3 Chip Stocks to Watch Amid Industry Turmoil

Between Donald Trump’s return and a slow market recovery, the chip industry is concerned about what the future holds.

Key Takeaways

The $1.61bn in funding received through the CHIPS and Science Act will help Texas Instruments to upgrade its manufacturing facilities, but critics point to a failure to innovate;

Despite near-term revenue pressures, ASML is “very, very bullish” about its long-term outlook as demand for AI chips shows no signs of slowing down;

In January, NXP announced it has agreed to acquire the Austrian provider of safety software solutions TTTech Auto for $625m in a bid to expand its market position.

Following Donald Trump’s return to the White House, the chip industry is concerned about what the next four years could hold.

During his election campaign in October, Trump told podcaster Joe Rogan that subsidies offered to semiconductor companies through the CHIPS and Science Act were “so bad”. He suggested that, instead, “all you had to do is charge them tariffs”.[1]

The US Department of Commerce’s Mike Schmidt, who led the rollout of the legislation for two years, told Bloomberg earlier this month that Trump’s idea for tariffs has “a role to play in industrial strategy”, but that “the incentives provided by the CHIPS Act were essential”. [2]

The main concern for chipmakers prior to Trump taking up office was that he could pull funding for the industry. However, the pick for US Secretary of Commerce, Cantor Fitzgerald CEO Howard Lutnick, has indicated that he will likely continue to support the CHIPS and Science Act in some form or another, Bloomberg reported.

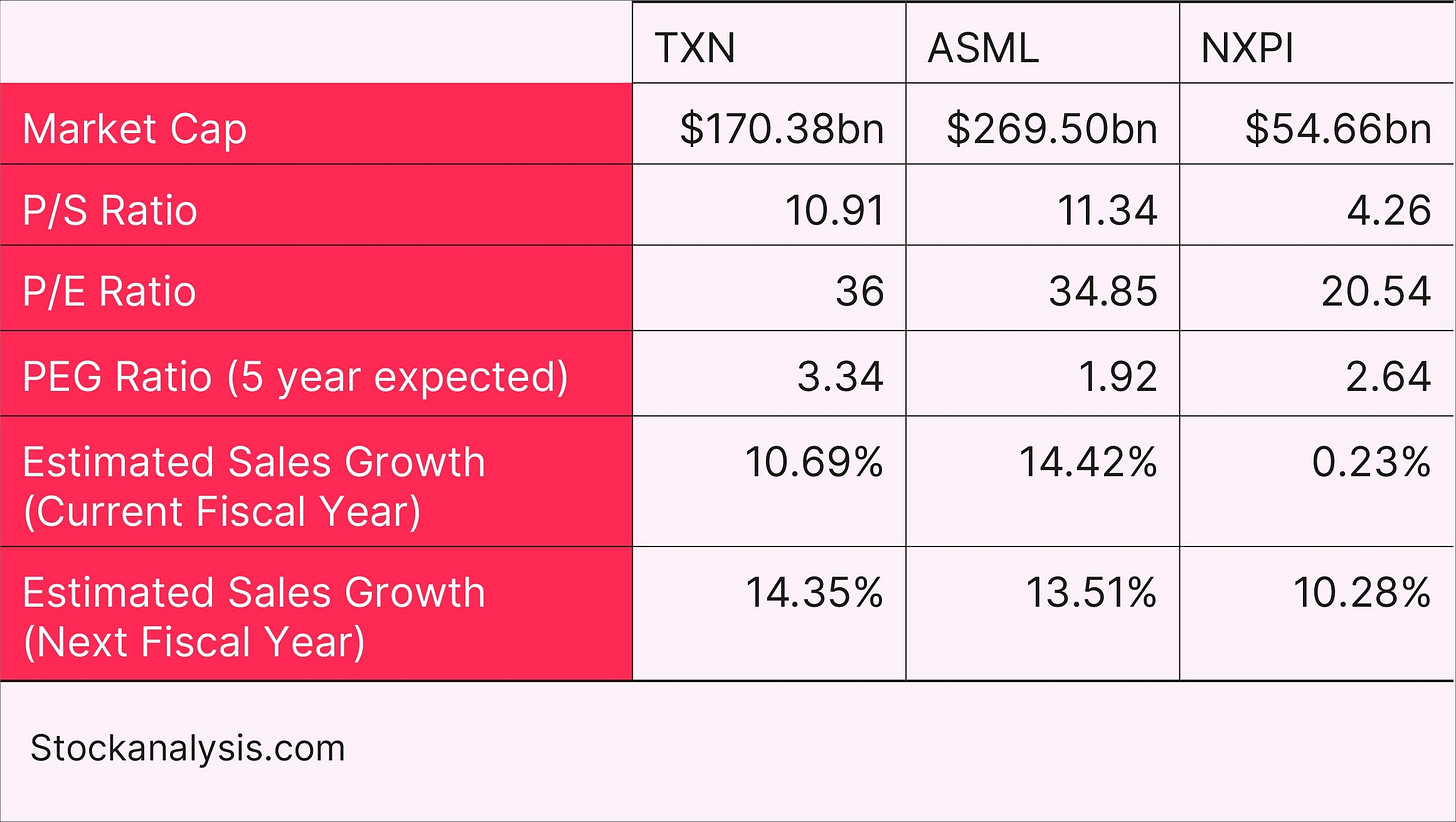

With the future still unclear, let’s take a closer look at three chip stocks: Texas Instruments [TXN], ASML [ASML] and NXP Semiconductors [NXPI].

Three Plays on the Chip Industry

Texas Instruments Has Chips Act Funding Confirmed

Just before leaving office, former President Joe Biden signed off on $1.61bn in funding for Texas Instruments, previously announced in August, to expand its manufacturing capacity of semiconductors deemed crucial for US economic and national security.[3]

“The increasing number of electronic devices in our lives depend on our foundational chips, and we appreciate the support from the US government to make the semiconductor ecosystem stronger and more resilient,” said Texas Instruments CEO Haviv Ilan.

Netherlands Expects ASML Export Restrictions to Remain

Trump’s return to office is expected to see him continue to push for curbs on exports of ASML’s chipmaking equipment to China.

The Netherlands had been pressured into introducing export restrictions by the Biden administration, as the US believed that China getting its hands on ASML’s cutting-edge lithography machines could be a national security risk.

Dutch Prime Minister Dick Schoof told Reuters last week that China remained an important trade partner for the Netherlands and that he had had positive conversations on ASML with China’s Vice Premier Ding Xuexiang.

“We have to wait for what the American government comes forward with,” said Schoof.[4]

NXP CEO Warns Against Nationalist Policies

Fellow Dutch chip stock NXP Semiconductors has not been directly impacted by US tariffs, but the company’s CEO Kurt Sievers recently addressed the issue.

At an electronics conference in November, Sievers was one of a handful of industry executives to speak out against countries drawing up policies to protect their own interests, asserting that no single, national semiconductor industry can operate independently.[5]

“If it was possible, it would become so expensive that no consumer could afford any device which uses chips. And I’m sure every government over time will understand it,” said Sievers.

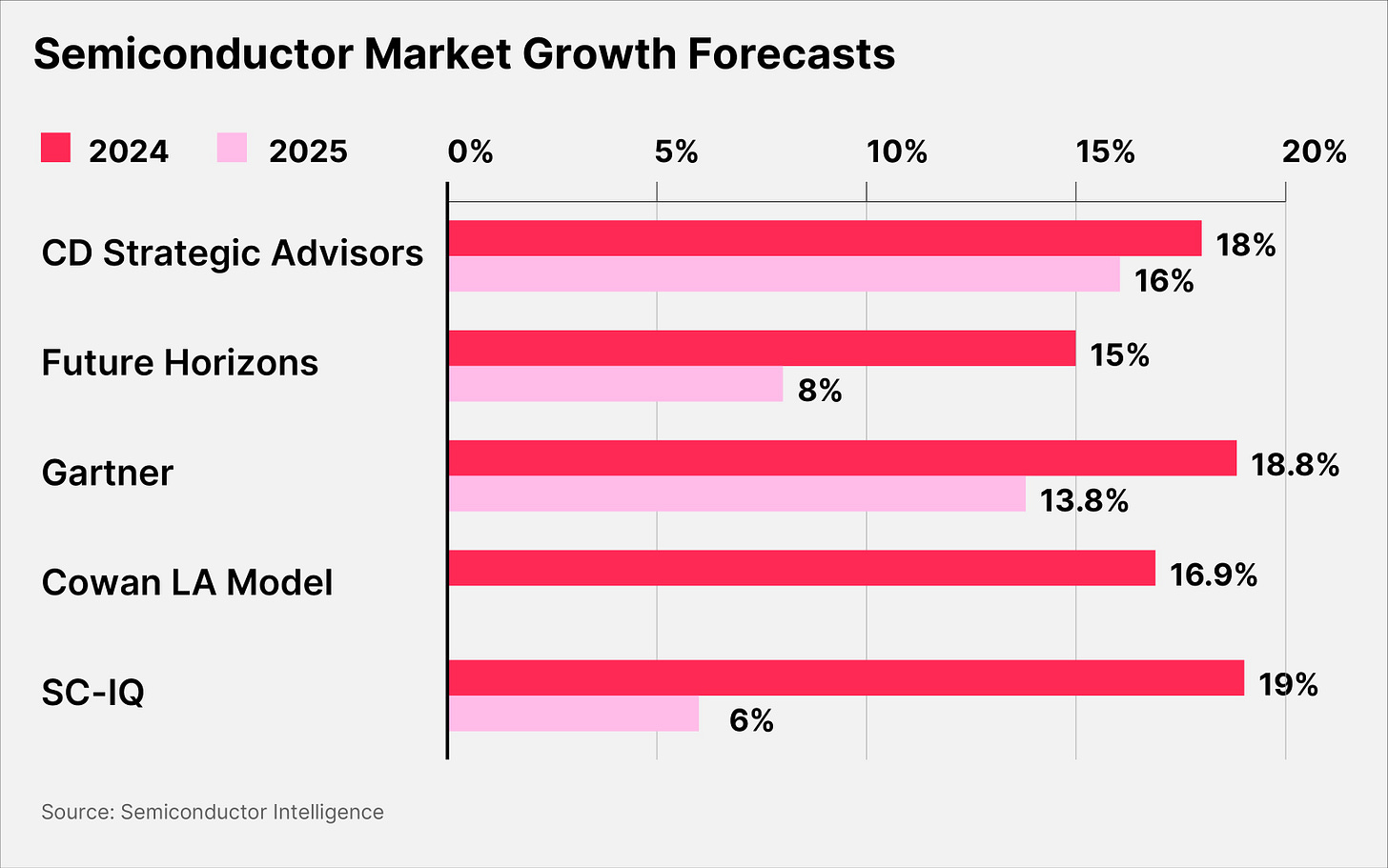

Chip Market Recovery Drags On

Trump notwithstanding, the recovery for the global chip industry has been slow, and likely will be for some time, as the revenue projections for Texas Instruments, ASML and NXP indicate.

Semiconductors: The Investment Case

The Investment Case for Texas Instruments

The Bull Case

The $1.61bn in funding received through the CHIPS and Science Act will help Texas Instruments to upgrade its manufacturing facilities.

While this may eat into its profit in the near term, the company is expecting it to reduce manufacturing costs in the long term and enable it to keep pace with Chinese competitors.[6]

As the company does not produce state-of-the-art chips, its exports to China are not restricted.

The Bear Case

Despite beating Q4 expectations last week, Q1 2025 guidance disappointed investors.[7]

The company is dealing with an inventory backlog amid a slump in the automotive and industrial markets. The problem is that these cyclical markets account for approximately 70% of its revenue.[8]

CNBC’s Jim Cramer criticized the company following the earnings report: “I’m absolutely convinced that if Texas Instruments wanted to, it could go beyond its cyclical nature. But it won’t … It’s content to remain as it is. It’s just not content with the critics.”[9]

The Investment Case for ASML

The Bull Case

ASML is “very, very bullish” about its long-term outlook as demand for artificial intelligence (AI) chips shows no signs of slowing down.[10]

CEO Christophe Fouquet said at the company’s investor day in November that the global chip market should be worth at least $1trn by 2030, with AI chips accounting for 40% of sales.

The company is targeting annual revenue of €44bn–60bn by the start of the next decade.

The Bear Case

The flip side is that ASML is not as confident about the near-term outlook.

Fouquet said on the call for its downbeat Q3 earnings in October that he expects the chip industry’s recovery to continue “well into 2025” as a result of “customer cautiousness and some push-outs in their investments”.[11]

ASML expects revenue for 2025 to be in a range of €30bn–35bn, up from an expected €28bn in 2024.[12] The company will update the market when it reports Q4 earnings on Wednesday.

The Investment Case for NXP Semiconductors

The Bull Case

At the start of January, NXP announced it has agreed to acquire Austrian provider of safety software solutions TTTech Auto for $625m.[13]

Jens Hinrichsen, NXP’s Executive Vice President, said in a statement that the transaction will help the company along its “journey to become the leading provider of intelligent edge systems in automotive and industrial IoT”.

The Bear Case

In the near term, NXP is facing “increasing macro-related weakness in the industrial and IoT market”, CEO Sievers conceded when Q3 earnings were reported in November.[14]

Automotive sales declined 3% year-over-year in the September quarter, while industrial and IoT sales fell 7%. Revenue guidance for Q4, which will be reported on February 3, “reflects broader macro weakness, especially in Europe and the Americas”, Sievers added.

Conclusion

The chip industry will be paying close attention to any move President Trump makes. In the meantime, however, the more pressing matter Texas Instruments, ASML and NXP are facing is a slow market recovery.

[1] https://www.datacenterdynamics.com/en/news/trump-bashes-chips-act-all-you-had-to-do-is-charge-them-tariffs/

[2] https://www.bloomberg.com/news/articles/2025-01-17/biden-s-chips-team-hands-off-52-billion-program-to-a-skeptical-trump

[3] https://www.commerce.gov/news/press-releases/2024/12/biden-harris-administration-announces-chips-incentives-award-texas

[4] https://www.reuters.com/world/dutch-pm-raised-asml-talks-with-chinas-ding-2025-01-24/

[5] https://www.reuters.com/default/ceos-european-chip-makers-concerned-about-nationalist-industrial-policies-2024-11-12/

[6] https://www.bloomberg.com/news/articles/2025-01-23/texas-instruments-outlook-signals-chip-slump-is-persisting?embedded-checkout=true&os=av.&ref=app

[7] https://www.investopedia.com/texas-instruments-q4-fy2024-earnings-8779435

[8] https://investor.ti.com/static-files/8858f18c-2a43-4a5e-8727-229f66c86aed#:~:text=In%202024%2C%20industrial%20and%20automotive,emphasis%20on%20industrial%20and%20automotive.

[9] https://www.cnbc.com/2025/01/24/jim-cramer-critiques-texas-instruments-auto-and-industrial-market-slump.html

[10] https://www.reuters.com/technology/asml-says-its-revenue-grow-44-bln-60-bln-euros-by-2030-2024-11-14/

[11] https://seekingalpha.com/article/4727159-asml-holding-n-v-asml-q3-2024-earnings-call-transcript

[12] https://www.asml.com/en/news/press-releases/2024/q3-2024-financial-results-dd3ac76a9d4d0f8c

[13] https://www.tttech-auto.com/newsroom/nxp-accelerates-transformation-software-defined-vehicles-sdv-agreement-acquire-tttech-auto

[14] https://media.nxp.com/news-releases/news-release-details/nxp-semiconductors-reports-third-quarter-2024-results