Bitcoin Miner Rises on Google-Backed Deal

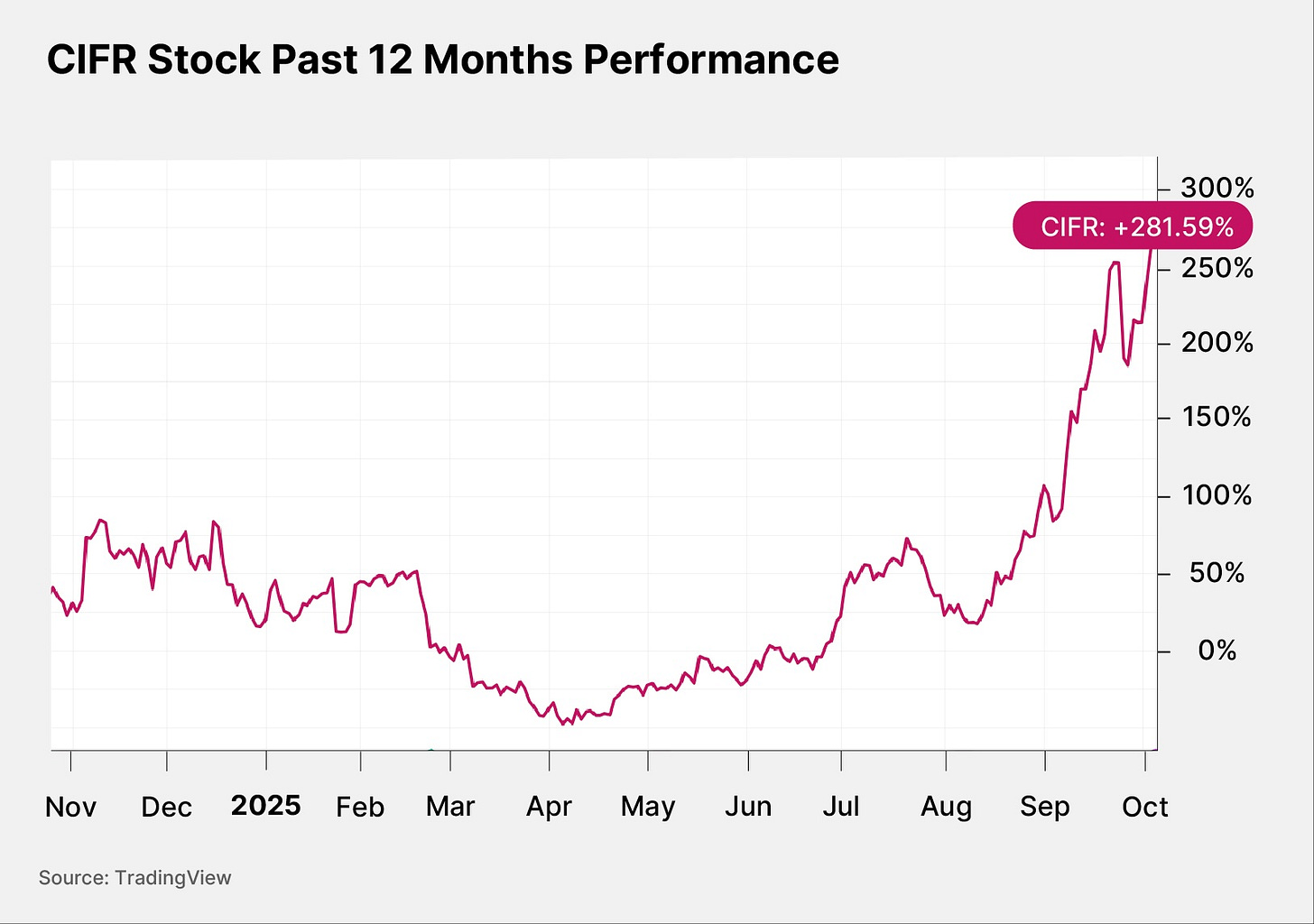

CIFR stock has hit an all-time high following an agreement that will accelerate its pivot to HPC hosting.

Key Takeaways

Cipher Mining has surged more than 230% in 2025 after securing a $3bn, Google-backed HPC deal with Fluidstack.

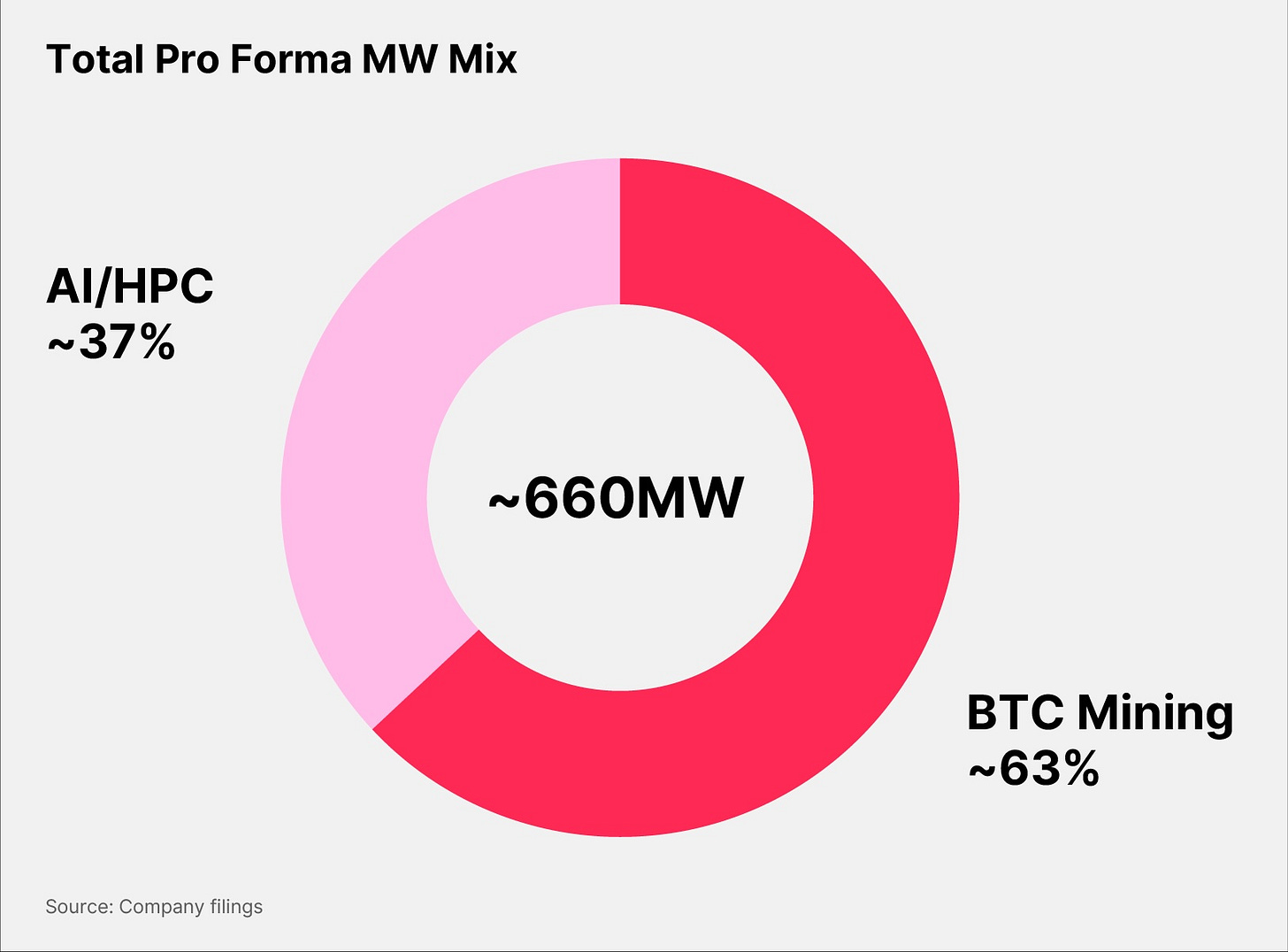

The agreement marks Cipher’s strategic pivot from bitcoin mining to AI-focused data center hosting, with 37% of its 660MW capacity now dedicated to HPC operations.

While the deal strengthens growth prospects, rising costs and concerns about a potential AI bubble pose risks to Cipher’s long-term profitability.

Cipher Mining [CIFR], a New York-based operator of bitcoin mining data centers, has become a major beneficiary of the artificial intelligence (AI) gold rush.

Miners that have provided computing capacity for bitcoin mining have been profiting from the demand for data centers to train and deploy AI models. Goldman Sachs has forecast data center demand will grow by approximately 50% to 92GW by 2027, with a CAGR of 17% between 2025 and 2028.[1]

This piece will look at why CIFR has been flying high on the back of a recent data center deal backed by Alphabet’s [GOOGL] Google. It will also ask whether the rally can continue and what the risks to investors might be if the AI boom proves to be a bubble.

Cipher Secures $3bn Data Center Deal

At the end of September, Cipher announced a high-performance computing (HPC) agreement with AI cloud firm Fluidstack. The deal will guarantee $3bn in revenue over a 10-year period — there are also two five-year options, which, if exercised, could generate a further $4bn.[2]

“This transformative transaction reinforces our HPC momentum as we continue to attract attention for our large and growing pipeline of sites,” said Cipher CEO Tyler Page in a press release.

The deal is expected to diversify Cipher’s revenue stream, as 37% of its 660MW power capacity is allocated to support HPC hosting, with the rest supporting ongoing bitcoin mining operations, as shown in the graph below.

Google will be anchoring the deal with $1.4bn in funding. In exchange, Google will acquire approximately 5.4% of Cipher’s shares. It is similar to an HPC deal the big tech giant is supporting between Fluidstack and data center operator TeraWulf [WULF], which was announced in August.[3]

CIFR Stock’s AI Surge

The rush to secure data center capacity for AI has fueled a 230.6% rally in CIFR stock year-to-date through October 6.

CIFR stock has surged 103.99% in the past month alone on the back of the Google news.

HPC Investments Weigh on Cipher’s Net Income

Cipher may be shifting focus to leasing out computing capacity to HPC tenants, but the company still generates its revenue from bitcoin mining.

Revenue for Q2 came in at $43.57m, up significantly from $36.81m in the year-ago quarter. The cost of revenue increased, though, from $14.28m to $15.33m. Cipher logged a net loss of $45.78m, more than triple the $15.29m loss recorded in Q2 2024 due to data center investments ramping up.[4]

Bitcoin mining at its 150MW Black Pearl data center in Texas commenced towards the end of Q2 2025.[5] The site will generate 300MW once phase two of the buildout has been completed and will help to meet the rising demand for HPC.

“Q2 was marked by consistent execution and thoughtful investment to best position the company for the future,” said Page in the earnings release.

In comparison, TeraWulf’s Q2 2025 revenue rose from $35.57m in the year-ago quarter to $47.63m, while the cost of revenue increased from $13.91m to $22.09m. Its net loss widened from $10.87m to $18.37m.[6]

“TeraWulf continues to execute on its strategy to develop scalable, sustainable digital infrastructure to support both HPC hosting and proprietary bitcoin mining,” said CEO Paul Prager in a statement.

Revenue for a fellow bitcoin miner, Las Vegas-based CleanSpark [CLSK], which is also investing in HPC capacity, surged to $198.64m in its Q3 2025, from $104.11m a year earlier. Cost of revenue doubled from $45.18m to $90.13m. However, net income swung from a loss of $236.24m in Q3 2024 to $257.39m.[7]

“This was the most successful quarter in CleanSpark’s history, and it reflects the strength of our strategy, the discipline of our execution and the tireless commitment of our team,” said CEO Zach Bradford in a statement.

Here is how the fundamentals of the three stocks currently compare.

All three stocks could be considered overvalued based on their forward P/E ratios — WULF stock is forecast to post negative EPS.

While CIFR’s revenue growth is expected to dip over the next couple of years, estimates could be revised upwards if and when the company’s bitcoin production increases and more HPC deals are signed.

CIFR Stock: The Investment Case

The Bull Case for CIFR Stock

The clear driver for Cipher in the near term is the bitcoin price, which could rally in Q4. Fundstrat’s Tom Lee believes it could hit $200,000 by the end of 2025[8] from approximately $125,000 at the time of writing.

Propping up the current cryptocurrency bull run has been the US Federal Reserve’s decision to cut rates last month. Further cuts are expected before the end of the year.

The Bear Case for CIFR Stock

The economic easing has seen the majority of stocks with exposure to cryptocurrency and digital assets continue to hit new highs. While there is optimism that the market can go much higher, there is also the question of whether the AI boom is a bubble.

Lisa Shalett, Chief Investment Officer at Morgan Stanley Wealth Management, thinks it is, and that the bubble is near to bursting point. “In market-pricing terms, we believe we are closer to the seventh inning than the first, and several developments indicate we may be entering the later phases of the boom,” she wrote in early October.[9] Recent deal-making “smacks of speculation and vendor-financing strategies of old,” she added.

If AI spending were to slow down, data center operators like Cipher could find their balance sheets coming under pressure.

Conclusion

There is plenty of excitement around Cipher Mining following the Google-backed deal with Fluidstack, but investors should tread carefully. CIFR stock could continue to run. However, at the same time, if AI spending and demand for HPC slows, mining companies like Cipher could see their share prices fall.

This is for informational purposes only. OPTO Markets does not recommend any specific securities or investment strategies. Investing involves risk and investments may lose value, including the loss of principal. Past performance does not guarantee future results.

[1] https://www.goldmansachs.com/insights/articles/how-ai-is-transforming-data-centers-and-ramping-up-power-demand

[2] https://investors.ciphermining.com/news-releases/news-release-details/cipher-mining-signs-168-mw-10-year-ai-hosting-agreement

[3] https://investors.terawulf.com/news-events/press-releases/detail/112/terawulf-signs-200-mw-10-year-ai-hosting-agreements-with

[4] https://investors.ciphermining.com/news-releases/news-release-details/cipher-mining-provides-second-quarter-2025-business-update

[5] https://investors.ciphermining.com/news-releases/news-release-details/cipher-mining-commences-bitcoin-mining-black-pearl-data-center

[6] https://investors.terawulf.com/news-events/press-releases/detail/110/terawulf-reports-second-quarter-2025-resultshttps://investors.terawulf.com/news-events/press-releases/detail/110/terawulf-reports-second-quarter-2025-results

[7] https://investors.cleanspark.com/news/news-details/2025/CleanSpark-Reports-Third-Quarter-Fiscal-2025-Results/default.aspx

[8] https://www.cnbc.com/video/2025/09/08/bitcoin-can-easily-get-to-200000-before-year-end-says-fundstrats-tom-lee.html

[9] https://www.morganstanley.com/pub/content/dam/mscampaign/wealth-management/wmir-assets/gic-weekly.pdf

Great breakdown of the Cipher/Google deal dynamics. The key insight here that I think many investors miss is the margin structure comparison between bitcoin mining and HPC hosting. Bitcoin mining operates with binary returns - when BTC prices surge, margins explode, but when they crash, you're underwater fast. The HPC model trades that volatility for stability through long-term take-or-pay contracts. What's interesting about the $3bn Fluidstack deal is that it's essentially forward-selling compute capacity at fixed rates - which looks brilliant if energy costs stay flat but could become problematic if power prices inflate faster than expected. The Q2 widening losses are concerning on the surface, but they're mostly deployment capex for the Black Pearl buildout. The real test comes in Q3-Q4 when we see whether the 37% HPC allocation can actually stabilize free cash flow. Lisa Shalett's "seventh inning" comment about the AI bubble is spot on - if hyperscaler capex growth decelerates even modestly, the entire HPC leasing model could face serious margin compresion.