AMD Stock Earnings Review: Can AI Chip Demand Continue to Drive Growth?

Advanced Micro Devices announced strong Q1 results, but chip curbs could weigh on the stock.

Key Takeaways

AMD could book a $1.5bn charge in FY 2025 as a result of the US export restrictions imposed on products to China.

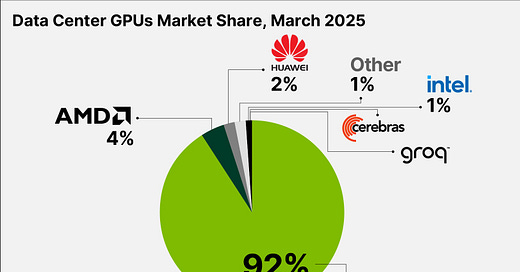

The chipmaker delivered a robust set of results on May 6 that surprised to the upside, with revenue boosted by data center GPU demand.

The company is set to debut the MI350 AI GPU in 2025, capable of up to 35 times the inference p…

Keep reading with a 7-day free trial

Subscribe to Foresight to keep reading this post and get 7 days of free access to the full post archives.