3 EV Battery Stocks to Watch Following CATL’s Hong Kong IPO

The EV battery market is heating up as CATL’s record-breaking Hong Kong IPO puts key players in the spotlight.

Key Takeaways

Albemarle faces headwinds from lithium oversupply and has halted US refinery plans.

GM eyes cheaper LMR batteries to compete in the next-generation EV race.

Solid Power is advancing ASSB technology with BMW, which could offer greater driving range for EVs.

Earlier this month, the global electric vehicle (EV) battery industry was shaken up by Contemporary Amperex Technology Co’s (CATL) [3750:HK] debut on the Hong Kong Stock Exchange.

Shares popped as much as 16% in the first day of trading on May 20, in what was the world’s biggest IPO year-to-date. The stock is up 4.39% through May 23.

The battery maker and Tesla [TSLA] supplier, which has its primary listing in Shenzhen, likely chose Hong Kong to facilitate its overseas expansion, as well as to make it more appealing to foreign investors.

The IPO attracted HK$30.72bn from institutional investors. Some 90% of these proceeds will be put towards the construction of a factory in Hungary.[1] CATL is the world’s biggest EV battery maker, as this graph shows.

CATL’s Hong Kong listing has brought other EV battery stocks into focus. Here, we will be taking a look at Albemarle [ALB], General Motors [GM] and Solid Power [SLDP], all three of which play a key role in the EV battery supply chain.

ALB Stock, GM Stock and SLDP Stock: Recent Updates

Albemarle Maintains 2025 Outlook

The world’s largest producer of lithium reiterated its full-year outlook when it reported its Q1 earnings on April 30. It was able to do so mainly because lithium is exempt from US President Donald Trump’s tariffs.[2]

However, lithium miners have had to deal with a supply glut over the past couple of years, sparked by China oversupplying lithium to overtake US rivals.[3] The ongoing impact of this has forced Albemarle to suspend a $1.3bn lithium refinery project in South Carolina.

“We’ve been wanting to build this Western supply chain. The economics just aren’t there to build that plant out in South Carolina … The math doesn’t work today,” Albemarle CEO Ken Masters told Reuters following the Q1 earnings.[4]

GM Targets Cheaper and Denser Batteries

GM revealed earlier in May that it had teamed up with LG Solutions [373220:KS] to develop batteries based on lithium-manganese-rich (LMR) chemistry.[5]

LMR will help to slash the cost of battery production without compromising performance, according to the automaker’s press release. The batteries are expected to enter the market through use in its full-size EVs from 2028.

If it were to achieve this, then it could beat Ford [F] to market. Ford announced in April that it is developing a “game-changing” LMR battery that will be integrated into its EV lineup by 2030.[6]

Solid Power Tests Battery Technology with BMW

Colorado-based Solid Power has been testing all-solid-state battery (ASSB) technology in BMW’s [BMWKY] i7 electric sedan in and around Munich.[7]

ASSB offers higher energy density than current lithium-ion batteries and can potentially be smaller and lighter. More energy packed into smaller cells means EVs fitted with this technology can achieve longer driving ranges.

Solid Power first partnered with BMW in 2016 and the automaker led a $130m investment in the company in 2021.[8]

EV Stocks Gain Following Tariff Losses

Shares in the lithium miner Albemarle are down 32.70% since the start of the year, and down 53.63% in the past 12 months.

Shares in automaker GM are down 8.36% year-to-date, but up 11.83% in the past year.

Shares in Solid Power are down 20.11% and down 12.21% in the respective periods.

For comparison, the Global X Lithium & Battery Tech ETF [LIT] is down 7.99% and down 15.48% in the respective periods. The fund had Albemarle as its biggest holding as of May 23, while it also offers exposure to CATL.[9]

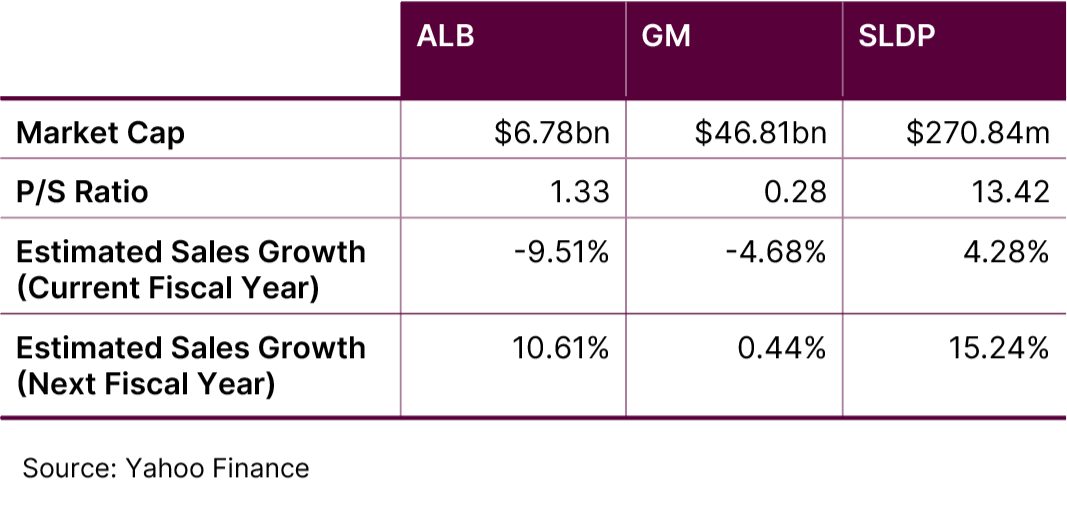

Here’s how the fundamentals of the three EV battery stocks compare.

Albemarle’s revenue is expected to drop this year due to falling lithium prices, though it could bounce back in 2026. Market uncertainty could explain its low P/S ratio.

GM imported more vehicles into the US last year than any other automaker.[10] Its revenue over the next couple of years is expected to be dented by President Trump’s tariffs.

Solid Power is showing potential for strong revenue growth, which could accelerate further should more automakers decide to switch to ASSB technology.

ALB Stock, GM Stock and SLDP Stock: The Investment Case

The Bull Case for Albemarle

Despite lithium being exempt from President Trump’s tariffs, the miner said on its Q1 earnings call that it is looking to increase sales in lower-tariff regions.[11] Most of its production is sold into Asian markets, with the US accounting for just 16.77% of total sales in 2024.[12]

The Bear Case for Albemarle

Nevertheless, the company has also warned that it is expecting a “modest” $30m–40m hit this fiscal year as a result of the impact of the trade tariffs.[13]

The Bull Case for GM

CEO Mary Barra wrote in the Q1 shareholder letter that she has been in “strong dialogue” with the Trump administration about the important role the company plays in US automotive manufacturing.[14]

The Bear Case for GM

Despite this, the company slashed its full-year profit forecast and warned that it expected tariffs to have a negative impact of $4bn–5bn.

The Bull Case for Solid Power

The battery specialist was awarded a $50m grant from the US Department of Energy in September 2024.[15] This capital will go towards scaling the production of sulfide-based solid electrolyte materials for ASSB cells to 75 metric tons in 2026 and 140 metric tons in 2028.

The Bear Case for Solid Power

The company expects that its ASSB cells will be powering 800,000 vehicles on the road by 2028,[16] but production delays could dent investor confidence.

Conclusion

Trump’s tariffs have brought uncertainty to the EV supply chain, which is likely to impact lithium miners such as Albemarle in the near term. However, demand for more advanced EV battery technology may boost the likes of GM and Solid Power in the medium and long term.

This is for informational purposes only. OPTO Markets does not recommend any specific securities or investment strategies. Investing involves risk and investments may lose value, including the loss of principal. Past performance does not guarantee future results.

[1] https://www.catl.com/en/uploads/1/file/public/202505/20250512071033_9of2dqw816.pdf

[2] https://s201.q4cdn.com/960975307/files/doc_earnings/2025/q1/earnings-result/Q12025_pressrelease.pdf

[3] https://www.reuters.com/markets/commodities/china-is-oversupplying-lithium-eliminate-rivals-us-official-says-2024-10-08/

[4] https://www.reuters.com/business/energy/albemarle-ceo-says-math-doesnt-work-us-lithium-refinery-project-2025-05-01/

[5] https://news.gm.com/home.detail.html/Pages/news/us/en/2025/may/0513-GM-LG-Energy-Solution-pioneer-LMR-battery-cell-technology.html

[6] https://www.linkedin.com/pulse/ford-makes-breakthrough-lmr-battery-chemistry-targeting-charles-poon-wfx3c/

[7] https://www.solidpowerbattery.com/investor-relations/investor-news/news-details/2025/BMW-Group-and-Solid-Power-are-Testing-All-Solid-State-Battery-Cells-in-a-BMW-I7/default.aspx

[8] https://www.reuters.com/business/autos-transportation/exclusive-ford-bmw-lead-130-mln-investing-round-solid-state-battery-startup-2021-05-03/

[9] https://www.globalxetfs.com/funds/lit

[10] https://www.bloomberg.com/news/newsletters/2025-05-08/supply-chain-latest-gm-imported-more-cars-into-us-than-any-other-automaker

[11] https://uk.investing.com/news/transcripts/earnings-call-transcript-albemarle-q1-2025-beats-eps-forecasts-stock-rises-93CH-4059879

[12] https://s201.q4cdn.com/960975307/files/doc_financials/2024/ar/ALBEMARLE-CORP_2024_Annual_Report-for-website.pdf

[13] https://uk.investing.com/news/transcripts/earnings-call-transcript-albemarle-q1-2025-beats-eps-forecasts-stock-rises-93CH-4059879

[14] https://investor.gm.com/news-releases/news-release-details/q1-2025-letter-shareholders

[15] https://solidpowerbattery.com/investor-relations/investor-news/news-details/2024/Solid-Power-Selected-by-U.S.-Department-of-Energy-for-Up-to-50-Million-Award-Negotiation-for-Continuous-Production-of-Sulfide-based-Solid-Electrolyte-Materials-for-Advanced-All-Solid-State-Batteries/default.aspx

[16] https://www.solidpowerbattery.com/sulfide-solid-electrolytes/default.aspx