Can a Sector Bounce-back Boost These 3 Biopharma Stocks?

After a sell-off at the end of 2024 following Donald Trump’s re-election, the biopharma sector seems to be bouncing back.

Key Takeaways

Weight loss drugs look set to continue supporting revenue growth for Novo Nordisk [NVO];

Eli Lilly’s [LLY] acquisition of Scorpion Therapeutics represents an upset in the breast cancer drugs market;

Recent approvals of Vertex’s [VRTX] cutting-edge gene therapy look promising, but may not be “needle movers” for the stock.

After a sell-off at the end of 2024 — following Donald Trump’s re-election and choice of vaccine skeptic Robert F Kennedy Jr as his health secretary — the biopharma sector seems to be bouncing back.

There was a flurry of M&A activity on the first day of the JPMorgan healthcare conference last month. Eli Lilly [LLY], GSK [GSK] and Johnson and Johnson [JNJ] all announced deals exceeding $1bn in valuation. This came on the back of a 47% year-over-year drop in biopharma M&A activity in 2024.[1]

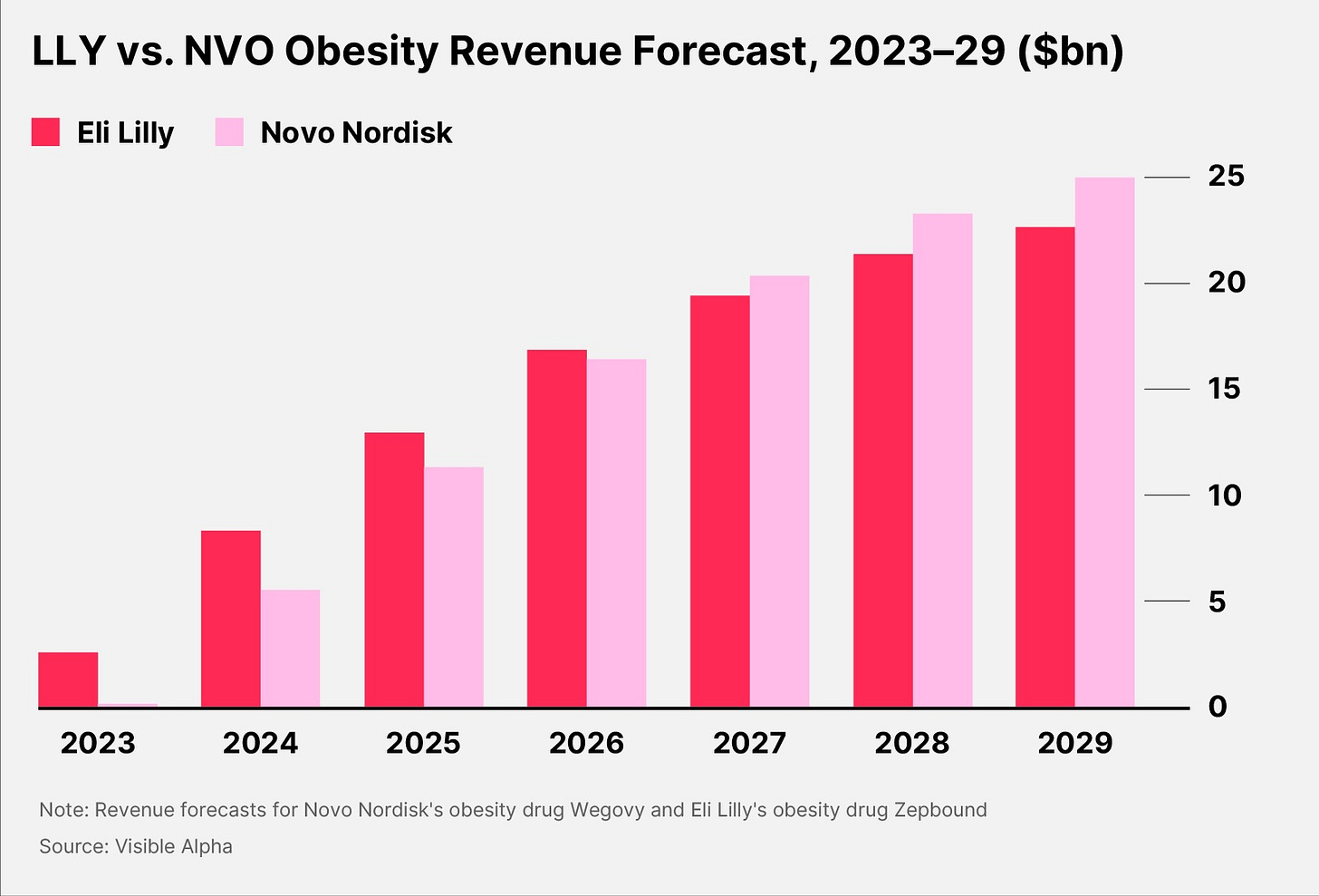

Weight loss drugs are likely to continue to be a fast-growing market in 2025. Though it is dominated by Eli Lilly and Novo Nordisk [NVO], plenty of other biotechs and new incumbents are developing treatments.

Gene editing and gene therapy are likely to be another trend to watch out for this year. The first CRISPR drug, from Vertex Therapeutics [VRTX] and CRISPR Therapeutics [CRSP], was approved by the FDA in December 2023.[2]

While there are still concerns about how Kennedy Jr as health secretary might impact healthcare in the US,[3] upcoming earnings reports from a number of biopharma giants are sure to give investors an idea of how the sector is faring.

Here, OPTO takes a closer look at Eli Lilly (reporting Thursday, February 6), Novo Nordisk (reporting Wednesday, February 5) and Vertex (reporting Monday, February 10), starting with some recent news.

Three Biopharma Plays

The Weight Loss Candidate Stock

Novo Nordisk has several potential follow-ups to its blockbuster weight loss drug Wegovy. According to data released at the end of January, its next-generation amycretin helped patients in a trial to lose 22% of their weight in 36 weeks.[4]

The data indicates that amycretin has better efficacy than Lilly’s Zepbound, which, in 2023, was found to help participants in a study lose 21% in the first 36 weeks.[5]

The M&A Stock

Lilly has kicked off the year with a deal to buy Scorpion Therapeutics’ cancer program for $2.5bn.[6]

Scorpion released phase 1 data for its breast cancer candidate last year. Early results show that it could successfully challenge Novartis’ [NVS] Piqray and Roche’s [RHHBY] Itovebi, which received FDA clearance in 2019 and 2024, respectively.[7]

The Gene Therapy Approval Stock

The UK’s National Institute for Health and Care Excellence announced on January 31 that National Health Service patients will be able to access Vertex’s Casevy, describing it as “groundbreaking”.[8] The cutting-edge gene therapy is used in the treatment of blood disorders, including sickle cell disease.

“Today is an important day for the sickle cell community who have gone too long without treatments that address the underlying cause of their devastating disease,” said Ludovic Fenaux, Senior Vice President at Vertex, in the press release.[9]

Biopharma’s Healthy Start to 2025

Biopharma stocks and the broader healthcare theme have had a positive start to the year. The iShares US Healthcare ETF [IYH] gained 6.49% in January, more than its 2.99% gain over the course of 2024.

Whether biopharma stocks can continue to rise could be influenced by upcoming earnings reports.

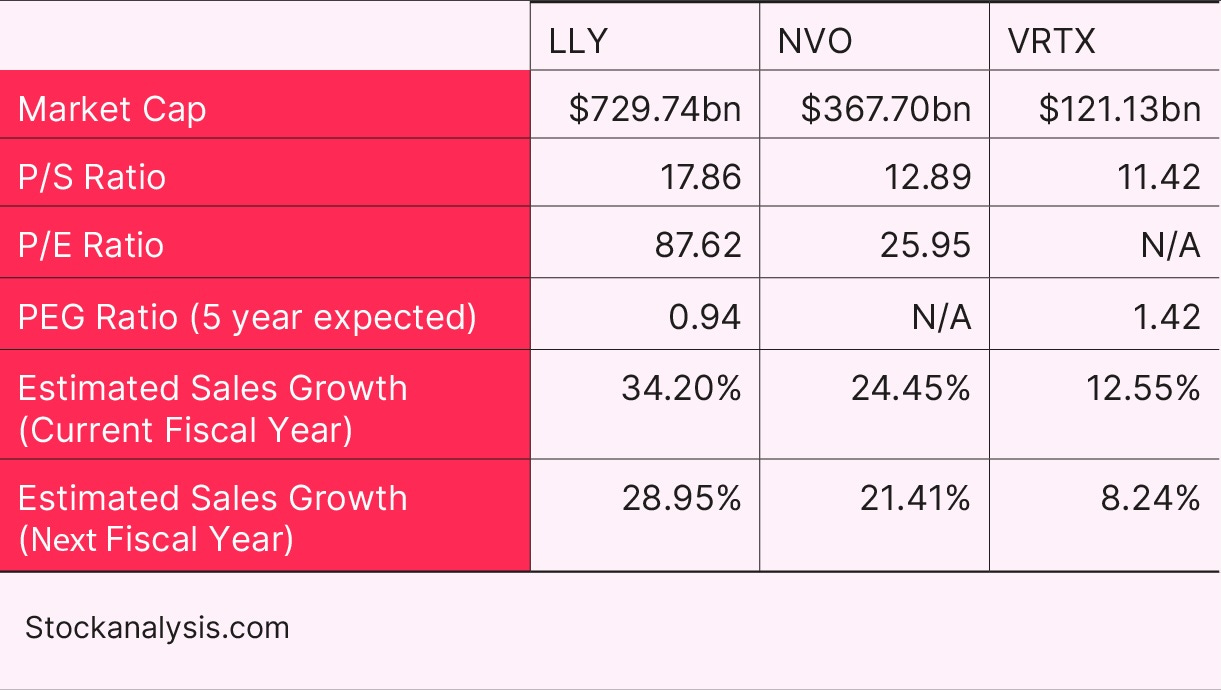

Here’s how the fundamentals of Lilly, Novo Nordisk and Vertex compare.

Biopharma: The Investment Case

The Investment Case for Eli Lilly

The Bull Case

Lilly’s revenue grew 42% year-over-year in Q3, driven by its new products segment and volume growth from its compounded tirzepatide brands Zepbound and Mounjaro, something which CEO David Ricks described as “impressive” in the earnings release in October.[10]

The Bear Case

Despite the strong sales growth, Lilly noted in the release that revenue was impacted by decreased inventory in its wholesaler channel.

An increase in supply had enabled Lilly to fulfill a backlog of wholesale orders in Q2, but this led to increased inventory of Zepbound and Mounjaro. Wholesalers then decided to cut back on the amount of stock they purchased in Q3.

As a result, Lilly lowered its full-year adjusted EPS forecast from a range of $16.10–16.60 per share to $13.02–13.52 per share.

The Investment Case for Novo Nordisk

The Bull Case

Novo Nordisk reported a 79% year-over-year jump in Wegovy sales in Q3, coming in at DKK17.3bn, significantly higher than the DKK15.9bn that analysts had been expecting.[11]

Wegovy sales in the US rose by 50%, even as prices dropped amid increased competition and more insurers agreeing to pay for the drug.[12]

The Bear Case

Sales guidance for the full year was lowered to a 23–27% year-over-year rise. CFO Karsten Munk Knudsen said on the Q3 earnings call that this “reflects continued periodic supply constraints and related drug shortage notifications across a number of products and geographies”.[13]

The Investment Case for Vertex

The Bull Case

Vertex raised its full-year revenue guidance in November on the back of a strong Q3. Demand for its cystic fibrosis treatment Trikafta helped to drive revenue up 12% in the September quarter.[14]

Vertex now expects 2024 product revenue to be in a range of $10.8bn–10.9bn, up from $10.65bn–10.85bn.

The Bear Case

The FDA approved Alyftrek,[15] a once-daily treatment for cystic fibrosis, in December, while suzetrigine,[16] used to treat acute pain, was given the green light on January 30. However, Wells Fargo has downgraded Vertex on the basis that these launches are not “needle movers” for the stock — at least in the near term.[17]

Conclusion

Lilly, Novo Nordisk and Vertex are likely to report mixed earnings over the next week or so. Investors could choose to focus on Kennedy Jr’s appointment and what it might mean for the US healthcare system and future drug development and access.

This is for informational purposes only. OPTO Markets does not recommend any specific securities or investment strategies. Investing involves risk and investments may lose value, including the loss of principal. Past performance does not guarantee future results.

[1] https://pharma.nridigital.com/pharma_feb25/mega-m-and-a-jp-morgan-conference-2025

[2] https://www.fda.gov/news-events/press-announcements/fda-approves-first-gene-therapies-treat-patients-sickle-cell-disease

[3] https://www.reuters.com/world/us/us-senate-panel-vote-rfk-jrs-health-secretary-nomination-2025-02-02/

[4] https://www.novonordisk.com/news-and-media/news-and-ir-materials/news-details.html?id=915251

[5] https://www.bloomberg.com/news/articles/2023-12-11/weight-loss-from-lilly-s-zepbound-reversed-slowly-after-treatment-stopped

[6] https://investor.lilly.com/news-releases/news-release-details/lilly-acquire-scorpion-therapeutics-mutant-selective-pi3ka

[7] https://www.fiercebiotech.com/biotech/jpm25-eli-lilly-strikes-25b-scorpion-buyout-twist-breast-cancer-tale

[8] https://www.england.nhs.uk/2025/01/revolutionary-gene-editing-therapy-for-sickle-cell/

[9] https://investors.vrtx.com/news-releases/news-release-details/vertex-announces-casgevyr-reimbursement-agreement-treatment

[10] https://investor.lilly.com/news-releases/news-release-details/lilly-reports-q3-2024-financial-results-highlighted-strong

[11] https://www.reuters.com/business/healthcare-pharmaceuticals/novo-nordisk-q3-line-with-expectations-narrows-fy-guidance-range-2024-11-06/

[12] https://www.bloomberg.com/news/articles/2024-11-06/novo-nordisk-s-wegovy-sales-exceed-expectations-in-third-quarter

[13] https://www.fool.com/earnings/call-transcripts/2024/11/06/novo-nordisk-nvo-q3-2024-earnings-call-transcript/

[14] https://investors.vrtx.com/news-releases/news-release-details/vertex-reports-third-quarter-2024-financial-results

[15] https://investors.vrtx.com/news-releases/news-release-details/vertex-announces-us-fda-approval-alyftrektm-once-daily-next

[16] https://news.vrtx.com/news-releases/news-release-details/vertex-announces-fda-approval-journavxtm-suzetrigine-first-class

[17] https://markets.businessinsider.com/news/stocks/wells-downgrades-vertex-to-equal-weight-on-lack-of-catalysts-1034287994