3 Cloud Stocks to Watch: A Snapshot of the Booming HCI Market

What role are Nutanix, Broadcom and Cisco playing in the data center infrastructure space?

Key Takeaways

Nutanix is gaining momentum in the hyperconverged infrastructure market, leveraging partnerships to grow its market share and revenue.

Broadcom, despite customer churn from VMware, has seen strong growth in its infrastructure software segment.

Cisco is pivoting toward AI and cybersecurity solutions to maintain relevance amid shifting enterprise needs.

More and more companies are choosing to revamp their data center operations with hyperconverged infrastructure (HCI). This is effectively an IT framework that combines computing, networking and storage resources into a single software platform.

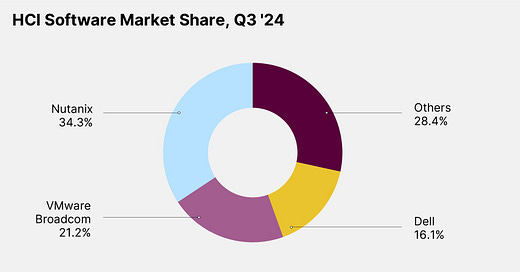

Nutanix [NTNX] was the HCI software leader in Q3 2024, with a 34.3% share of the market, followed by Broadcom’s [AVGO] VMware, which had a 21.2% share, according to IDC’s Worldwide Quarterly Converged Systems Tracker.[1] Third was Dell [DELL], with 16.1%, while a number of other smaller players, including Hewlett Packard Enterprise [HPE], made up 28.4%, as shown in the graph below.

Cisco [CSCO] previously fell into the ‘others’ category, but killed its HCI product HyperFlex back in 2023 to focus on a strategic partnership with Nutanix.[2]

This special report will take a closer look at Broadcom, Cisco and Nutanix.

Nutanix Partners Up to Attract Disgruntled VMware Customers

For the past 18 months or so, the HCI market has been dominated by news of customers turning their backs on VMware, acquired by Broadcom for $69bn in November 2023,[3] for rival Nutanix.

The latter made a number of major announcements at the NEXT conference in Washington, D.C., in early May to strengthen its offering and appeal to businesses looking for an alternative to VMware. One of these was a plan to integrate its cloud platform with flash arrays — hardware for storage in an HCI system — from Pure Storage [PSTG].[4]

Equity research firm William Blair believes the integration “provides dissatisfied VMware customers with an easier migration route off VMware as it removes the need for hardware refreshes,” according to a note seen by SDxCentral.[5]

Nutanix also announced a separate partnership with both Pure Storage and Cisco.

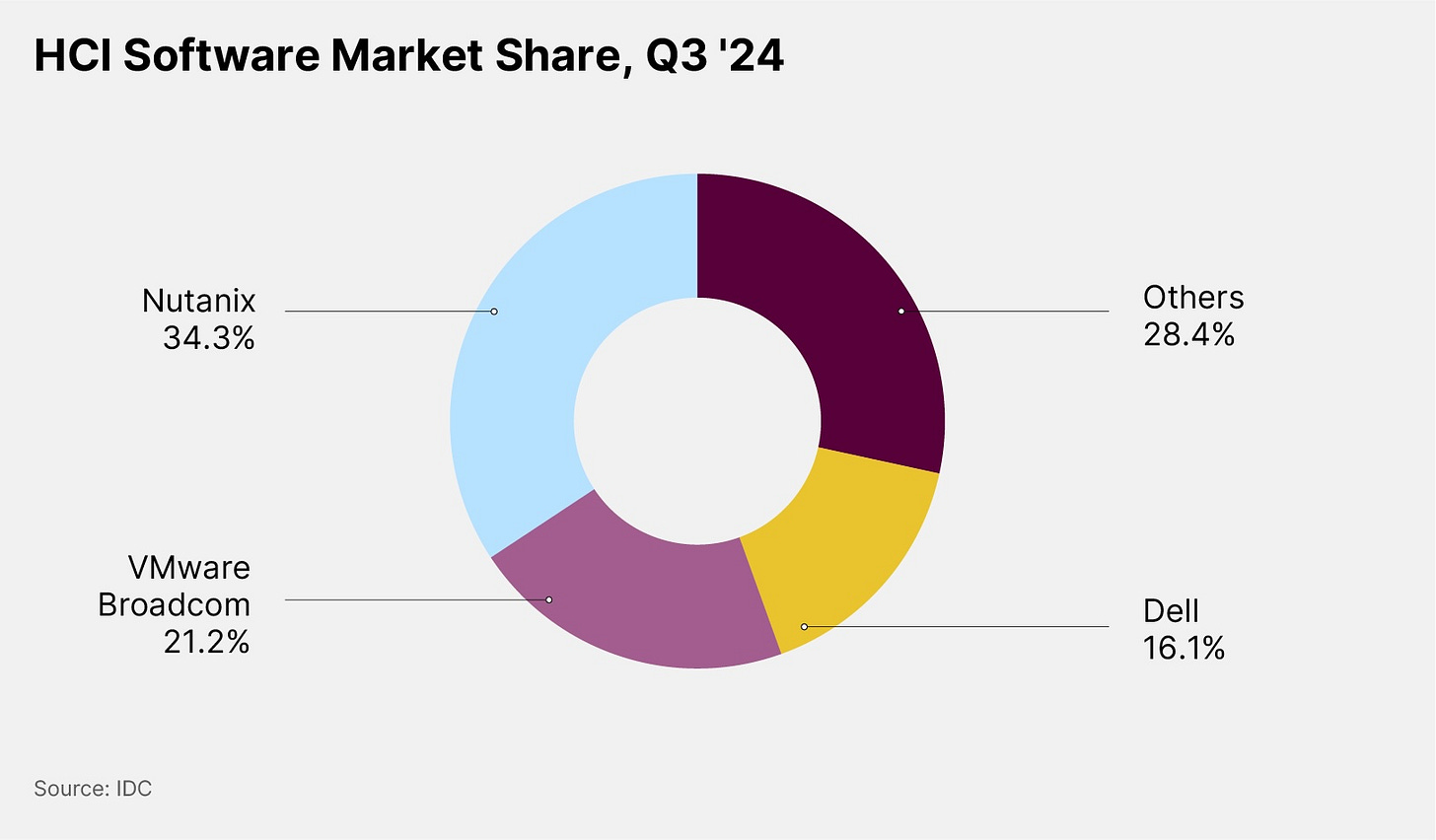

AVGO, CSCO and NTNX Stock Performance

The Broadcom share price has surged 89.49% in the past 12 months and is up 7.60% since January 1. The Cisco share price has gained 41.45% and 9.31% in the respective periods.

The Nutanix share price has gained 39.32% to $77.06 in the past 12 months through June 2 and is up 25.96% since the start of the year, setting an all-time high of $83.36 on May 19.

For comparison, the First Trust Cloud Computing ETF [SKYY], which holds Cisco and Nutanix, is up 28.53% and down 2.95% in the respective periods.[6]

Nutanix Beats Estimates

The Nutanix share price has fallen in the past week despite the company reporting strong Q3 results on May 28.

Revenue was up 22% year-over-year to $639m, comfortably beating the analyst estimate of $626m. However, annual recurring revenue of $2.14bn, up 18%, fell short of the $2.16bn consensus.[7]

CEO Rajiv Ramaswami said on the earnings call that Nutanix is benefiting from organizations looking “to modernize their IT footprints, including adopting hybrid multi-cloud operating models and modern applications, as well as those looking for alternatives in the wake of industry M&A.”[8]

He added: “We do think that that market … represents a significant opportunity, given the big vacuum that is out there now with VMware.”

Despite customers walking away from VMware, Broadcom’s Q1 2025 earnings, reported on March 6, suggest the acquisition is bearing fruit.

The company does not report VMware revenue separately, but it reported infrastructure software revenue growing 47% year-over-year to $6.70bn in Q1.[9] Revenue in the last quarter before VMware was recognized, Q4 2023, was $1.97bn.[10] Q2 2025 earnings are being reported on June 5.

Cisco reported an 11% increase in revenue for its Q3 2025 on May 14, but added that orders in its artificial intelligence (AI) network infrastructure segment rose 71% from the previous quarter, to $600m.[11] Demand is being driven by cloud companies building AI data centers.

Here are how the fundamentals of Nutanix, Broadcom and Cisco compare.

NTNX could be considered fairly valued when you take into account its P/S ratio and projected revenue growth, especially compared to those of AVGO stock and CSCO stock. However, Nutanix is yet to report an annual profit.

AVGO Stock, CSCO Stock and NTNX Stock: The Investment Case

The Bull Case for Broadcom

Despite the migrations away from VMware, Broadcom CEO Hock Tan said on the Q1 earnings call that 70% of its largest 10,000 customers are now paying for the VMware Cloud Foundation subscription.[12]

The Bear Case for Broadcom

While Q2 earnings are expected to be strong,[13] the Broadcom share price is trading just below its all-time high. Priced at 115.14 times trailing P/E, as of June 2, the stock could pull back, even if the results do not disappoint.

The Bull Case for Cisco

CEO Chuck Robbins said on the Q3 earnings call last month that Cisco is seeing signs that AI spending is holding up well in the face of disruption from US President Donald Trump’s tariffs.

“The AI transition is just so important that they’re going to continue to spend until they just absolutely have to stop,” said Robbins. He added that customers will be shopping for Cisco’s solutions to meet their AI and cloud needs for the next few years at least.[14]

The Bear Case for Cisco

Cisco has been shifting away from its core networking business to selling higher-margin AI-powered cyber security and software solutions,[15] but networking still accounted for approximately half of total revenue in Q3.[16]

A slowdown in enterprise spending on software could eat into the company’s margins and earnings.

The Bull Case for Nutanix

Nutanix should continue to gain customers from VMware. In the press release announcing the Pure Storage partnership, the company highlighted Gartner research that “cost concerns will drive 70%” of VMware customers to “migrate 50% of their virtual workloads” by 2028.

The Bear Case for Nutanix

CFO Rukmini Sivaraman said on the Q2 earnings call in February that the company is seeing “modestly elongated average sales cycles compared to historical levels”. As a result, some deals are taking longer to close. This could persist given the current macroeconomic environment, added Sivaraman.[17]

Conclusion

As more companies invest in data centers, the demand for computing, networking and storage solutions will increase. Nutanix is well-positioned to continue dominating HCI software and growing its share of the market, potentially at the expense of Broadcom’s VMware.

This is for informational purposes only. OPTO Markets does not recommend any specific securities or investment strategies. Investing involves risk and investments may lose value, including the loss of principal. Past performance does not guarantee future results.

[1] https://www.linkedin.com/posts/leecaswell_from-idc-nutanix-leads-q3-hci-market-share-activity-7276042831603871744-61yZ/

[2] https://futurumgroup.com/insights/cisco-discontinues-hyperflex-to-focus-on-nutanix-based-hci/

[3] https://www.reuters.com/markets/deals/broadcom-closes-69-bln-vmware-deal-after-china-approval-2023-11-22/

[4] https://www.nutanix.com/press-releases/2025/nutanix-and-pure-storage-partner-to-deliver-greater-customer-choice

[5] https://www.sdxcentral.com/news/nutanix-partners-with-pure-storage-in-latest-vmware-assault/

[6] https://www.ftportfolios.com/retail/etf/ETFholdings.aspx?Ticker=SKYY

[7] https://www.investors.com/news/technology/nutanix-stock-nutanix-earnings-q32025/

[8] https://uk.investing.com/news/transcripts/earnings-call-transcript-nutanix-beats-q3-fy2025-earnings-expectations-93CH-4108588

[9] https://investors.broadcom.com/news-releases/news-release-details/broadcom-inc-announces-first-quarter-fiscal-year-2025-financial

[10] https://investors.broadcom.com/news-releases/news-release-details/broadcom-inc-announces-fourth-quarter-and-fiscal-year-2023

[11] https://s2.q4cdn.com/951347115/files/doc_earnings/2025/q3/transcript/Q3FY25-Prepared-Remarks.pdf

[12] https://www.fool.com/earnings/call-transcripts/2025/03/06/broadcom-avgo-q1-2025-earnings-call-transcript/

[13] https://sherwood.news/markets/broadcom-soars-after-earnings-beat-sunny-revenue-guidance/

[14] https://uk.investing.com/news/transcripts/earnings-call-transcript-cisco-q3-2025-beats-expectations-stock-rises-after-hours-93CH-4087491

[15] https://www.cmcmarkets.com/en/optox/csco-stock-what-to-look-out-for-in-ciscos-earnings-call-on-wednesday

[16] https://investor.cisco.com/news/news-details/2025/CISCO-REPORTS-THIRD-QUARTER-EARNINGS/default.aspx/

[17] https://uk.investing.com/news/transcripts/earnings-call-transcript-nutanix-q2-fy2025-revenue-beats-forecast-stock-surges-93CH-3948265