Can Global Expansion Revive this Ailing Stock?

Could a new partnership and international expansion spur Affirm’s growth, as regulators look to clamp down on installment spending?

Introduction

Affirm [AFRM] is a financial services and technology company founded by PayPal [PYPL] Co-Founder Max Levchin. It offers customers flexible payment plans, with no late fees.

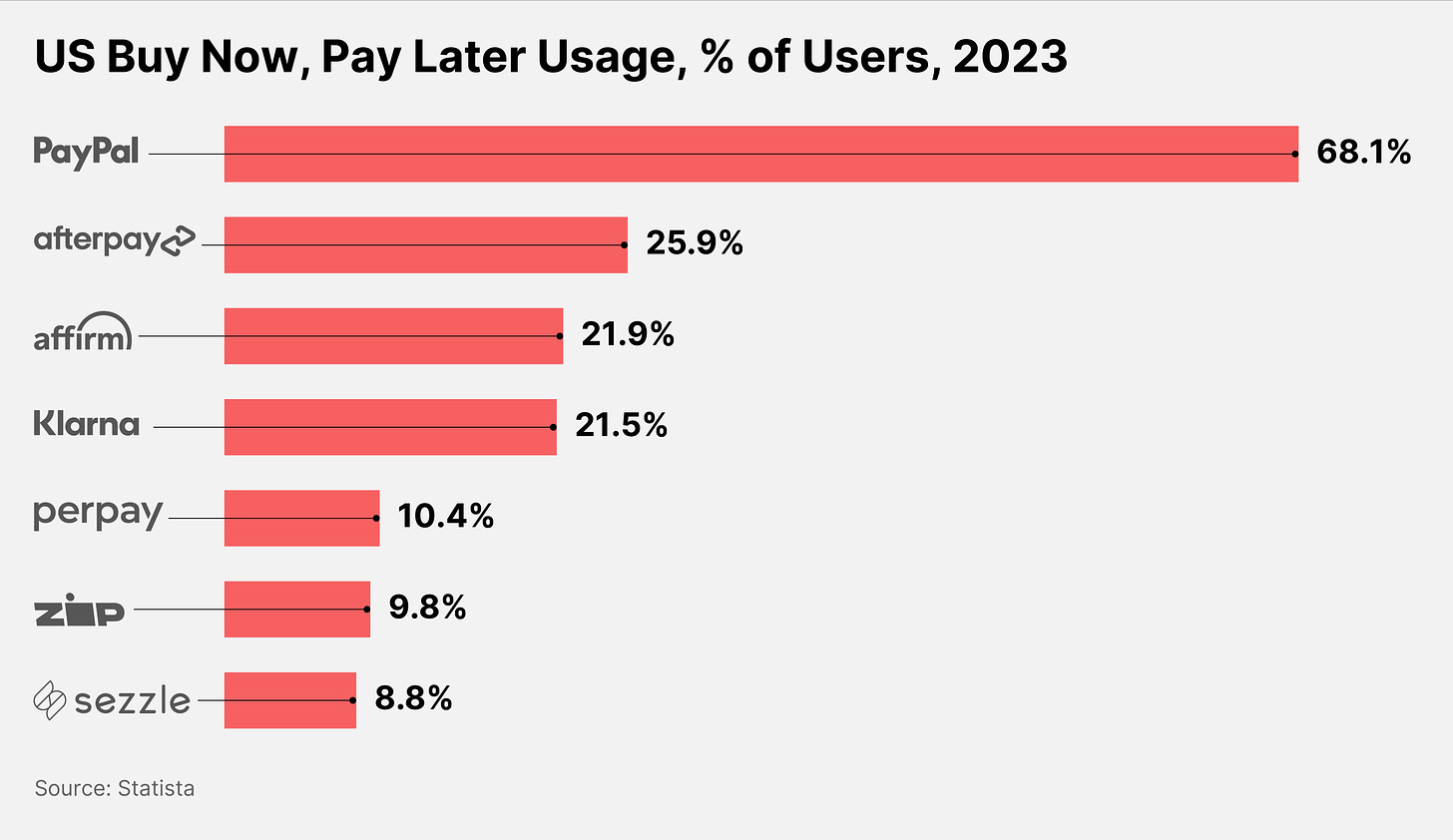

According to Statista, Affirm was the third-largest buy now, pay later (BNPL) lender in November 2023, with a 21.9% share of the market. PayPal was first with a 68.1% share, followed by Block’s [SQ] Afterpay, with 25.9%.[i]

This stock spotlight will look at why Affirm has chosen the UK as its first BNPL launch outside of North America. It will also discuss the company’s recent financial performance following its Q1 2025 earnings report on November 7, and highlight the tailwinds and headwinds that could affect the business going forward.

Affirm Enters the UK BNPL Market

Affirm announced its first expansion outside North America on November 3 with the launch of BNPL in the UK. The first two merchants to offer customers the option to spread payments are flight booking site Alternative Airlines and fintech and payments processor Fexco.[ii]

CEO Levchin told CityAM that a number of its partners already operated in the UK. When asked whether they would be interested in Affirm’s services or preferred to stick with existing players in the UK’s BNPL market, “we heard a resounding ‘Yes, please come,’” said Levchin.[iii]

He added that the UK was an attractive market to break into because it has “a clear appreciation for more flexible and transparent payment options” and “consumers here are sophisticated and savvy”.

AFRM Stock Rallies on Recent Earnings Reports

The Affirm share price rocketed back at the end of August and has continued to rise since, buoyed by strong earnings reports for Q4 2024 and Q1 2025. It has gained 22.32% in the past month alone through November 12, to trade at a 52-week high.

AFRM stock is up 17.20% since the start of 2024, and it has risen 156.75% in the past 12 months.

Affirm is Growing Faster than the US E-commerce Market

In Q1 2025, Affirm saw revenue jump 41% year-over-year to $698m, while gross merchandise volume (GMV) climbed 35% to $7.6bn.[iv]

“Affirm is growing faster than US e-commerce itself, while earning more revenue in the US than all of our pure-play competitors combined,” wrote Levchin in the Q1 shareholder letter.

For Q2, which ends December 31, revenue is forecast to be in a range of $770m–810m, which would be a 33.67% rise at the midway point of the $591m reported in the year-ago quarter.[v] GMV is expected to be in a range of $9.35bn–9.75bn, up 27.33% at the midway point.

In comparison, Jack Dorsey’s Block reported BNPL GMV growing 23% year-over-year to $8.24bn in its Q3 2024.[vi] PayPal’s Q3 total transaction volume rose 9% to $423bn, mainly thanks to a 15–20% rise in BNPL use.[vii]

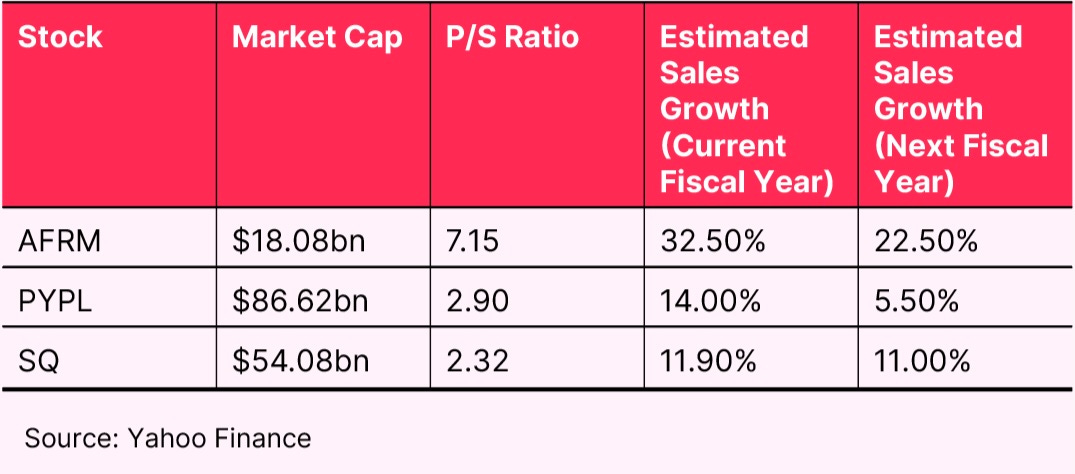

Here’s how Affirm’s fundamentals stack up against those of Block and PayPal.

While Affirm has said that it is growing faster than the broader US e-commerce market, revenue forecasts for the next couple of fiscal years suggest a slowdown from the 46% growth rate reported in fiscal 2024, which ended June 30.[viii] AFRM stock could be overvalued compared to PYPL and SQ, although its growth rate for the next two years is significantly higher.

AFRM Stock: The Investment Case

The Bull Case for Affirm

On September 17, Affirm’s BNPL payment option was made available to users running the iOS 18 and iPadOS operating systems.[ix]

When the partnership was first announced a few months earlier, Mizuho Securities Managing Director Dan Dolev argued in a note to clients that Affirm could see its GMV boosted by 35% in fiscal 2025, which began July 1, compared to average analyst estimates.[x]

Morgan Stanley analyst James Faucette believes the Apple [AAPL] integration could deliver $1.94bn in transaction volume by fiscal 2026, compared to previous expectations of $1bn–1.5bn.[xi]

Affirm CFO Michael Linford said in June that the company expects the partnership to have no material impact on its profit and loss statements for the next fiscal year.[xii]

The Bear Case for Affirm

While Affirm is well-placed to capitalize on the demand for BNPL payment options, the key to its long-term growth could be further expansion overseas, especially if more and more markets start to bring in regulation to clamp down on BNPL lenders.

In May 2024, the US Consumer Financial Protection Bureau ruled that BNPL users must be treated and receive the same federal protection as credit card customers.[xiii] However, most BNPL loans still go undetected on credit reports as lenders are not required to report them.

If rules were introduced that meant people could see how a BNPL loan impacts their credit score, then this could potentially result in fewer loan applications and fewer approvals, which in turn would impact BNPL lenders’ top and bottom lines.

Conclusion

Demand for BNPL is not expected to slow down anytime soon, despite the specter of regulators looming over the market. While this is something for investors to keep an eye on over the next few years, the integration of Affirm into Apple Pay could be a huge catalyst for AFRM stock.

-

OPTO’s proprietary theme relevance system maps the world’s biggest investing megatrends. For in-depth analyses of stocks with high growth potential, subscribe to OPTO Foresight.

[i] https://www.statista.com/chart/31336/popular-buy-now-pay-later-providers-in-the-us/

[ii] https://investors.affirm.com/news-releases/news-release-details/affirms-flexible-and-transparent-pay-over-time-options-now

[iii] https://www.cityam.com/us-fintech-giant-affirm-muscles-into-uks-buy-now-pay-later-market/

[iv] https://investors.affirm.com/system/files-encrypted/nasdaq_kms/assets/2024/11/07/15-50-51/AFRM%20-%20FQ1%2725%20Shareholder%20Letter.pdf

[v] https://investors.affirm.com/static-files/753da02e-35cc-4831-a046-8c8a9125e310

[vi]https://s29.q4cdn.com/628966176/files/doc_financials/2024/q3/Shareholder_Letter_Block_3Q24.pdf

[vii] https://www.fool.com/earnings/call-transcripts/2024/10/29/paypal-pypl-q3-2024-earnings-call-transcript/

[viii] https://investors.affirm.com/static-files/91087f9d-ae98-4006-a9ed-df028ec36606

[ix] https://www.paymentsdive.com/news/apple-launches-affirm-bnpl-option/727232/#:~:text=That%20means%20consumers%20can%20use,cases%20with%20no%20interest%20payments.

[x] https://www.paymentsdive.com/news/affirm-apple-pay-buy-now-pay-later-bnpl-payment/719627/

[xi] https://www.benzinga.com/analyst-ratings/analyst-color/24/10/41256171/affirm-earns-stock-upgrade-morgan-stanley-says-apple-pay-integration-expected-to-dr

[xii] https://seekingalpha.com/article/4699349-affirm-holdings-inc-afrm-cfo-fireside-chat-transcript

[xiii] https://www.consumerfinance.gov/about-us/newsroom/cfpb-takes-action-to-ensure-consumers-can-dispute-charges-and-obtain-refunds-on-buy-now-pay-later-loans/