Can These 3 Upstart EV Stocks Challenge the Big Players?

Amid geopolitical uncertainty, what would it take for these EV companies to capture greater market share?

Key Takeaways

Chinese behemoth BYD and US EV leader Tesla remain leaders in the global market.

The EV market could cool as companies adjust to the reduction of subsidies and the imposition of tariffs on a “a very international supply chain”.

While Lucid Motors and Rivian face headwinds due to Trump’s tariffs, Li Auto’s focus on the Chinese market could help it dodge any adverse effects.

The global electrical vehicle (EV) industry continues to be dominated by Chinese behemoth BYD [BYDDF] and US EV darling Tesla [TSLA].

Warren Buffett-backed BYD and Elon Musk’s Tesla had a 22.2% and 10.3% share of the EV market, respectively, in 2024, according to deliveries data compiled by EV Volumes.[1] The rest of the top 10 held a combined 22% share of the market between them.

Here, OPTO examines the recent performances of three emerging EV brands — Lucid Motors [LCID], Li Auto [LI] and Rivian [RIVN] — and unpacks the challenges they face, as well as possible catalysts for growth in the near term.

Q1 Volumes Lower but Still Up

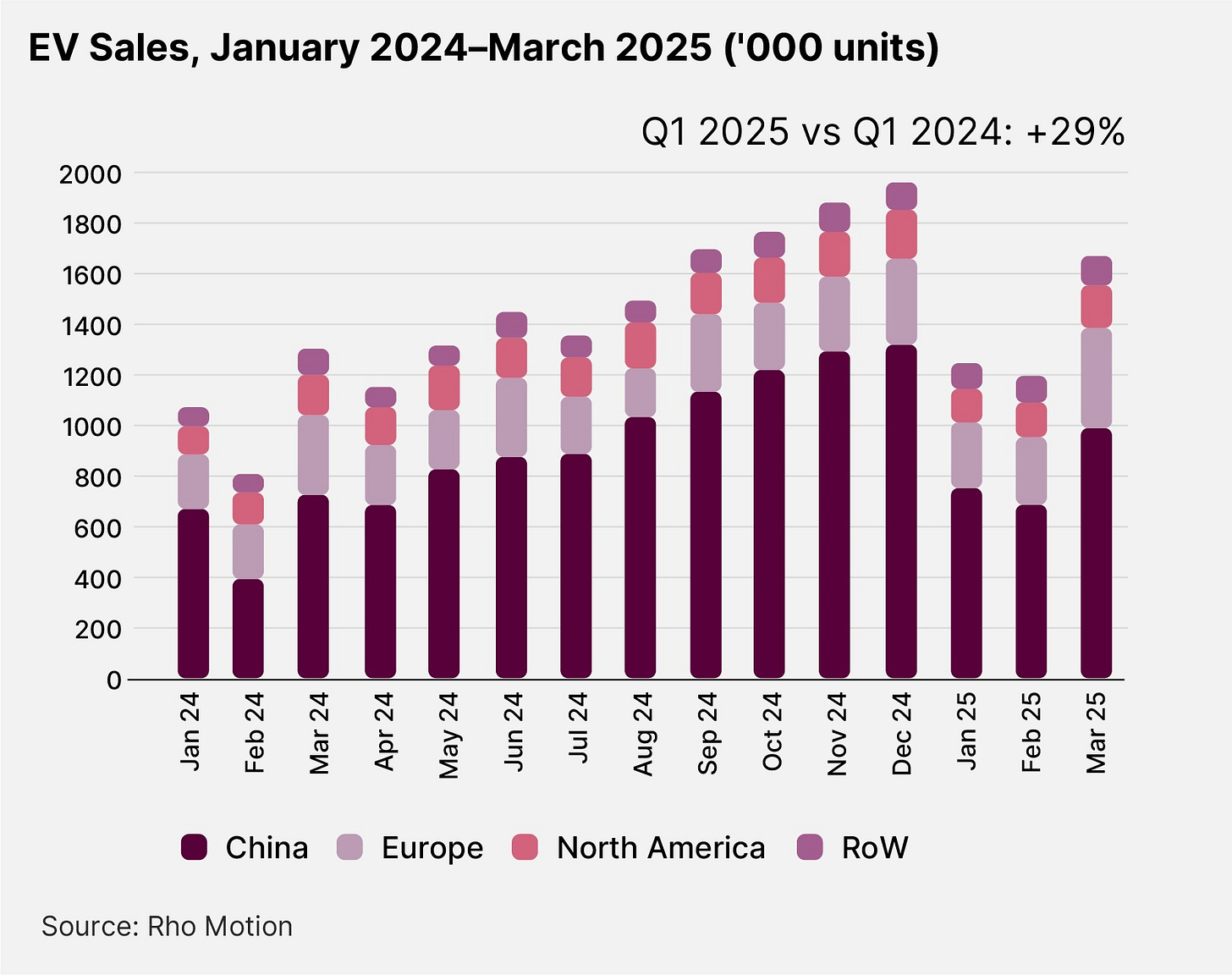

Total global EV sales were 4.1 million units in Q1 2025, according to EV research consultancy Rho Motion.[2] While volumes were lower than the past few quarters, as shown in the following graph, they were up 29% from Q1 2024.

China was the best-performing region, seeing growth of 36%, to 2.4 million vehicles sold. Sales were up 22% in Europe, to approximately 900,000, and 16% in North America, to 500,000.

“What is sure is that the EV market is already struggling to compete with [the internal combustion engine] on cost, so reductions in subsidies and hefty tariffs for a very international supply chain are guaranteed to have a cooling effect on the industry,” said Rho Motion Data Manager, Charles Lester, in a news release.

EV Stocks Stall

EV makers were caught up in the turbulence caused by US President Donald Trump’s reciprocal tariffs announcement in early April.

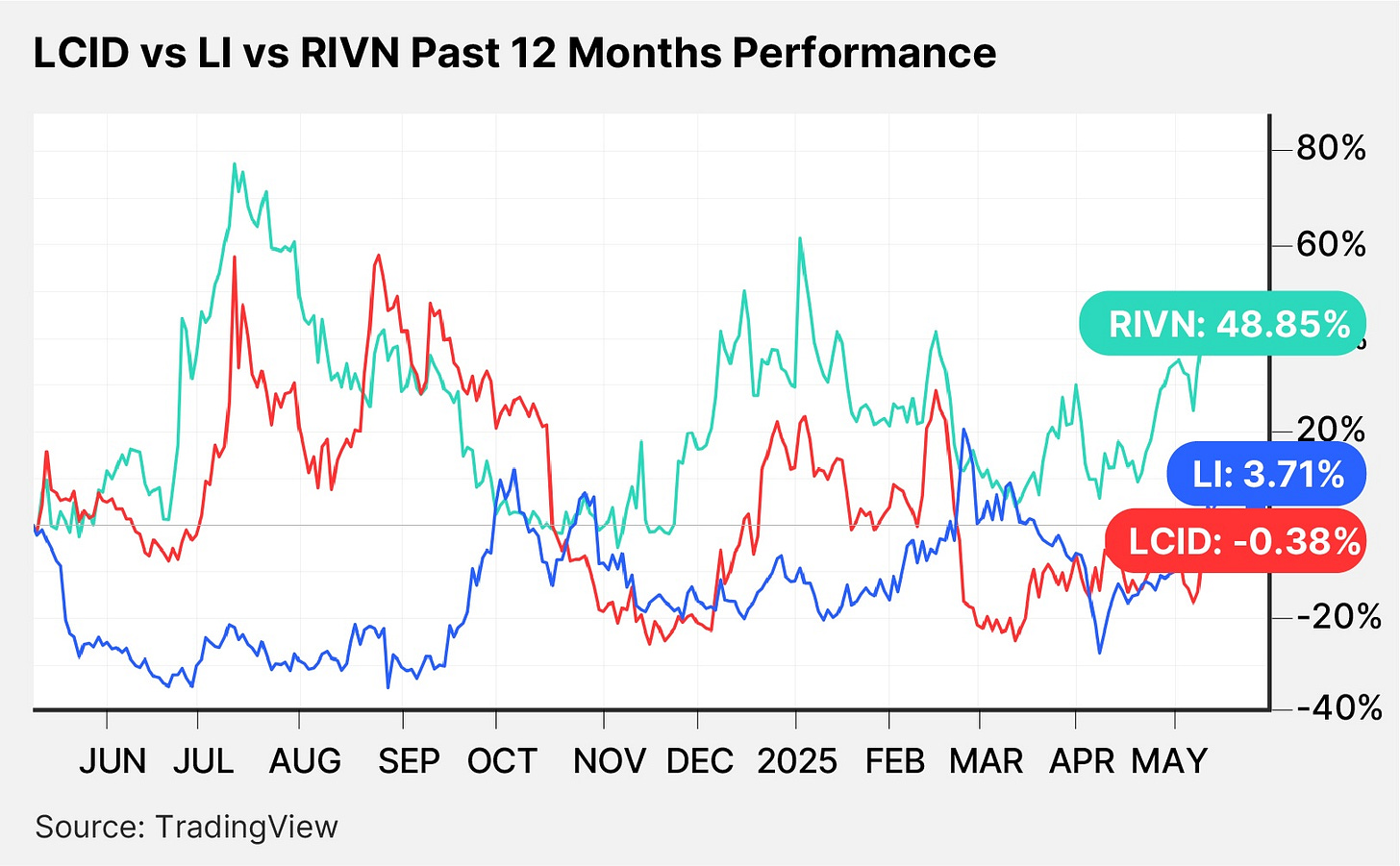

The Lucid share price fell as low as $1.99 in early March, just above its 52-week low of $1.93, set on November 15 last year, and closed on May 13 at $2.65. LCID stock is down 12.25% year-to-date and down a marginal 0.38% in the past 12 months.

The Li Auto share price fell from a 52-week high of $33.12 on February 26 to $19.10 on April 8. LI stock closed on May 13 at $27.96, up 16.55% year-to-date, and up 3.71% in the past 12 months.

The Rivian share price fell to $10.36 on April 4, having been as high as $16.65 on January 3. RIVN stock closed on May 13 at $14.87, up 11.8% year-to-date and up 48.85% in the past 12 months.

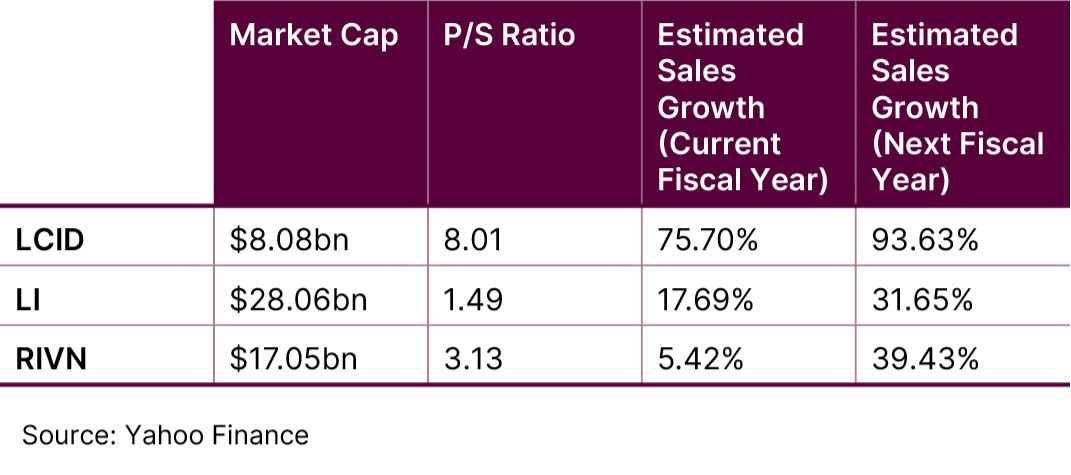

Here is how the fundamentals of the three stocks currently compare.

LI stock and LCID both look undervalued relative to their projected revenue growth over the next couple of years, whereas RIVN stock could look overvalued in comparison.

Whether any of these three EV challenger stocks represent an interesting investment opportunity also depends on how the companies are currently being impacted by Trump’s tariffs, if at all.

LCID Stock, LI Stock, RIVN Stock: The Investment Case

The Bull Case for Lucid

Lucid delivered 3,109 vehicles in Q1, up 58% from 1,967 deliveries in the year-ago period.[3] It was the fifth straight quarterly record.

The EV maker reaffirmed its previous production forecast of 20,000 units this year in its Q1 2025 earnings release on May 6. This would be more than double the 9,029 vehicles produced in 2024.[4]

The Bear Case for Lucid

Nonetheless, Lucid CFO Taoufiq Boussaid said on the Q1 earnings call that the EV maker is likely to face gross margin headwinds of 8–15%, up from its previous guided range of 7–12%, due to Trump’s tariffs. The situation remains fluid, he added, and the range could change as a result.[5]

The Bull Case for Li Auto

Li Auto should be largely sheltered from any tariff impact, because it does not sell any vehicles to the US.

The Chinese challenger delivered 33,939 vehicles in April, up 31.6% year-over-year, better than the 26.5% growth rate recorded for March’s deliveries.[6]

The Bear Case for Li Auto

Li Auto is due to hold its Q1 2025 earnings call on May 29, but the company issued guidance in March that disappointed investors.

Revenue, the company said, should be between RMB23.4bn and RMB24.7bn, down from RMB25.6bn in Q1 2024.[7] It added that it expected to deliver between 88,000 and 93,000 vehicles. The Q1 total was 92,864, up 15.5% year-over-year.[8]

The Bull Case for Rivian

There was not much to cheer about following Rivian’s Q1 2025 results, delivered on May 6. However, the EV maker did maintain its adjusted EBITDA outlook of a loss between $1.7bn–1.9bn.[9] This would be an improvement on the $2.69bn adjusted loss in 2024.[10]

The Bear Case for Rivian

Rivian CFO Claire McDonough said on the Q1 earnings call that the company is expecting Trump’s tariffs to add “a couple thousand dollars” onto the cost of its vehicles.[11]

As such, the 2025 delivery target has been slashed from 46,000–51,000 to 40,000–46,000. Meanwhile, capital expenditure is expected to increase from previous guidance of $1.6bn–1.7bn to $1.8bn–1.9bn.

Conclusion

The uncertainty caused by tariffs could impact vehicle production and deliveries in the near term. However, this should be just a bump in the road.

Li Auto, Lucid Motors and Rivian are all expected to report a jump in sales in the next fiscal year, indicating that demand for EVs should accelerate in the medium term.

This is for informational purposes only. OPTO Markets does not recommend any specific securities or investment strategies. Investing involves risk and investments may lose value, including the loss of principal. Past performance does not guarantee future results.

[1] https://autovista24.autovistagroup.com/news/what-are-the-global-ev-markets-most-successful-brands/

[2] https://rhomotion.com/news/global-ev-sales-up-29-in-2025-from-previous-year/

[3] https://ir.lucidmotors.com/static-files/90032b0d-7bef-4fbb-b478-25b35ac6baa1

[4] https://ir.lucidmotors.com/news-releases/news-release-details/lucid-announces-q4-production-deliveries-sets-date-fourth-0

[5] https://uk.marketscreener.com/quote/stock/LUCID-GROUP-INC-112589428/news/Transcript-Lucid-Group-Inc-Q1-2025-Earnings-Call-May-06-2025-49847731/

[6] https://ir.lixiang.com/news-releases/news-release-details/li-auto-inc-april-2025-delivery-update

[7] https://ir.lixiang.com/static-files/956e9437-9c4c-493b-a464-ffc8338334fe

[8] https://ir.lixiang.com/news-releases/news-release-details/li-auto-inc-march-2025-delivery-update

[9] https://rivian.com/en-GB/newsroom/article/rivian-releases-first-quarter-2025-financial-results

[10] https://downloads.ctfassets.net/2md5qhoeajym/4bRHWWpn57tfMt9KEdEuhT/f9e991ab2f9a3fbe7dcfa33b63ae4917/EX_-_99.2_4Q24_Shareholder_Letter.pdf

[11] https://uk.investing.com/news/transcripts/earnings-call-transcript-rivian-beats-q1-2025-expectations-stock-dips-93CH-4068934