP, Rio Tinto has historically generated the bulk of its profit from its iron ore business. But its copper operations’ share of overall underlying EBITDA grew significantly in the last fiscal year.

Copper production for Q1 rose 16% year-over-year to 210,000 tons, although this was down 8% from Q4 2024. This drop was attributable to an 11% decline in production at its Kennecott mine in Utah, which produced 42,000 tons in the January–March period.

Rio Tinto is expecting to produce between 780,000 and 850,000 tons of copper in fiscal 2025, up from 697,000 in 2024, which itself was a 13% increase on 2023.[23]

Production is being boosted by operations at its Oyu Tolgoi underground copper mine in Mongolia. The asset achieved record production in Q1, up 42% year-over-year to 65,000 tons.[24]

Copper has been identified as the key driver of long-term growth. Rio Tinto is targeting production of 1 million tons annually by 2030, it announced at its Investor Seminar in London in December.[25]

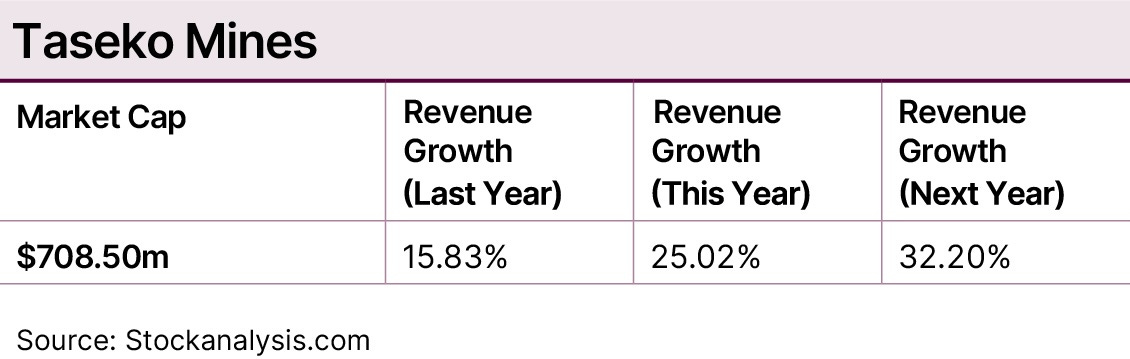

Taseko Mines

The Canadian miner operates the second-largest open-pit copper project in Canada, Gibraltar Mine in British Columbia. It is also constructing a mine, Florence Copper, in Arizona — production is set to start in Q4.

Despite the significant exposure to North America, Taseko has confirmed that sales from Gibraltar Mine will not be impacted by Trump’s tariffs. This is because all copper produced there is bought by international metal traders and sold to Asian markets. There are offtake contracts in place through to the end of 2026.[26]

“Although these new tariffs will not directly impact our business … we are hopeful that a more constructive trade relationship will emerge for copper and other critical minerals, for the benefit of both Canada and the US,” said Taseko CEO Stuart McDonald in a press release.

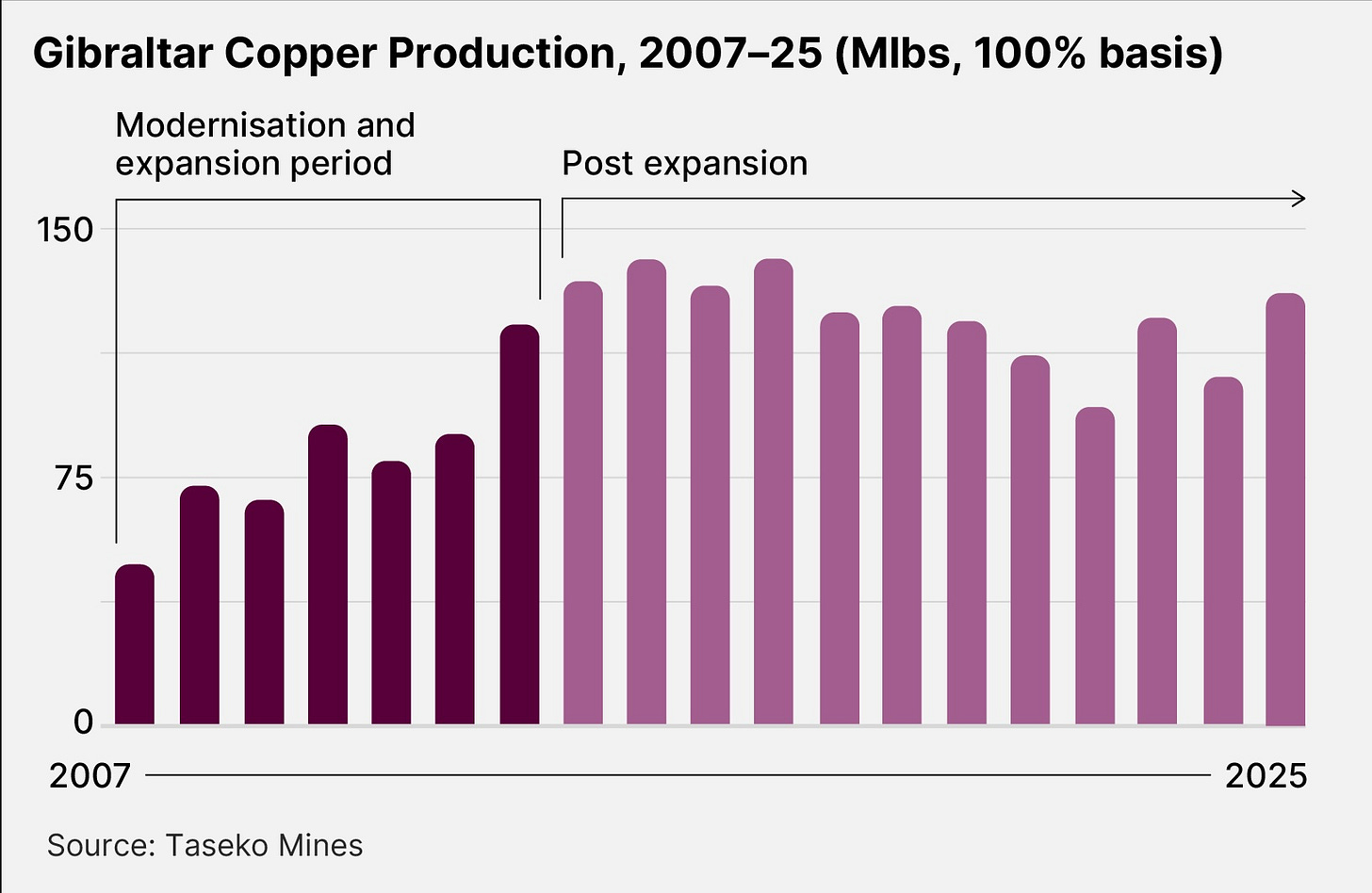

While Taseko’s market cap is a fraction of other mining majors, production at Gibraltar Mine, of which Taseko took full ownership in March 2024,[27] has been fairly consistent.

Gibraltar Mine produced 106 million pounds of copper last year. But production has been ramping up, with output of 29 million pounds in Q4.[28]

Taseko is expecting 2025 copper production to be between 120 million and 130 million pounds.

As for the long term, once Florence Copper is up and running, Taseko plans to use its cash to develop another mine in British Columbia. The miner is hoping to publish an updated technical report for the Yellowhead copper project in Q2.[29]

“It’s an interesting time in Canada with the threat of US tariffs and here in British Columbia the government is clearly focused on how to respond and bolster our economy,” said Chief Operating Officer Richard Tremblay on the Q4 2024 earnings call.

4. Conclusion

Copper stocks have lost their luster this year amid uncertainty around Trump’s tariffs. There’s a chance that they could continue on a downward trend until more clarity has been provided.

That said, all five miners could potentially play a key role in helping North America to boost its domestic copper production in the long term.

This is for informational purposes only. OPTO Markets does not recommend any specific securities or investment strategies. Investing involves risk and investments may lose value, including the loss of principal. Past performance does not guarantee future results.

[1] https://www.iea.org/data-and-statistics/charts/copper-supply-requirements-and-expected-supply-from-announced-projects-in-2035

[2] https://www.ief.org/focus/ief-reports/copper-mining-and-vehicle-electrification

[3] https://www.whitehouse.gov/presidential-actions/2025/02/addressing-the-threat-to-nationalsecurity-from-imports-of-copper/

[4] https://www.bloomberg.com/news/articles/2025-03-26/trump-may-implement-copper-import-tariffs-within-weeks

[5] https://think.ing.com/articles/trumps-copper-tariffs-might-be-coming-sooner-than-you-expect/

[6] https://www.reuters.com/markets/commodities/us-mine-development-timeline-second-longest-world-sp-global-says-2024-07-18/

[7] https://www.ishares.com/us/products/239655/ishares-msci-global-metals-mining-producers-etf

[8] https://www.reuters.com/markets/commodities/chiles-antofagasta-expects-copper-demand-defy-tariff-turmoil-2025-04-08/

[9] https://www.antofagasta.co.uk/our-business/mining-division/

[10] https://www.antofagasta.co.uk/investors/news/2025/quarterly-production-report-q1-2025/

[11] https://www.reuters.com/legal/litigation/us-blocks-mining-parts-minnesota-dealing-latest-blow-antofagastas-copper-project-2023-01-26/

[12] https://www.bhp.com/-/media/documents/media/reports-and-presentations/2025/250417_bhpoperationalreviewfortheninemonthsended31march2025.pdf

[13] https://www.reuters.com/markets/commodities/bhp-considered-spinning-off-iron-ore-coal-divisions-2025-04-02/

[14] https://www.reuters.com/markets/commodities/bhp-first-half-underlying-profit-falls-23-lower-iron-ore-prices-2025-02-17/

[15] https://www.bhp.com/news/media-centre/releases/2024/08/bhp-takes-next-step-in-smelter-and-refinery-expansion-at-copper-south-australia

[16] https://www.fastmarkets.com/insights/impact-tariffs-freeport-mcmorans-copper-production-andrea-hotter/

[17] https://www.reuters.com/markets/commodities/ceraweek-freeport-sees-500-million-annual-boost-if-trump-declares-copper-2025-03-10/

[18] https://investors.fcx.com/investors/news-releases/news-release-details/2025/Freeport-Provides-First-Quarter-2025-Operational-Update/default.aspx#:~:text=FCX's%20consolidated%20average%20realized%20price,price%20of%20%244.24%20per%20pound.

[19] https://uk.marketscreener.com/quote/stock/FREEPORT-MCMORAN-INC-12574/news/Transcript-Freeport-McMoRan-Inc-Presents-at-Jefferies-Global-Industrial-Conference-2024-Sep-05-2-47814300/

[20] https://www.permitting.gov/newsroom/press-releases/trump-administration-advances-first-wave-critical-mineral-production

[21] https://www.fastmarkets.com/insights/tariffs-create-volatility-long-term-conviction-remains-rio-tinto-andrea-hotter/

[22] https://resolutioncopper.com/about-us/

[23] https://www.riotinto.com/en/news/releases/2025/rio-tinto-releases-fourth-quarter-production-results

[24] https://www.riotinto.com/en/news/releases/2025/rio-tinto-releases-first-quarter-2025-production-results

[25] https://www.riotinto.com/en/news/releases/2024/rio-tinto-investing-for-a-stronger-more-diversified-portfolio

[26] https://www.tasekomines.com/investors/news/taseko-comments-on-new-us-and-canadian-tariffs/

[27] https://www.tasekomines.com/investors/news/taseko-acquires-100-of-gibraltar-mine/

[28] https://www.tasekomines.com/investors/news/taseko-announces-2024-production-results-and-amendment-to-gibraltar-silver-stream/

[29] https://seekingalpha.com/article/4760335-taseko-mines-limited-tgb-q4-2024-earnings-call-transcript