This “Unsexy” AI Stock is at a Three-Year High

ADSK stock may be overshadowed by bigger AI names, but demand for AI tools that help manufacturers save time and cut costs has pushed the Autodesk share price to a three-year high.

Autodesk [ADSK] is a San Francisco-headquartered 3D design software firm that builds and sells solutions for drawing, visualization and modeling. Its products are predominantly used by the construction, engineering and manufacturing industries.

This stock spotlight will examine how Autodesk’s earnings have been boosted by a new transaction model designed to make it easier for customers to manage subscriptions. It will discuss the push into generative artificial intelligence (AI) to improve operations and deliver efficiencies.

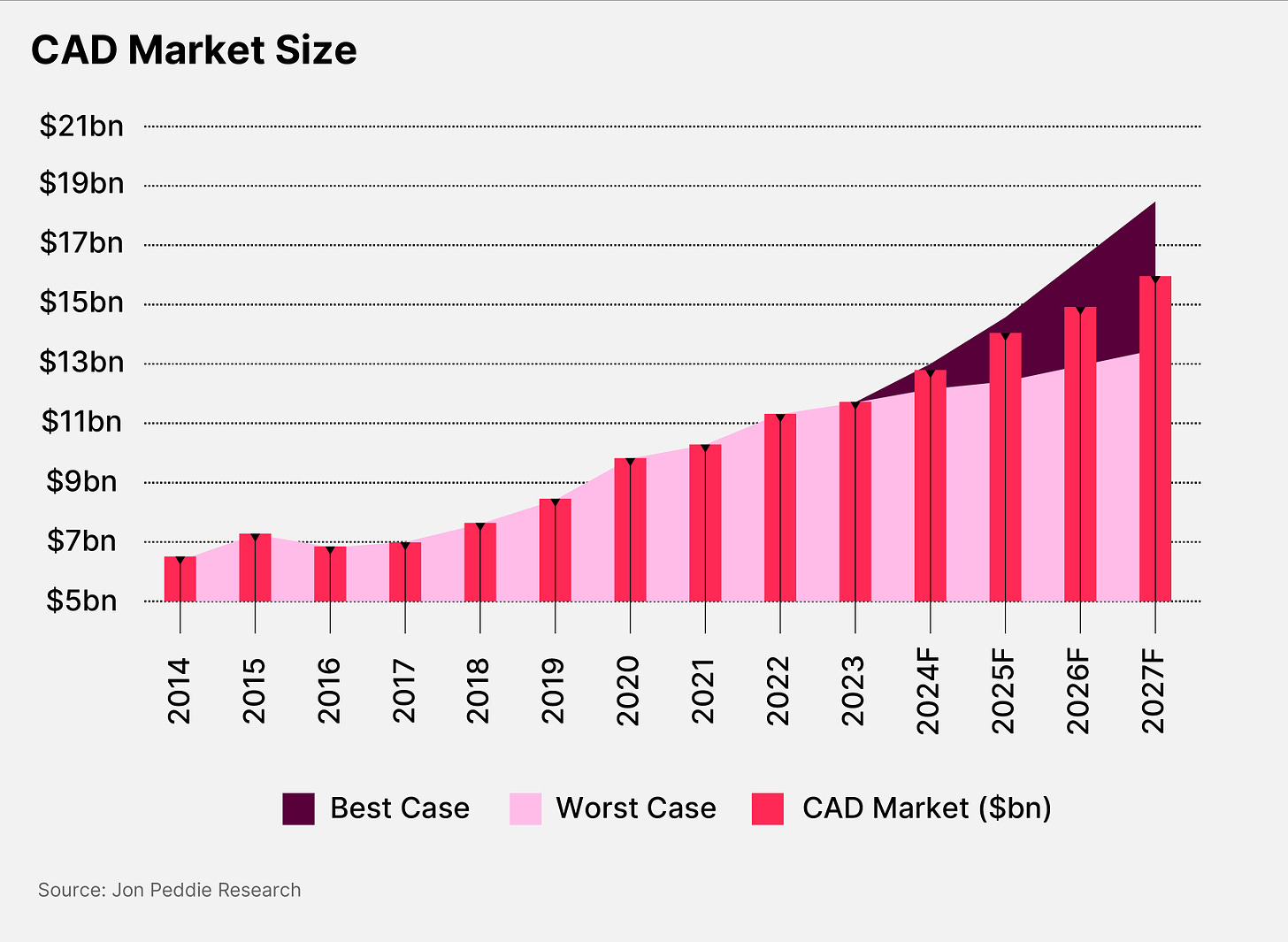

Autodesk, Dassault Systèmes [DASTY] and Siemens [SIEGY] control over 65% of the computer-aided design (CAD) market. According to Jon Peddie Research, the market is expected to grow at a CAGR of 7% between 2024 and 2027, to a valuation of $16bn.[i]

Autodesk Launches AI Features for Manufacturers

At its annual design and make conference, Autodesk University, held in San Diego on October 15–17, the company unveiled a range of AI features for its cloud-based CAD tool, Autodesk Fusion, used in manufacturing and engineering.

One feature is AutoConstrain, which uses AI to automatically suggest sketch constraints. Autodesk says that the feature will save designers time, helping them to sketch more quickly by eliminating the need to add constraints manually.

Another feature is Autodesk Assistant in Fusion, described as an “on-demand expert trained with both Autodesk-specific knowledge… as well as general industry knowledge”.

Jeff Kinder, Executive Vice President of Product Development and Manufacturing Solutions, wrote in a blog post that tools like Autodesk Fusion “will enable you to thrive by helping you meet the market’s demands for increasingly unique, complex products”.[ii]

Autodesk Powers to 52-Week High

The Autodesk share price hit a 52-week high of $294.13 on October 18 following the conclusion of the three-day Autodesk University event. It closed 1.52% lower at $289.66 on October 29.

ADSK stock is up 18.97% since the start of 2024 and has gained 48.43% in the past year.

Autodesk’s Q2 Earnings Boosted by New Transaction Model

The Autodesk share price got a big boost at the end of August following the release of earnings for its Q2 2025, which ended July 31.[iii]

Earnings were $2.15 a share, beating analysts’ consensus estimate of $2, according to FactSet.[iv] Revenue came in at $1.51bn, up 12% year-over-year and significantly higher than expectations of $1.48bn. Full-year earnings are expected to be in a range of $8.18–$8.31, up from previous guidance of $7.99–$8.21.[v]

The company attributed the strong quarter to its new transaction model that went live across North America in June. This model is designed to make it easier for customers to manage their subscriptions.

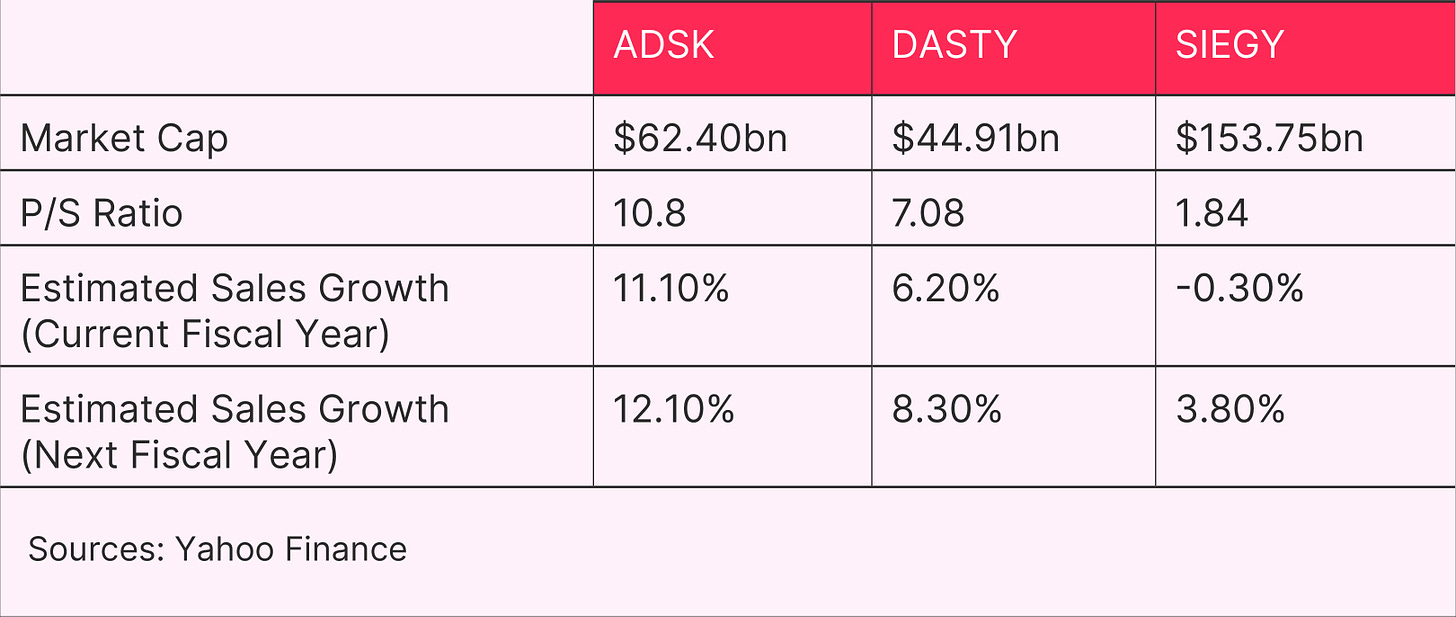

By comparison, Dassault Systèmes reported a 4% rise in revenue for its Q3 2024, which ended September 30.[vi] Siemens beat forecasts when it reported its Q3 2024 earnings, covering the three months to the end of June, driven by demand for production software. However, the German technology giant warned that some customers had been hesitant to spend due to concerns around the costs of borrowing.[vii]

Autodesk has the highest P/S ratio of the three firms, making it potentially the most expensive option; however, it also offers the highest rate of revenue growth over the next two years.

ADSK Stock: The Investment Case

The Bull Case for Autodesk

Following the Autodesk University event, BMO Capital reiterated a market perform rating on ADSK stock along with a price target of $287, which represents a drop of less than a single percentage point from the October 29 closing price.[viii]

The firm pinpointed Autodesk’s AI tools and the potential for them to transform industries and deliver operational efficiencies.

In September, ADSK stock was named as one of 10 ‘unsexy’ AI stocks involved in Goldman Sachs’ Communacopia and Technology Conference in a list compiled by Insider Monkey.[ix]

The Bear Case for Autodesk

Bank of America Securities’ analyst Michael Funk has boosted his price target for ADSK stock from $285 to $325. However, he maintained a ‘neutral’ rating.[x]

Funk’s takeaway from discussion at Autodesk University was that customers were willing to upgrade existing product subscriptions, but were more reluctant to add to their product portfolio. There were also observations that some customers had pressed pause on spending ahead of the upcoming US election.

While the election result may not impact Autodesk directly, decisions made by the next president could have an impact on interest rates. A Trump win could lead to higher rates, the Institute of International Finance has warned.[xi] If this were to happen, then manufacturing could potentially face a slowdown, which, in turn, could lead to lower demand for Autodesk’s products.

Conclusion

Autodesk is one of the leading providers of AI design tools to help manufacturers save time and cut costs. The company is confident that demand for its software should strengthen as interest rates continue to fall and customers are more inclined to spend. However, investors should keep in mind the potential impact the election result may have on the manufacturing industry.

OPTO’s proprietary theme relevance system maps the world’s biggest investing megatrends. For in-depth analyses of stocks with high growth potential, subscribe to OPTO Foresight.

[i] https://www.jonpeddie.com/news/computer-aided-design-cad-market-continues-its-dramatic-growth-7-cagr/

[ii] https://adsknews.autodesk.com/en/news/autodesk-ai-strengthens-fusion-and-alias/

[iii] https://investors.autodesk.com/static-files/3a59aade-bf73-4939-8106-93820b2df8ac

[iv] https://www.tradingview.com/symbols/NASDAQ-ADSK/forecast/

[v] https://adsknews.autodesk.com/en/pressrelease/autodesk-inc-announces-fiscal-2025-first-quarter-results/

[vi] https://investor.3ds.com/news-releases/news-release-details/dassault-systemes-third-quarter-results-line-anticipating-top

[vii] https://www.reuters.com/markets/europe/siemens-quarterly-profit-beats-market-view-electrification-software-2024-08-08/

[viii] https://uk.investing.com/news/company-news/bmo-reaffirms-autodesk-stock-rating-and-target-noting-steady-themes-on-ai-and-industry-data-at-autodesk-university-93CH-3744859

[ix] https://www.insidermonkey.com/blog/10-unsexy-ai-stocks-according-to-goldman-sachs-1355900/5/

[x] https://uk.investing.com/news/company-news/bofa-raises-autodesk-shares-price-target-to-325-from-285-93CH-3741456

[xi] https://www.cnbc.com/2024/10/23/trump-tariffs-likely-to-lead-to-higher-us-interest-rates-iif-chief.html